Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Jan, 2026

All 123 publicly traded US equity real estate investment trusts analyzed by S&P Global Market Intelligence traded below their respective consensus price target estimates.

The REITs had a median implied upside of 15.0% to their consensus S&P Global Market Intelligence price target estimates as of Jan. 5.

The analysis included US-listed equity REITs that traded on the Nasdaq, NYSE or NYSE American and had at least three S&P Global Market Intelligence price target estimates.

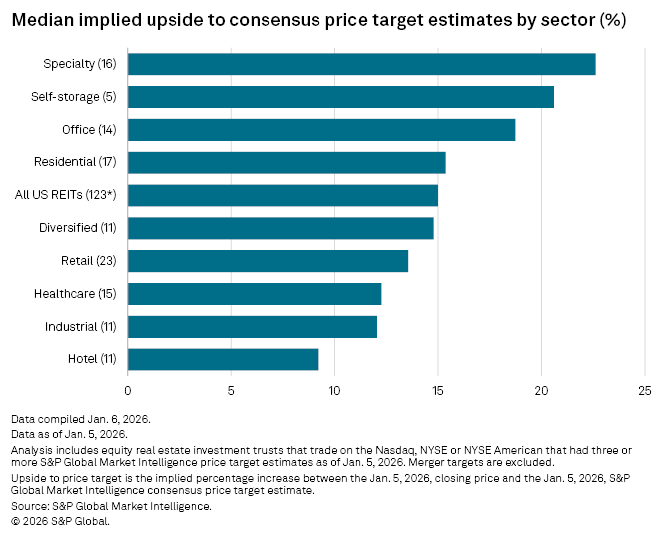

Specialty REITs trade with highest median implied upside

The specialty sector, which includes advertising, casinos, communications, data centers, energy infrastructure, farmland and timber, had the largest median implied upside to its consensus price target estimate, at 22.6%.

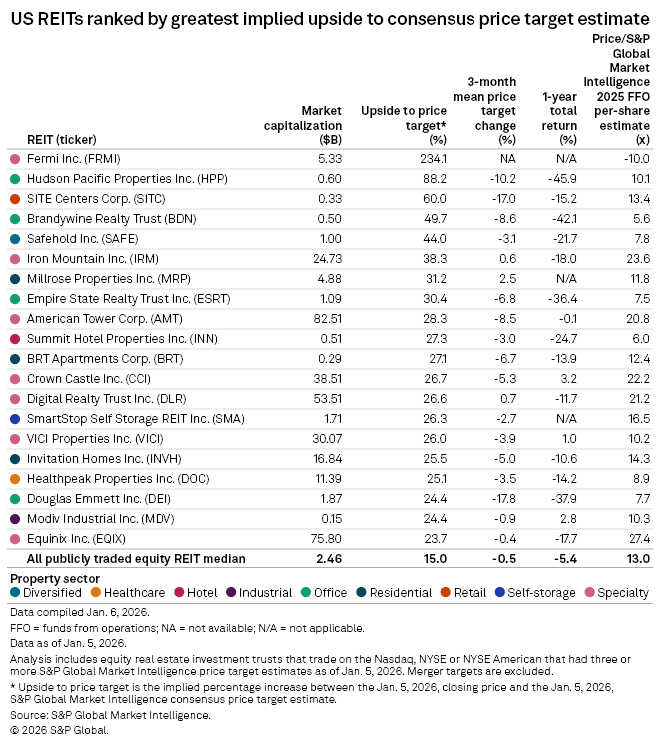

Within the sector, Fermi Inc. had the largest implied upside among all analyzed REITs as of Jan. 5, at over 200%. The REIT's share plunged mid-December 2025 after it revealed that a prospective tenant at its 11-GW data center campus in Texas had withdrawn from a lease agreement worth approximately $150 million.

Iron Mountain Inc., a storage and information management REIT in the specialty sector, had an implied upside of 38.3% and ranked sixth.

Five more specialty REITs ranked among the top 20 for implied upside: communications-focused American Tower Corp. at 28.3% and Crown Castle Inc. at 26.7%, data center REIT Digital Realty Trust Inc. at 26.6%, casino landlord VICI Properties Inc. at 26.0% and data center-focused Equinix Inc. at 23.7%.

REITs in the self-storage segment showed a 20.6% median implied upside to their consensus price target estimates, while the office sector followed closely at 18.7% and the residential sector at 15.4%.

The hotel sector had the smallest implied upside, with a median implied upside of 9.2%.

– Set email alerts for future Data Dispatch articles.

– For further capital offerings research, try the REIT Consensus Estimates Model template.

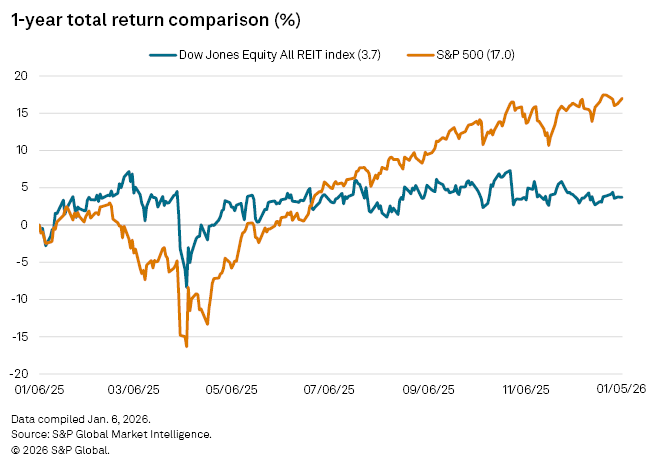

US REITs generally underperformed the broader market over the past year. The Dow Jones Equity All REIT index recorded a one-year total return of 3.7% as of Jan. 5, which was much lower than the S&P 500's return of 17.0% over the same period.

REITs with the highest implied upside

Following Fermi, office REIT Hudson Pacific Properties Inc. ranked second for implied upside to the price target estimate. As of the market close on Jan. 5, its shares were priced at $10.98, which is slightly more than half of the consensus price target estimate of $20.67. Shopping center-focused SITE Centers Corp. ranked third, with a consensus price target estimate 60.0% above its share price.

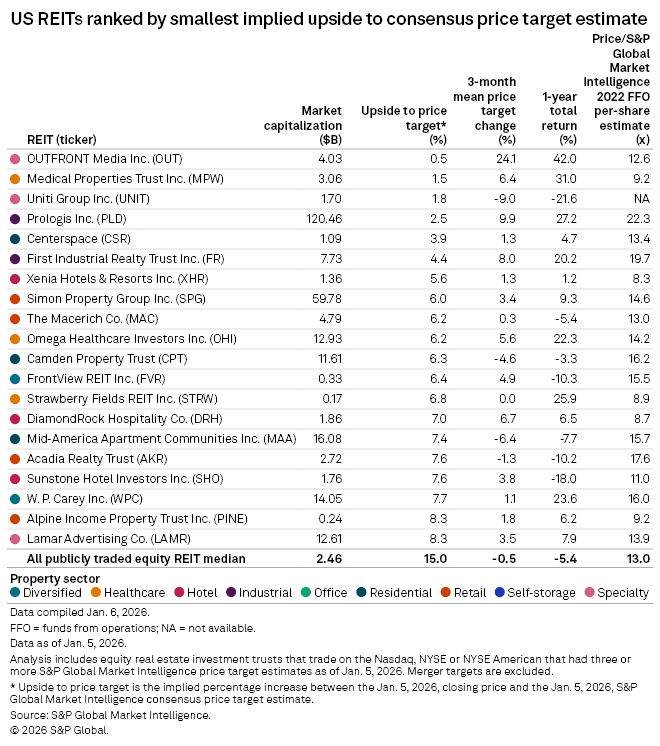

REITs with the least implied upside

Outfront Media Inc., an advertising-focused specialty REIT, had the lowest implied upside to its price target estimate, closing at $24.08 per share on Jan. 5, near its consensus price target of $24.20. Healthcare REIT Medical Properties Trust Inc. and communications REIT Uniti Group Inc. followed, with consensus price targets set at 1.5% and 1.8% above their respective share prices as of Jan. 5.