Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Jan, 2026

By Zoe Sagalow and Ayesha Shahbaz

Some of the largest US bank deals announced in three years are closing at a fast clip.

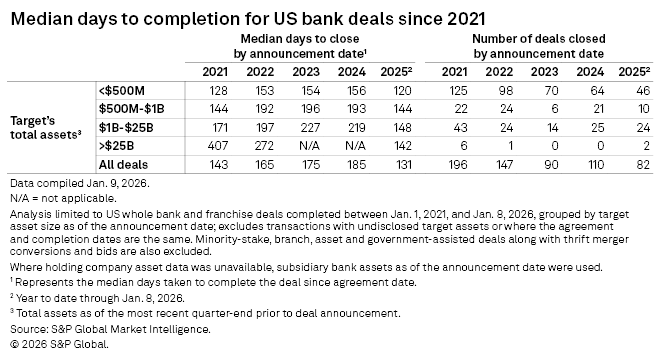

Four transactions involving bank targets with over $25 billion in assets were announced in 2025, marking the first deals of that size since 2022. Half of those deals have closed, representing a median closing time frame of 142 days, down from 272 days for a similar-sized deal announced in 2022 and 407 days for six such deals announced in 2021.

Between the two, PNC Financial Services Group Inc. closed its $4.08 billion purchase of FirstBank Holding Co. the quickest, at 122 days, lower than the 131-day median for all deals announced in 2025 that have closed so far and just above the 120-day median for the smallest deals involving targets with under $500 million in assets. The deal, announced Sept. 8, 2025, closed in about four months on Jan. 5.

Pinnacle Financial Partners Inc. closed its $7.90 billion tie-up with Synovus Financial Corp. in 161 days, and now it must demonstrate success to combat investors' negative bias toward mergers of equals, analysts said.

Reducing banks' M&A regulatory burden and shortening closing timelines have been a priority for current federal regulators.

"Mergers and acquisitions involve coordinating a number of time-dependent processes, including transaction closing and staffing related planning, and the process of scheduling technology integrations with specialized vendors. Missing deadlines can be costly for the institutions involved, and we are currently working to improve this process by addressing these and other challenges, especially for community banks," Federal Reserve Vice Chair for Supervision Michelle Bowman said in a speech during the week of Jan. 5.

Deals involving the smallest community banks with under $500 million in assets have seen the fastest closing timelines with a median of 120 days for deals announced in 2025. Deals involving banks between $500 million and $1 billion in assets have taken 144 days to close, while deals with targets between $1 billion and $25 billion of assets have taken 148 days.

Overall, bank deals announced in 2025 have taken a median of 131 days to close, down from a five-year high of 185 in 2024.

Several other large deals announced in 2025 recently secured regulatory and shareholder approvals and are set to close soon, setting them up for fast closing timelines.

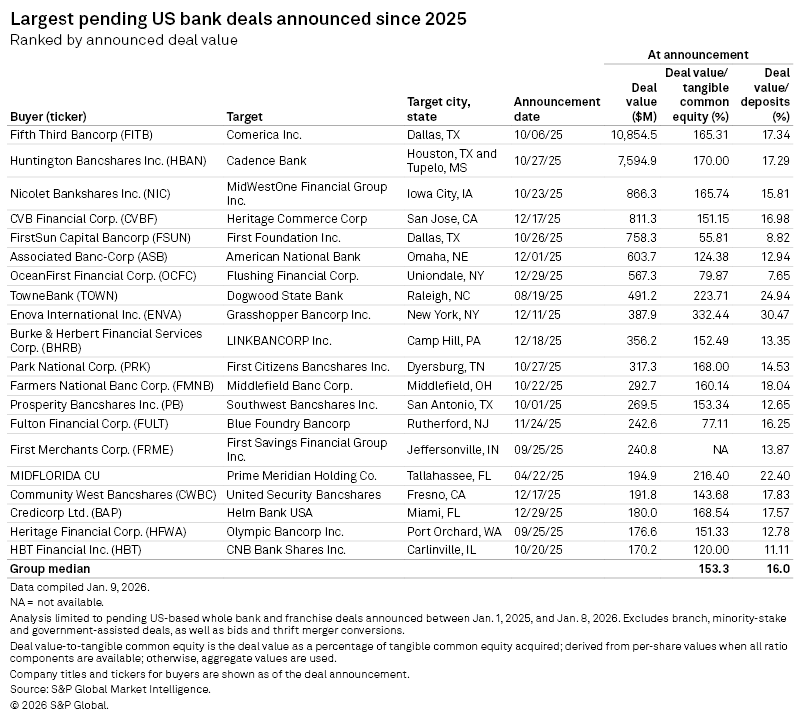

The largest pending US bank deal, Fifth Third Bancorp's $10.85 billion acquisition of Comerica Inc., is set to close this quarter after receiving all regulatory and shareholder approvals. The deal was announced Oct. 6, 2025, about 100 days ago.

Huntington Bancshares Inc.'s planned $7.59 billion purchase of Cadence Bank also recently received the necessary approvals and is set to close Feb. 1, 97 days from the Oct. 27, 2025, deal announcement date. Both banks were able to quickly close acquisitions of other banks earlier in the year.

All but one of the 20 largest pending US bank deals since Jan. 1, 2025, were announced in the second half of 2025. The only deal disclosed earlier in the year was MIDFLORIDA CU's proposed $194.9 million acquisition of Prime Meridian Holding Co., announced in April 2025.

Credit unions' acquisitions of banks typically take longer to close since both bank and credit union regulators are involved in the approval process.