Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Jan, 2026

Global private equity fundraising fell 11.0% to $490.81 billion across buyout, growth, secondaries, general partner stakes and diversified strategies in 2025, marking a second consecutive year of decline, according to data from With Intelligence, part of S&P Global Market Intelligence.

The 2025 total compares to the $551.16 billion raised in 2024.

There were 364 funds launched in 2025 across the measured strategies, which excludes venture capital vehicles. In 2024, 392 funds were launched.

Venture capital decline

Global venture capital fundraising also appeared on track to continue a multiyear decline, with $86.7 billion raised as of Nov. 30, 2025, according to Preqin data. This marks the first time global venture capital total has fallen below $100 billion since 2015.

In contrast, the number of venture capital funds launched in 2025 reached 7,598, the highest level recorded over the same period.

Venture capital fundraising was "extremely muted" in 2025, but a recent increase in IPO activity is a hopeful sign for the industry, Conor Moore, global head of KPMG private enterprise, told Market Intelligence.

"If those IPOs continue to happen, more and more exits happen, and the fundraising picks up," Moore said.

|

– Read about pensions and endowments with the highest allocation to private equity. |

Outlook

After a multiyear slowdown in private equity fundraising and distributions, early signs of recovery are emerging.

"The worst of the distribution drought of the private equity industry is behind us," Josh Zweig, co-head of North American private equity research at Cambridge Associates, told Market Intelligence, adding that institutional investors are now approaching the market with cautious optimism.

However, Zweig noted that the recovery has been uneven across market segments. Larger, established managers are leading the rebound, while midmarket and sector specialists are showing resilience through their ability to differentiate. The flight-to-quality trend among limited partners has left some middle-market and lower-middle-market funds struggling.

Gavin Geminder, global head of private equity at KPMG, said that many of these smaller funds are unlikely to survive the fundraising slowdown.

"Some are doing well. Others are doing not so well. And ultimately, that will mean that those that are struggling will not raise the next fund. And they will literally shut down or they will be consolidated," Geminder said.

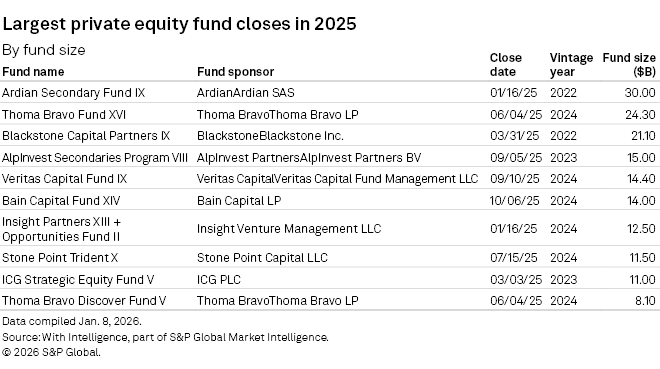

Largest fund closes

The top 10 fund closes in 2025 to Nov. 30 have fund sizes totaling $161.90 billion. The largest fund close was Ardian SAS' $30 billion Ardian Secondary Fund IX, followed by Thoma Bravo LP's $24.30 billion Thoma Bravo Fund XVI LP.