Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Jan, 2026

By Brian Scheid

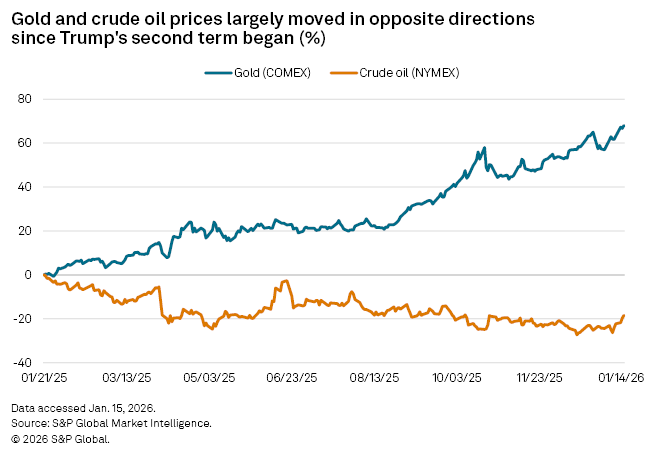

Just over two weeks into 2026, President Donald Trump has approved the apprehension of Venezuela's president, made fresh threats against Iran, again pushed to take over Greenland, called for lower credit card and mortgage rates, and continued to threaten the Federal Reserve's independence.

Financial markets shrugged.

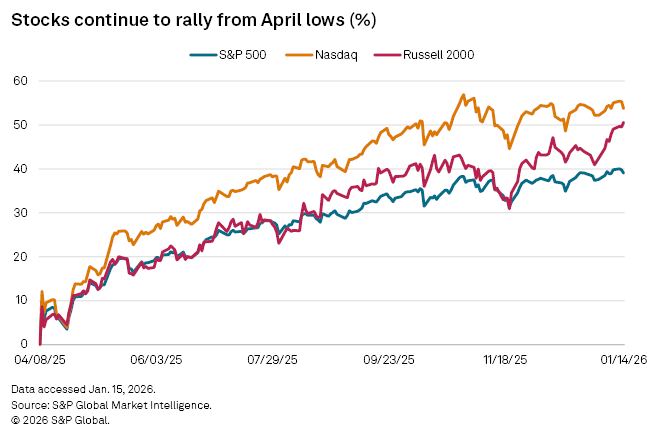

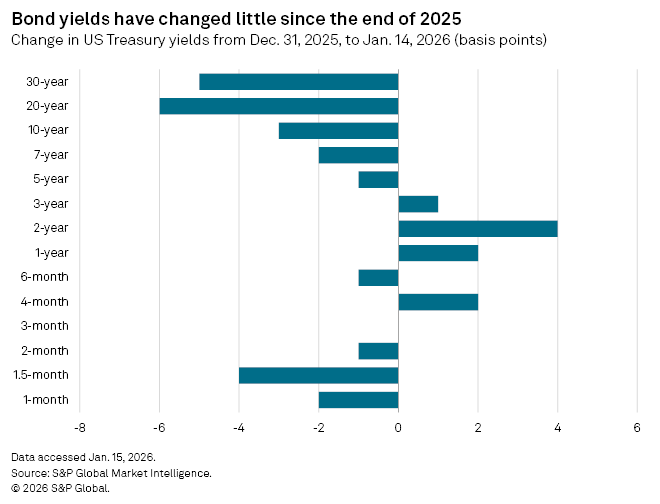

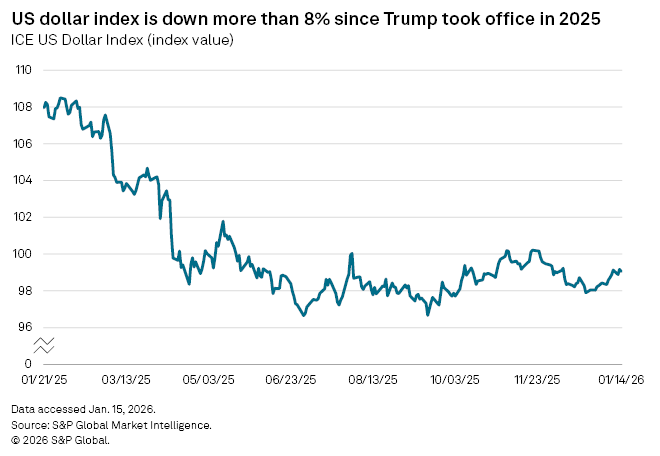

Even with the torrent of risks out of the White House to upend long-standing geopolitics and the economy, US stocks soared to all-time highs, government bond yields barely budged, and the dollar moved little within the narrow range it has been in for months.

"There are interesting things going on around the world, of course, but these tend to be short-lived for markets," said JP Coviello, Citi Wealth's head of portfolio strategy, in an interview. "We fall back on fundamentals, which is where is earnings growth coming from and where is it likely to continue to come from."

As global conflicts have escalated, few have had much market impact, said Tyler Richey, a co-editor with Sevens Report Research.

"It's as if markets have grown numb to geopolitical influence," Richey said.

Investors began 2026 with an overall complacent mindset, pursuing their instincts in equities to continue to buy on any dips in the market. Investor enthusiasm has been fueled by expectations for significant earnings growth, a soft landing again avoiding a recession and a third year of strong market gains, said Richey.

Richey described the market as being in the midst of a "Rip Van Winkle" period.

"It's accustomed to easy money, low-to-negative real rates, and a soft Fed afraid of breaking anything loose in the financial system," Richey said.

The market could be in for a "rude awakening" this year as it continues to underestimate risks, Richey said.

Much of the lack of recent movement in markets could be due to the "Trump Put," a belief that if the market stumbles too significantly, the president will reverse course on any action that could be negatively impacting stocks, said Michael O'Rourke, chief market strategist with JonesTrading.

But the efficacy of the Trump Put could be weakening, O'Rourke said.

"The barrage of policy moves might finally begin to take a toll here," O'Rourke said. "We are likely to hit a point where investors will start mild profit taking in order to allow the numerous initiatives to process. The president's populist attacks on corporate America are beginning to garner negative reactions."

Much of the news out of the White House is unprecedented and poses significant potential consequences for the US and the world, but market strategists said much of it has no immediate, clear impact on companies' cash flows, returns on assets, nor profitability.

"These issues have not really impacted the fundamentals," said Michael Crook, chief investment officer at Mill Creek Capital. "The fundamentals are still good."

While efforts to undermine the Fed's independence could upend bond yields if ultimately successful or further military actions could hinder economic growth, the outcome and impacts remain unclear, said Torsten Slok, chief economist at Apollo Global Management.

For now, there has been no clear impact on corporate earnings, which has left financial markets mostly unaffected.

"We just don't know where this is going," Slok said. "A lot of these things are still so uncertain."