Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

20 Jan, 2026

By Karl Angelo Vidal and Shambhavi Gupta

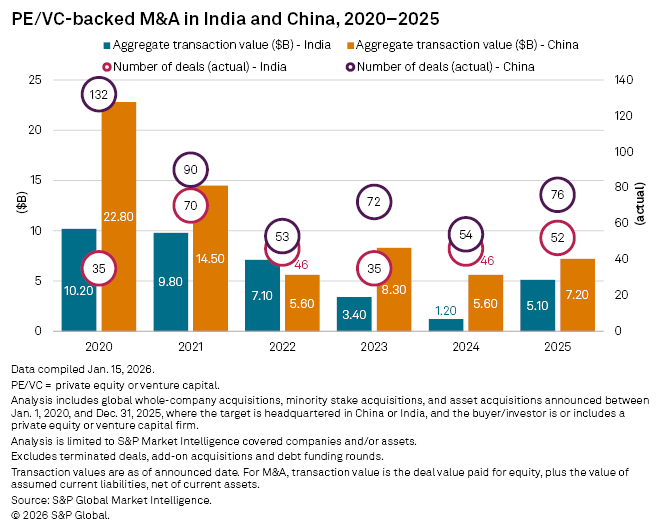

Global private equity and venture capital-backed M&A in India and mainland China rebounded in 2025, following the trend in global private equity deals, which saw 20% year-over-year growth.

Private equity acquisitions in India surged to $5.10 billion in 2025 from $1.20 billion in 2024, according to S&P Global Market Intelligence data.

In mainland China, deal value reached $7.20 billion in 2025, a 29% increase from $5.60 billion in 2024.

The M&A momentum across Asia-Pacific picked up in the second half of 2025 as investors adjusted to macroeconomic uncertainty and resumed deal processes paused earlier in the year, said Jamie McLaren, a partner focusing on private equity across India and Southeast Asia at Clifford Chance LLP.

"India stood out for its continued stability, favorable macro environment and the ever-increasing number of PE/VC sponsors focusing on the market and building up teams on the ground," McLaren said.

The strong fundamentals driving M&A in India will continue to hold true in 2026, helped further by regulatory changes to acquisition financing from Indian banks and onshore lending by international private credit funds, McLaren said. Investors see market opportunities across infrastructure, consumer, healthcare, life sciences, IT and financial services.

In the largest private equity-backed deal in India in 2025, Blackstone Inc. agreed to acquire a 64% stake in Aadhar Housing Finance Ltd. for $1.39 billion.

In China, buyouts picked up as sellers finally reset pricing expectations from the 2021 peak, while sponsors felt pressure to sign deals when activity accelerated in the second half of the year, said Julie Fu, greater China M&A and private equity partner at Clifford Chance.

Deal activity in China is expected to remain robust as momentum from the second half of 2025 continues and valuation expectations normalize, Fu said.

Boyu Capital Group Management Ltd.'s offer to buy a 45% stake in department store operator Beijing Hualian (SKP) Department Store Co. Ltd. for $2 billion was the largest M&A deal in China in 2025, according to Market Intelligence data.

– Download a spreadsheet with data in this story.

– Read about private equity entries in China and India in 2024.

– Explore more private equity coverage.

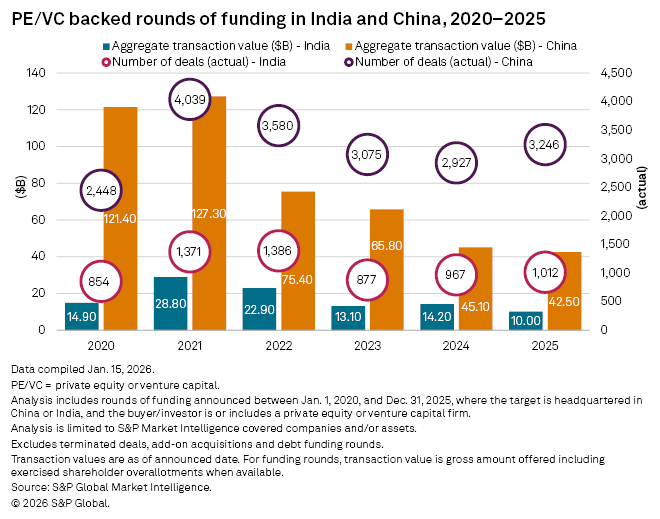

Venture capital slump

Rounds of funding fell in India, with total transaction value reaching $10 billion, down from $14.20 billion in 2024.

In China, rounds of funding fell 6% year over year to $42.50 billion, marking the fourth consecutive annual decrease in total transaction value.

The appetite for growth rounds of funding in China was selective in 2025 as investors assessed IPO timing, and investments in sensitive technologies were constrained by outbound rules for US-linked capital, Fu said.

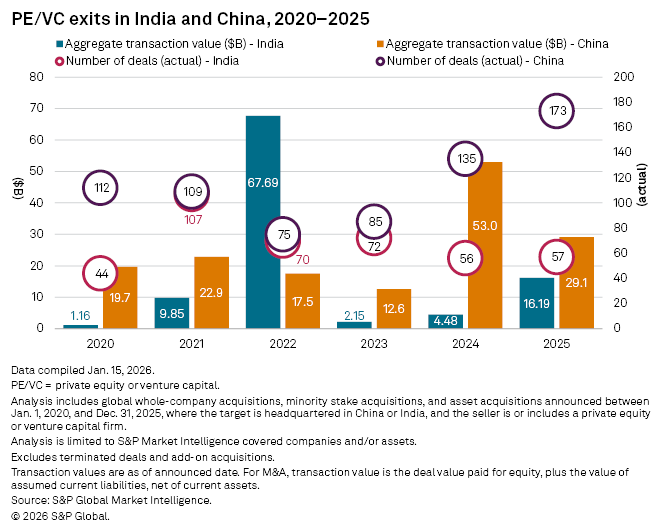

Private equity exit returns soar in India, fall in China

Private equity exit value in India soared 261% year on year to $16.19 billion in 2025, the highest value since 2022. The volume of exits was up slightly to 57.

China, conversely, recorded more private equity-backed exits in 2025 but generated a lower return on exit deals, mirroring the global trend for the year.

There were 173 private equity-backed exits in China in 2025, up from 135 deals in 2024. However, total transaction value fell to $29.10 billion from $53.00 billion a year ago.

The growth in number of exits in China is linked to sellers accepting current pricing reality, Fu said.

"Overall value is lower as many of these are mid‑market or portfolio clean‑ups executed at recalibrated valuations, with continuation vehicles and selective trade sales used case‑by‑case under tighter [limited partner] scrutiny," she said.

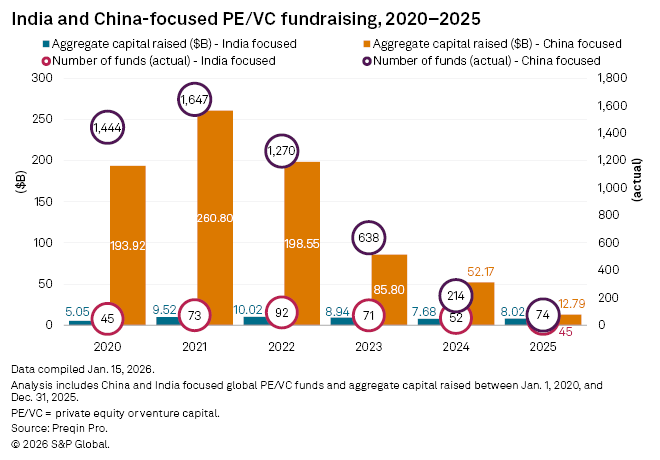

Fundraising in China extends decline

The two huge economies also diverged in fundraising. Global private equity and venture capital funds focused on India raised $8.02 billion, up from $7.68 billion in 2024.

Mainland China-focused funds raised $12.79 billion, down from $52.17 billion the prior year and representing a four-year decline, according to Preqin Pro data.