Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Jan, 2026

By Dylan Thomas and Noreen Izabel Jazul

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Some private equity companies sold portfolio investments in 2025 that could have used more time to mature, but patience is in short supply for fund managers.

The number of exits from private equity and venture capital portfolio company investments increased 5.4% year over year to 3,149 globally in 2025, according to S&P Global Market Intelligence data. At the same time, the announced value of those exits fell 21.2% from the prior year total to $412.07 billion, meaning the average exit produced a smaller return in 2025 than it did in 2024.

Fund managers' apparent willingness to accept something less than top dollar for portfolio company investments is a sign they are bowing to fundraising imperatives. Managers who do not prioritize exits and the distribution of profits to their limited partner investors are harming their ability to raise future funds, Joe Donohue, vice chairman of investment bank DC Advisory US, told Market Intelligence in an interview.

"If there's anything that's going to propel us forward in a really robust way in 2026 on the M&A front, it's going to be because of these slightly recalibrated expectations for exits," Donohue said.

Read more about private equity exits in 2025.

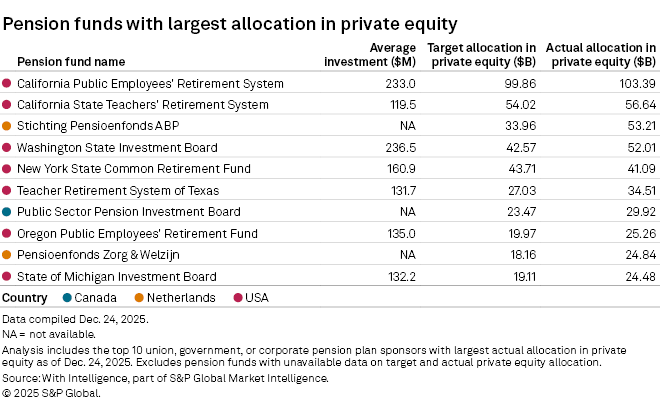

CHART OF THE WEEK: CalPERS leads all other pension funds with $103B private equity allocation

⮞ At more than $103 billion, California Public Employees' Retirement System had the largest allocation to private equity among global public pension funds as of late December 2025, according to data from With Intelligence, a part of S&P Global.

⮞ Seven of the top 10 public pension funds with the largest private equity allocations were based in the US, while two were based in the Netherlands and one was based in Canada.

⮞ The top 10 together had $445.35 billion in private equity investments.

TOP DEALS

– KKR & Co. Inc. and Germany-based energy utility firm RWE AG formed a 50/50 joint venture to develop two UK offshore wind projects with 3 GW of capacity, requiring over $15 billion in investment. KKR is funding the investment through its advised capital accounts.

– Gaw Capital Partners purchased a 100% stake in Korea Environment Technology Co. Ltd. for approximately $500 million from E&F Private Equity and IS DongSeo Co. Ltd.

– EQT Life Sciences sold its stake in Ireland-based medical-device maker Vivasure Medical Ltd. to medical technology company Haemonetics Corp. for €100 million upfront, plus up to €85 million in contingent payments.

TOP FUNDRAISING

– Coller Capital Ltd. raised $17 billion at the close of International Partners IX. The fund, which invests in limited partner-led and general partner-led secondary transactions globally, is already more than 70% deployed.

– Andreessen Horowitz LLC raised over $15 billion across multiple funds. The firm plans to focus on AI and cryptocurrency, while investing in applications across healthcare, defense and other strategic sectors.

– Bansk Group LLC closed Fund II at $1.45 billion. The fund, which already completed investments in PetIQ Inc., Byoma and Arcadia Consumer Healthcare Inc., will continue investing in consumer health, food and beverage, household products and personal care brands. Evercore Private Funds Group was placement agent to Bansk, and Kirkland & Ellis LLP was fund counsel.

– HIG Capital LLC closed its Europe Capital Partners IV fund with €1.6 billion in capital commitments. The fund targets undermanaged European lower-middle-market companies.

– Apheon closed the MidCap Buyout VI fund at its €1.25 billion hard cap, with an additional €50 million from the Apheon team. The fund will target majority buyout investments in the healthcare, services, consumer and niche industrial sectors across core countries in Europe. Evercore Private Funds Group was placement agent, while Houlihan Lokey Capital Solutions Group, Paul Weiss Rifkind Wharton & Garrison LLP and Arendt & Medernach advised on the fundraising.

– Amethis Investment Fund Manager SA and partner Edmond De Rothschild Private Equity closed pan-African vehicle Amethis Fund III SCA at its target of €406 million. The fund's backers include International Finance Corp., Swedfund International AB, FinDev Canada and Proparco SA. The fund targets African small and midsize companies with investment tickets ranging from €25 million to €40 million.

MIDDLE-MARKET HIGHLIGHTS

– HIG Capital sold a minority stake in automotive dealership software provider Kaarya LLC, doing business as myKaarma, to Warburg Pincus LLC. RBC Capital Markets was financial adviser to Warburg Pincus, while Houlihan Lokey and TD Securities advised myKaarma.

– ECI Partners LLP sold workforce safety software provider Rocksure Systems Ltd., doing business as Peoplesafe, to Summa Equity AB. ECI's advisers on the deal included Baird on finance and Squire Patton Boggs on legal matters.

– Arlington Capital Partners bought engineering company Pond & Co. Inc. from DC Capital Partners LLC. AEC Advisors and Stifel are financial advisers while Gibson Dunn & Crutcher LLP and Morrison & Foerster LLP are legal advisers to Arlington. Robert W. Baird, Harris Williams and Arnold & Porter advised DC Capital on the deal.

FOCUS ON: EXIT MARKET REOPENING

Exit markets are expected to gradually reopen this year, according to a market outlook report by law firm Goodwin Procter LLP.

Signs of recovery are particularly evident in the UK and European markets where structured sales processes are returning, driven by increasing buyer interest and a growing pipeline of sell-side opportunities from sponsors. A multitude of exit and partial exit strategies have also emerged as sponsors remain under pressure to generate liquidity.

European firms are routinely considering fund-to-fund transfers, continuation vehicles and recapitalizations, along with traditional exits. In the US, IPOs and dual-track processes are becoming more credible options in addition to traditional M&A for upper-middle-market companies.

Disclaimer: This content may be AI-assisted and is composed, reviewed, edited and approved by a human at S&P Global.

______________________________________________

For further private equity deals, read our latest "In Play" report , which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private debt news, see our latest private debt newsletter