Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Jan, 2026

By Brian Scheid

With more interest rate cuts looming, inflation decreasing, and the economy holding relatively steady, investors are readying for a breakout in small-cap stocks.

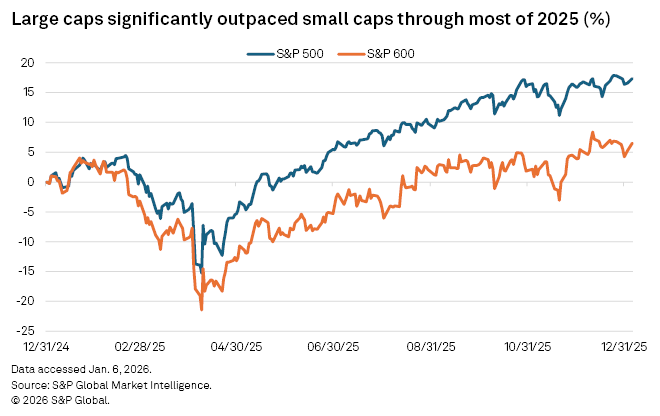

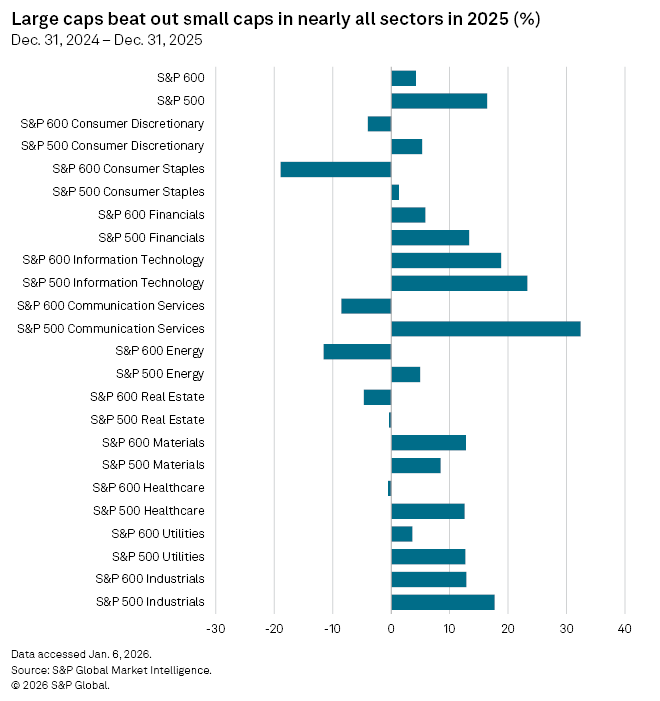

Stocks with market capitalization roughly less than $2 billion stumbled early in 2025, with the S&P 600 falling about 21% through roughly the first four months of last year. As tariff fears intensified and inflation expectations rose, the large-cap S&P 500 also struggled, dropping about 15% over that stretch.

But from its April low, when it appeared the worst fears over tariffs would not be realized, small caps rallied, with the S&P 600 climbing about 33%, though it still underperformed the S&P 500 for most of the year.

"Investors have been waiting for small caps to play catch-up in this bull market," said Bret Kenwell, a US investment and options analyst at eToro. "Contrary to normal market recoveries, small caps didn't lead the charge and pass the baton to large-cap firms. Instead, investors now hope that broadening earnings growth in 2026 helps to also broaden the market rally, allowing small caps to have their moment in the sun."

While large caps outperformed their smaller counterparts in 2025, a small-cap rally could intensify in 2026, according to Tyler Richey, a co-editor with Sevens Report Research, but that largely depends on whether disinflation continues to move toward the Federal Reserve's target.

The Fed wants core personal consumption expenditures, an inflation measure that excludes volatile food and energy prices, to move to 2% annual growth. The core measure fell to 2.8% in September 2025, down from 2.9% in August, according to government data.

The S&P 600 did worse than the S&P 500 for much of the first half of 2025 because inflation fears boosted the likelihood of the Fed keeping interest rates elevated for longer than expected, Richey said. If fears of rising inflation resurface in 2026 and the lagged effects of tariffs boost the odds of stagflation or another threat to growth, small caps will again struggle, likely far more than larger stocks.

"Small caps will almost certainly underperform their larger cap peers in a similar fashion to what we observed into the April 2025 lows as small caps are generally more sensitive to interest rates than well-capitalized large cap companies," Richey said.

The macroeconomic environment appears to be generally positive for the stock market in 2026 with the Fed expected to continue to ease monetary policy later this year and the most severe impacts of tariffs likely to fade, said Sonu Varghese, a global macro strategist with the Carson Group Pty. Ltd. This is expected to support large, mid-, and small-cap stocks, but it is unclear whether small caps will outperform large-caps due to the uncertainty over the Fed's interest rate plans.

"Small caps outperformed in the middle of last year amid expectations of Fed cuts but pulled back relatively more than large caps in early November amid hawkish commentary from Fed officials," Varghese said.

Fed policy shapes landscape for small caps

In December 2025, the Fed made its third cut in four months, lowering the benchmark federal funds rate by another 25 basis points. But with views within the Fed fractured over whether to prioritize bringing inflation down or bolstering the wobbling domestic jobs market, it is unclear when the central bank may cut rates again.

Less than 20% of the futures market expects the Fed to cut rates at their meeting later this month, less than half expects the next cut by March, and over 40% expects the Fed to hold rates steady until June, according to CME FedWatch.

"A hawkish Fed is not a friend of the stock market in general, but it is historically an outright enemy for small caps," said Richey with Sevens Report Research. "The best case scenario for small caps to extend the rally off the April 2025 lows is for more of the same from the economy and Fed, with the soft-landing narrative remaining intact while AI-enthusiasm moderates"

Still, even if the Fed continues to cut rates, the impact on small caps could hinge on the pace of those reductions, said Kenwell with eToro.

"Plunging rates may seem attractive at first glance, but if it's to counter a significant deterioration in the economy, that could very well disproportionately weigh on small caps," Kenwell said. "Instead, a slow-but-steady decline in rates, like we have now, bodes well for a group that's already expected to generate solid margin expansion alongside higher revenue, profit and cash flow in 2026."