Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Jan, 2026

By Hailey Ross and Jason Woleben

The US life insurance industry is likely to see more closed block deals in 2026, while analysts who cover the sector are largely upbeat about its expected performance for the year.

Life insurers were involved in more than $100 billion of closed block reinsurance transactions in the US in 2025. One of the largest of these deals was Venerable Holdings Inc.'s acquisition of $51 billion in variable annuities from Corebridge Financial Inc. The transaction was valued at about $2.8 billion and is expected to produce roughly $2.1 billion of net distributable proceeds after tax for Corebridge.

Although insurers have options for dealing with their closed blocks, including involving third-party administrators and managing them in-house, selling them might be an attractive move, Capgemini Global Head of Life, Annuity and Benefits Samantha Chow said in an interview.

"I think some will go down the path of, 'I just don't want to deal with it,'" Chow said.

Plenty of upside

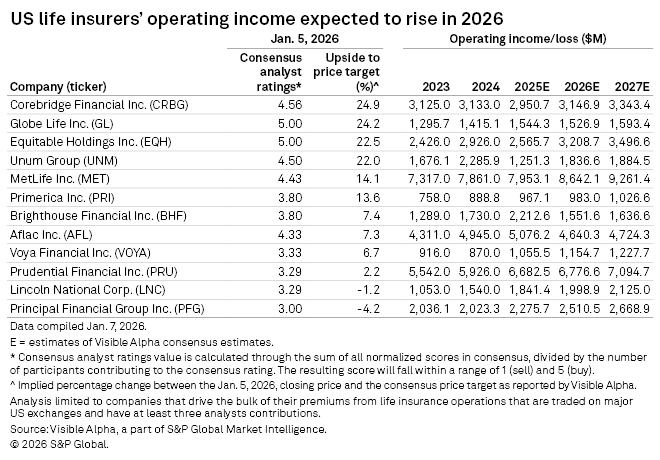

The majority of the US life insurance sector is trading below analysts' consensus estimates, which leaves plenty of room for potential growth in 2026, according to an S&P Global Market Intelligence analysis of Visible Alpha data.

Among US public life insurers in the analysis, Corebridge has the highest implied upside to its price target, at 24.9%, measured as the percentage gap between the company's current stock price and analysts' consensus target price of the shares for the next year. The insurer has a consensus analyst rating score of 4.56, which reflects a "buy" recommendation.

Globe Life Inc. follows closely behind Corebridge, with an implied upside to its price target of 24.2%. The Texas-based insurer has a consensus analyst rating score of 5.0, representative of a "buy" rating.

In a note, Morgan Stanley analyst Bob Jian Huang highlighted Globe Life as one of his preferred stocks going into 2026 because its valuation is "abnormally low relative to historical levels, despite encouraging developments and performance."

Lincoln National Corp. and Principal Financial Group Inc. were outliers in the trend. The analyst consensus reflected upsides to price targets of negative 1.2% for Lincoln National and negative 4.2% for Principal Financial.

Jefferies analyst Suneet Kamath is keeping a "constructive" view on the life sector in 2026, saying in a note that he believes sector underperformance in 2025 was a "bump in the road" and not indicative of a larger trend.

"We expect continued robust annuity sales, stronger pension risk transfer activity and stable group underwriting," Kamath said. "We see a better outlook for EPS ahead as new business earns in, and certain companies lap the initial dilution from risk transfers."

AI regulation and interest rates

The impact of AI should continue to be a major theme in 2026 as carriers keep shifting to integrate the technology into workflows and insurance departments determine how to approach regulation.

"As we're maturing in our ways of wanting to use this data, so are the regulations," Chow said. "And I think we're going to see some solidification of some of these regulations around it."

The National Association of Insurance Commissioners has been torn on whether to create a model law related to insurers' use of AI, but more deliberation is expected to take place this year.

As interest rates edge lower, analysts from Moody's project that the global life insurance sector will stay "stable."

"Many life insurance products are long term and will continue to generate predictable recurring profit," analysts said in a note. "Interest rates are falling in most regions, but life insurers' investment returns will hold steady because long-term government bond yields remain high."

Moody's also highlighted China as one place in particular where "falling rates and market volatility exacerbate risks from savings products with guaranteed returns."

In Japan, consumers are predicted to possibly "surrender savings policies in favor of higher yielding alternative[s]" due to rising interest rates.

Visible Alpha is a part of S&P Global Market Intelligence.