Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Jan, 2026

By Audrey Elsberry and Annie Sabater

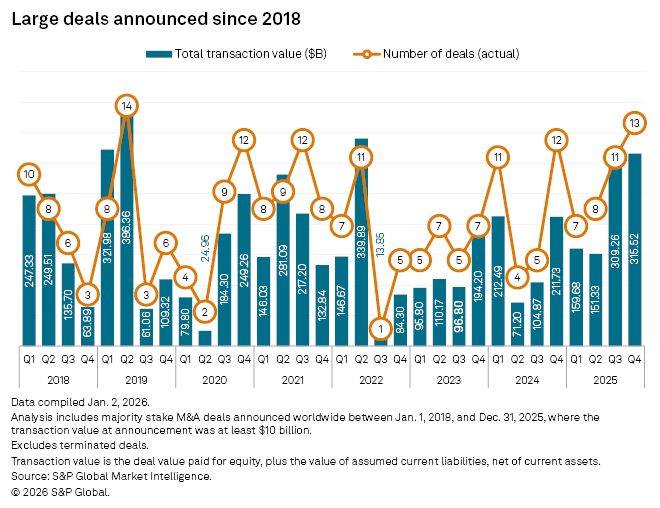

Large-cap M&A trended up in 2025, as the year's total number of deals with at least $10 billion in transaction value worldwide climbed to the highest level in a decade.

The last month of the year added two deals to the 2025 tally, including Netflix Inc.'s agreement to purchase Warner Bros. Discovery Inc., a landmark deal in the entertainment sector announced Dec. 5. The transaction is the second-largest M&A deal announcement in the past 12 months, with $82.70 billion in transaction value. The other deal announced in December was International Business Machines Corp.'s planned acquisition of software company Confluent Inc., with a transaction value of $10.66 billion.

There were 39 deals of $10 billion or more in transaction value announced in 2025, the most since 44 in 2015, according to S&P Global Market Intelligence data. The fourth quarter, with 13 $10 billion-plus deals, had the most announcements of that size since the second quarter of 2019, in which there were 14 $10 billion-plus deal announcements.

Netflix-Warner Bros.

The merger with Warner Bros. Discovery would transform Netflix into a more traditional media company with the addition of HBO, HBO Max and film and TV studios belonging to Warner Bros.

Warner Bros. announced in June that it plans to split into two companies, dividing its streaming service, which Netflix plans to acquire, from its cable unit, which includes CNN, TNT and Discovery.

"This deal provides greater choice and value for consumers," Netflix Co-CEO Gregory Peters said during the deal call with analysts Dec. 5, 2025. "Warner Bros. has one of the world's deepest libraries of [intellectual property], of films and TV shows, and for our members, that means more bang for their buck."

Netflix's cash and stock acquisition is valued at $27.75 per Warner Bros. common share, with shareholders receiving $23.25 per share in cash and $4.50 in shares of Netflix common stock, according to the deal announcement.

|

– View – Read the M&A and equity offerings research paper. – Read more |

The prospect of a combination of Netflix and HBO Max, two of the most popular streaming services, has stoked antitrust concerns, notably from President Donald Trump, who said he would be involved in the deliberations over whether the deal is approved.

"Regulatory approval is highly uncertain," Morningstar analyst Matthew Dolgin wrote in a Dec. 5, 2025, note following the deal. "An antitrust case could be strong, centering on the common ownership of the top and fourth-biggest streaming platforms in the US."

The deal's approval could hinge on how regulators calculate each company's market share. Because households usually subscribe to more than one streaming service, metrics such as subscriber count versus total hours watched could determine if the deal is considered anticompetitive, according to a Barrons report.

Paramount's bid

While Netflix and Warner Bros. celebrated the proposed transaction, Paramount Skydance Corp. submitted competing offers to take over Warner Bros., offering a higher price.

Paramount's all-cash offer, first submitted to the Warner Bros. board Dec. 4, 2025, and later amended and resubmitted Dec. 22, 2025, includes both soon-to-split segments of the selling company for $30.00 per share.

"Our proposal is superior to Netflix's in every dimension, higher headline value, increased certainty in that value, greater regulatory certainty and a pro-Hollywood, pro-consumer and pro-competition future," Paramount Chairman and CEO David Ellison said on a proposed merger call Dec. 8, 2025. "We're confident that once shareholders have the opportunity to choose for themselves, they'll choose Paramount."

Warner Bros. advised its shareholders in a Jan. 7 letter to reject Paramount's latest takeover offer in favor of the deal with Netflix, citing the $54 billion bridge loan financed by Bank of America Corp., Citigroup Inc. and Apollo Global Management Inc. needed to fund the acquisition.

Paramount's bids came only a few months after its own merger, which combined legacy Paramount Global with Skydance Media LLC, closed in August.