Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jan, 2026

Mainland China and Hong Kong private equity- and venture capital-backed investments in the US fell in 2025 amid mounting regulatory and geopolitical pressures.

Chinese outbound investments into the US totaled $5.96 billion in the year through Dec. 23, 2025, down from the full-year totals of $26.11 billion in 2021 and $8.89 billion in 2024, according to S&P Global Market Intelligence data.

The number of deals dropped to 164 from 438 in 2021 and 271 in 2024.

Fewer Chinese investors are allocating capital into the US due to tighter screening, especially for deals involving technology or data, said Julie Fu, greater China M&A and private equity partner at Clifford Chance LLP.

Under the Foreign Investment Risk Review Modernization Act, noncontrolling investments in critical technology, critical infrastructure and sensitive personal data in the US are required to undergo the scrutiny of the US Committee on Foreign Investment.

"For sensitive jurisdictions like China, there is a real risk that the investment could get delayed or blocked. Many companies would rather forgo the investment than accommodate it on a delayed basis, with the risk that it may not get approved," added Nick O'Keefe, partner at Foley & Lardner LLP.

Mainland private equity investors also face pressure from Beijing authorities, who are encouraging Chinese funding sources to invest domestically, particularly in key areas such as semiconductors, O'Keefe said.

– Download a spreadsheet with data in this story.

– Read about Chinese private equity-backed investments in US and Europe as of June 2025.

– Explore more private equity coverage.

Shift to Europe, other regions

The more stringent deal scrutiny in the US has, to an extent, increased Chinese outbound investment into Europe, Fu said.

"In general, Europe appeals to investors because they see clear processes and fewer surprises, which, combined with realistic valuations and strong brands, makes it easier to get deals done," Fu said.

In 2025, Chinese private equity-backed investments into Europe totaled $14.75 billion, compared with $12.72 billion in 2021 and $20.02 billion in 2024.

"Europe does not have as developed a venture capital industry as the US, and thus Chinese investors can play a more important role in providing funding," O'Keefe said, adding that Europe has not implemented the same level of legal and political opposition to Chinese investments compared with the US.

Chinese investors are also active in other regions, Fu said. Southeast Asia and Japan are getting attention, particularly in digital and consumer businesses, while the Middle East and Africa are seeing more deals in energy and infrastructure projects.

Top investment sectors

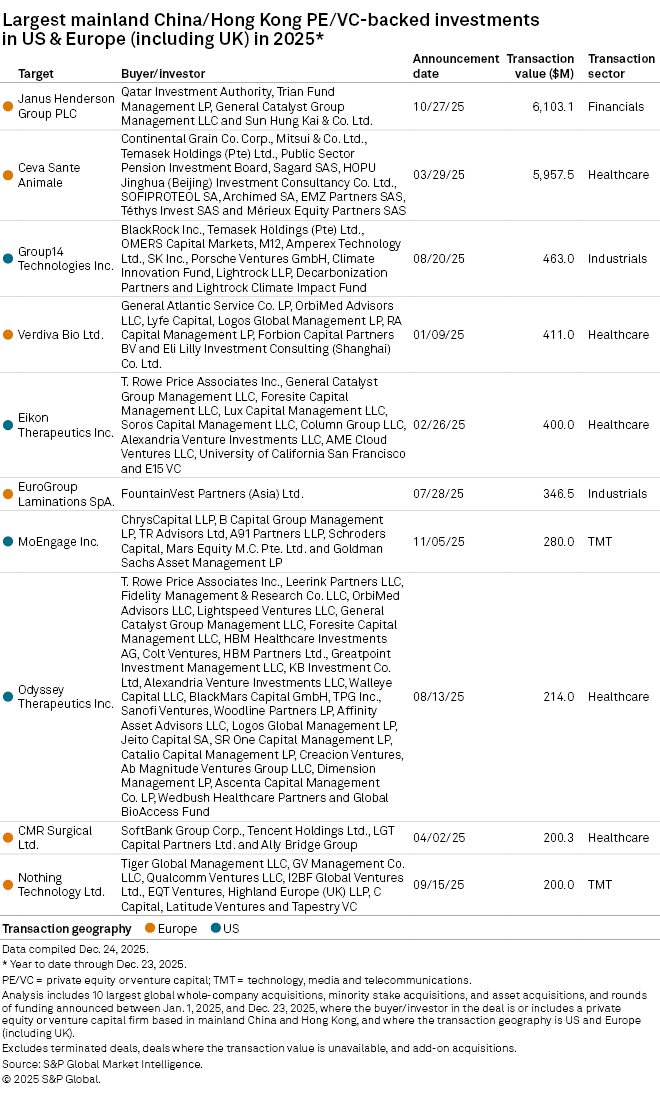

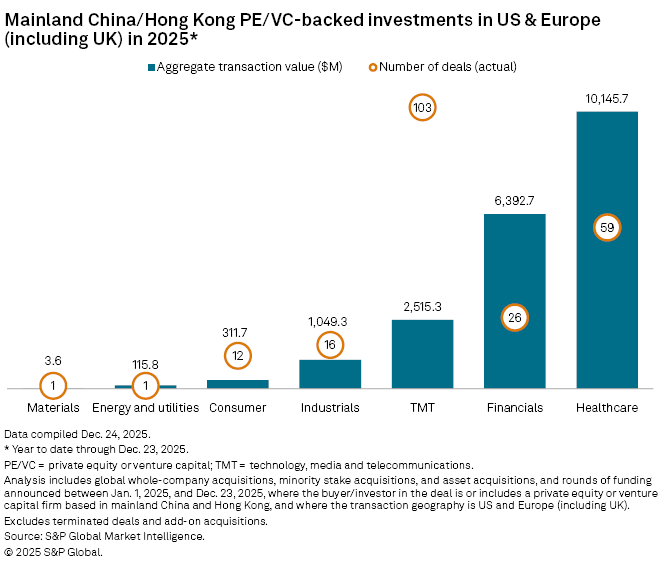

From Jan. 1, 2025, to Dec. 23, 2025, the healthcare industry was the largest recipient of Chinese private equity-backed investment targeting US and European markets, raising about $10.15 billion across 59 transactions.

The financial sector followed, with $6.39 billion in total investments across 26 transactions.

Largest deals

In the largest Chinese private equity-backed deal in the US and Europe in 2025, Qatar Investment Authority, Trian Fund Management LP, General Catalyst Group Management LLC and Sun Hung Kai & Co. Ltd. offered to buy London-based asset manager Janus Henderson Group PLC for $6.10 billion.

The HOPU Jinghua (Beijing) Investment Consultancy Co. Ltd.-backed funding round for French pharmaceutical company Ceva Sante Animale was second, with $5.96 billion in transaction value.