Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jan, 2026

By Brian Scheid

US food prices are rising at a pace faster than broader inflation, souring economic expectations and skewing consumers' views of the domestic economy.

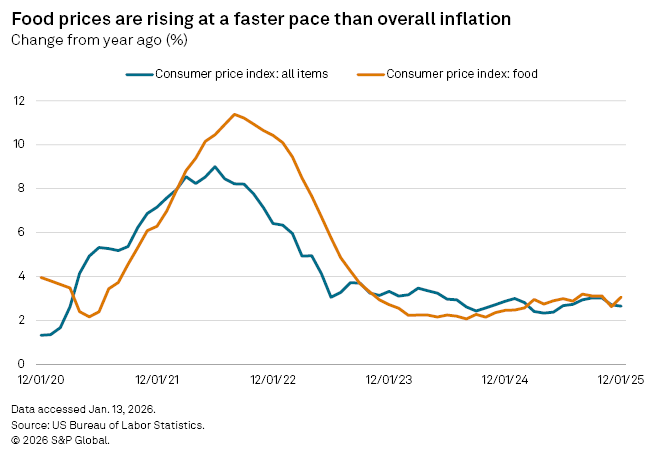

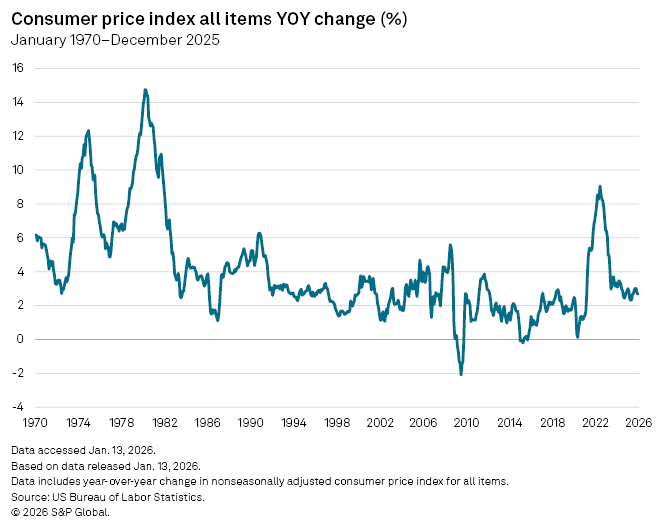

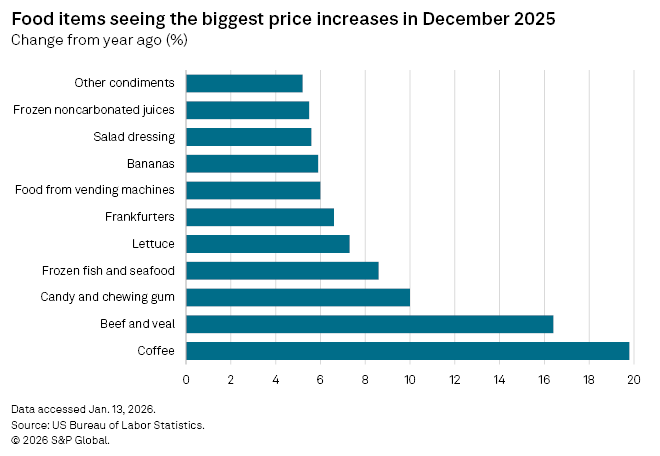

The consumer price index, the market's preferred inflation measure, rose just under 2.7% from December 2024 to December 2025, the lowest annual growth since May 2025. The food component of the index, which makes up about 14% of its overall weight, increased 3.1%.

Food price inflation has outpaced consumer price inflation nearly every month since March 2025. While overall price growth is drifting down toward the Federal Reserve's 2% target, higher grocery prices could be worsening inflation expectations.

"I think there is a disconnect between official inflation numbers and the perception of inflation, which is often driven by frequently purchased items, such as food and gasoline," said James Knightley, chief international economist at ING. "We only buy a new TV or washing machine every few years and 'owners' equivalent rent' is not something that we observe in reality anyway. Therefore, we have less awareness of many of the items that are helping to dampen inflation."

While annual growth in inflation and core inflation, which strips out volatile food and energy prices, have both dipped nearly 40 basis points since September 2025, food prices have remained relatively elevated.

Rising food prices are unlikely to boost the odds of a recession, but the consequences on consumer views could be severe, according to Bret Kenwell, a US investment and options analyst at eToro.

"It could create further angst among consumers who feel they've already been pushed too far," Kenwell said. "Despite a resilient economy and record-high stocks, consumer confidence has not recovered since its decline in March. If food inflation persists, it may contribute to confidence remaining subdued."

Food prices are key for consumer confidence since Americans face them on every grocery store trip, Kenwell said.

"While consumers can adjust their purchases based on budget, many still feel like they're being squeezed, and without relief at restaurants or grocery stores, food costs may continue to be a pain point," Kenwell said.

If food prices continue to rise, consumer views of the state of the economy could worsen, even as the prices of other goods and services fall, said Derek Tang, an economist with LH Meyer/Monetary Policy Analytics.

"Food inflation outpacing overall inflation makes inflation expectations more susceptible to rising, but also crowds out other consumer spending and might make other foods and services less inflationary," Tang said.

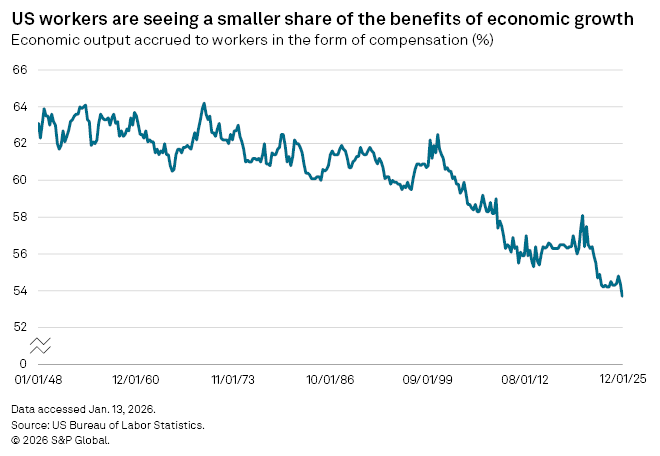

The rise in food prices and the corresponding slump in consumer confidence comes as GDP remains relatively robust and US stock markets continue to rise to all-time highs. This has caused a disconnect between the corporate sector, which is receiving an increasing share of the benefits of economic growth, according to Knightley at ING.

This is likely why the Trump administration keeps attempting to appeal to American consumers through policy proposals such as capping credit borrowing costs, buying mortgage-backed securities in order to lower rates, and removing some items from the scope of tariffs, Knightley said. "This suggests we could see more efforts from the administration to generate positive headlines."

While persistently high food prices will likely continue to frustrate shoppers, most Americans have space in their budgets for food, said David Russell, global head of market strategy at TradeStation.

"Higher food prices will increase inflation expectations, but it's not clear this will hurt demand in a meaningful way," Russell said. "The main result could be more political than economic."