Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Jan, 2026

By John Wu and Uneeb Asim

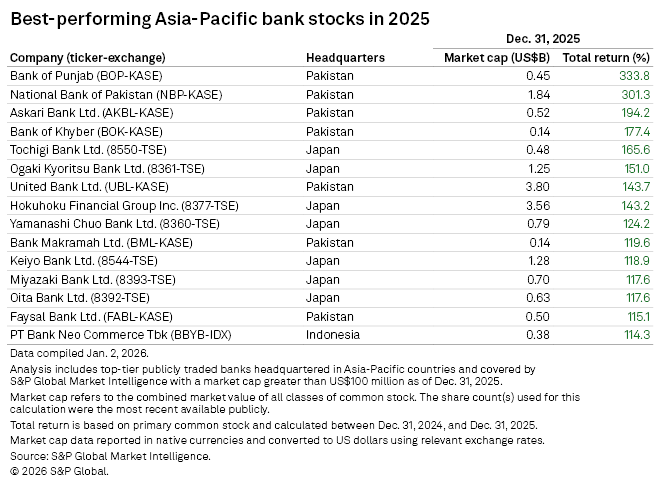

Smaller lenders in Pakistan and Japan delivered some of the highest total returns to investors among banks in Asia-Pacific in 2025, tracking the rally in local equity markets.

The Bank of Punjab reported total returns of 333.8% for its investors in 2025, ranking it top among Asia-Pacific banks with a market capitalization exceeding $100 million covered by S&P Global Market Intelligence. The National Bank of Pakistan, headquartered in Karachi, ranked second with total returns of 301.3%, according to Market Intelligence data.

Askari Bank Ltd. and The Bank of Khyber rounded off the top four, with gains of 194.2% and 177.4%, respectively. Banks based in Pakistan accounted for six of the top 10 positions.

Pakistan's benchmark KSE-100 stock index gained for a third consecutive year, driven by improved economic indicators, fiscal management and political stability, logging a 51.2% gain in 2025 to end the year at a record high.

The International Monetary Fund estimated that the South Asian nation's economy grew by 10.5% in 2025, compared with 10.4% in the prior year, while inflation stood at 3.2%, down from a 12.6% increase in prices in 2024.

More than half of the top 10 gainers in the Market Intelligence analysis had market capitalizations below $1.0 billion, according to the data.

Japanese banks

The Tochigi Bank Ltd. of Japan ranked fifth with an annual gain of 165.6% at a market capitalization of $0.48 billion, according to Market Intelligence data. The Ogaki Kyoritsu Bank Ltd. followed, posting a 151.0% gain in 2025.

Hokuhoku Financial Group Inc. and The Yamanashi Chuo BankLtd. also ranked among the top 10 lenders.

The Bank of Japan on Dec. 19 raised its benchmark interest rate by 25 basis points to 0.75%, the highest in three decades, which has raised expectations of improved profit outlooks for Japanese banks amid widening spreads between lending and deposit rates.

"Given that real interest rates are at significantly low levels ... the Bank, in accordance with improvement in economic activity and prices, will continue to raise the policy interest rate and adjust the degree of monetary accommodation," the Bank of Japan said in its statement, indicating it would continue its path of monetary policy normalization.

The central bank's actions, along with the economic policies of Prime Minister Sanae Takaichi's government, have boosted Japan's equity markets.

Indian lenders trail

Midsized Indian lenders were among the worst performers by total returns in 2025, according to Market Intelligence data. Utkarsh Small Finance Bank Ltd.'s total returns dropped 48.6% for its shareholders. Punjab & Sind Bank posted a 42.1% decline, while ESAF Small Finance Bank's total returns fell 36.6%, according to the data.

The Reserve Bank of India cut its key policy rate by 25 basis points to 5.25% in December, the lowest level since July 2022, bringing the aggregate cut for the year to 125 bps. Policy rate cuts generally shrink banks' interest margins, as asset yields typically fall faster than funding costs, pressuring net interest income and profitability.

"With inflation staying below target and growth expected to moderate, we see scope for another 25 bps cut in the first quarter of 2026," ING Group said in a Dec. 5 note.

The biggest loss among regional peers came from China's Bank of Jiujiang Co. Ltd., down 66.9%, as shares of the Jiangxi-based lender fell ahead of its announcement of an equity fundraising plan in late October 2025.