Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jan, 2026

The global private equity industry produced more exits in 2025 but generated a lower return on exit deals as fund managers trimmed expectations for long-held portfolio company investments.

Exit volume ticked up 5.4% to 3,149 exits globally in 2025 from 2,989 in 2024, according to S&P Global Market Intelligence data. Even as the number of exits increased, the announced value of those exits declined 21.2% to $412.07 billion in 2025 from $523.12 billion in 2024.

"Expectations have been ever so slightly lowered on the part of partners at private equity firms, and I think that's a good thing," said Joe Donohue, vice chairman of investment bank DC Advisory US. "If there's anything that’s going to propel us forward in a really robust way in 2026 on the M&A front, it’s going to be because of these slightly recalibrated expectations for exits."

The pressure to monetize aging portfolio company investments and return profits to limited partners is behind the shift to more, but smaller, exits, said Donohue. Fund managers who wanted more time to grow underperforming portfolio companies are now selling and moving on, in part to protect limited partner relationships.

"The lifeblood of the private equity world is to continue raising new funds, and that is really stifled when you can't deliver distributions to your limited partners," Donohue said.

'A little more flexible'

"LPs want distributions, and we're all working to deliver them," added Stewart Kohl, co-CEO of middle-market private equity firm The Riverside Co. Kohl said distributions are especially important to sustain fundraising momentum in the middle market as large, institutional investors increasingly concentrate their private equity allocations with the largest alternative asset managers.

"We are all being a little more flexible. If it's an A company, we still want an A price. But if it's a B-minus company, maybe we'll sell for a B-minus price," Kohl said.

That shift was a long time coming. The interest rate hikes that began in 2022 reduced corporate valuations and created a lasting gap between buyers and sellers in M&A markets. Higher borrowing costs lead buyers to negotiate lower prices, affecting sellers' returns.

US President Donald Trump's Liberation Day announcement of steep new US tariffs on global trading partners landed early in the second quarter of 2025, sapping a slow recovery in exit momentum.

"What happens in periods of volatility is bid-ask spreads widen, and therefore it's much harder to get a deal done. You've either got to get the buyer to jump over the chasm or the seller to jump over the chasm," Kohl said.

Kohl said buyers were willing to make the leap for grade-A businesses, allowing private equity firms to exit prize assets at their target valuations. But for less-stellar portfolio investments, it was managers who had to step across the bid-ask spread.

"Even with good companies, buyers are as discerning as I've ever seen them. They’re going to be concerned about any flaw," Kohl said.

Leader board

Technology startup accelerator Y Combinator produced 53 exits in 2025, more than any other private equity or venture capital firm. Alternative asset manager Blackstone Inc.'s 34 exits ranked second and put it ahead of its peers among the Big Four private equity firms: KKR & Co. Inc. with 16 exits; and The Carlyle Group Inc. and Apollo Global Management Inc., with 15 exits each.

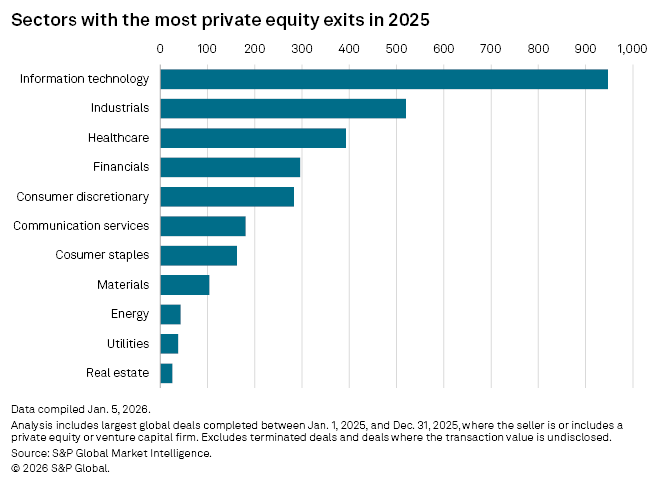

Portfolio companies in the information technology sector accounted for 947 exits in 2025, or 30% of the annual total.

Trade sales were largest exits

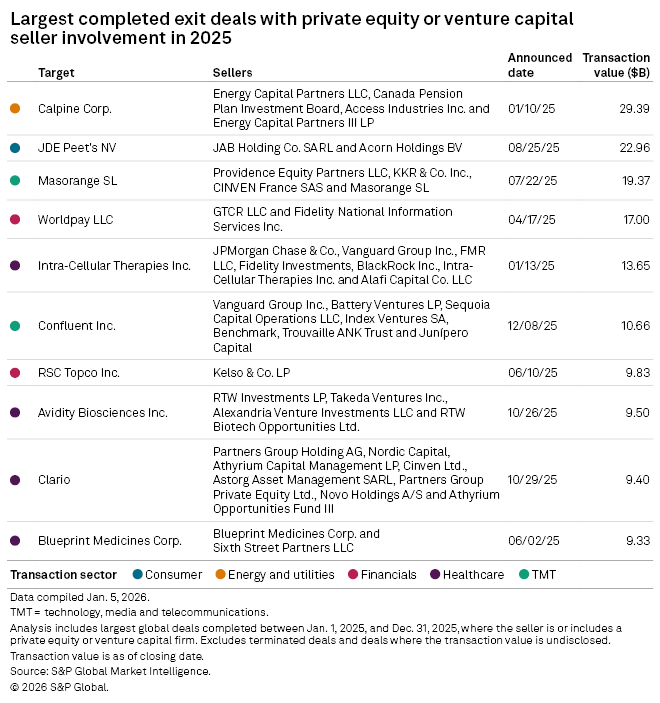

The largest private equity exits of 2025 was the $29.39 billion sale of power company Calpine Corp. to Constellation Energy Generation LLC. Calpine was backed by Access Industries Inc., Canada Pension Plan Investment Board and Energy Capital Partners LLC.

All of the 10 largest private equity or venture capital exits of 2025 came via trade sale to strategic acquirers. Trade sales totaled 2,493 in 2025, the highest annual total since 2021.

"Strategics have been super-acquisitive, which is really good to see," said Scott Voss, a managing director at HarbourVest Partners LLC.

|

– Download a file of raw data from this story. |

The year closed on signs of building momentum behind private equity-backed IPOs, with the 27 portfolio company IPOs recorded in the fourth quarter of 2025 representing the highest quarterly total in four years. That was despite a temporary US government shutdown from October to mid-November that delayed some public offerings, Voss noted.

Voss said the lineup of potential blockbuster IPOs anticipated in 2026 — including Space Exploration Technologies Corp., OpenAI LLC and Anthropic PBC — would clear a path for more private equity-sponsored companies to exit into the public markets this year.