Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Jan, 2026

By Brian Scheid

Job openings and hiring in the US are nearing pandemic lows, a clear signal that the domestic labor market has weakened.

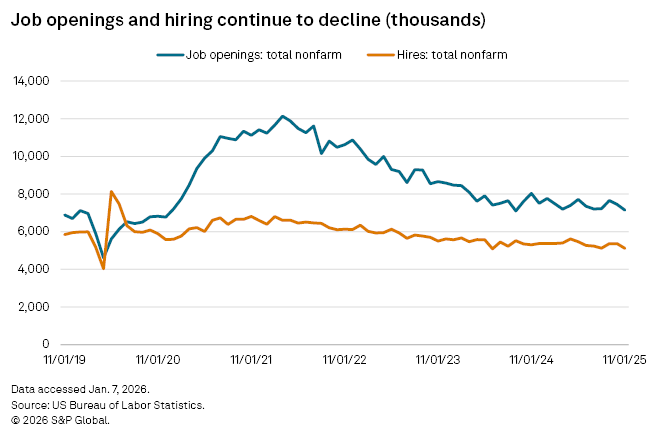

There were fewer than 7.2 million job openings in November 2025, the US Bureau of Labor Statistics reported Jan. 7. That's down 11% from a year ago and down about 41% from March 2022, when US job openings peaked at more than 12.1 million.

Meanwhile, total hires dropped to nearly 5.1 million in November 2025, down about 4% from a year earlier and the lowest level of hiring since April 2020, when many businesses were shuttered due to the COVID-19 pandemic. Outside the pandemic era, this is the weakest level of hiring in the US since January 2015.

"Given all the policy and technological uncertainty employers face, they aren't at all confident that hiring will lead to profit," said Aaron Sojourner, labor economist and senior researcher at the W.E. Upjohn Institute For Employment Research. "They're reluctant to commit to new payroll expenses, so they've reduced job openings over the year."

The lack of hiring drove unemployment to 4.6% in November 2025, its highest level since September 2021, despite companies' reluctance to reduce their workforces, Sojourner said.

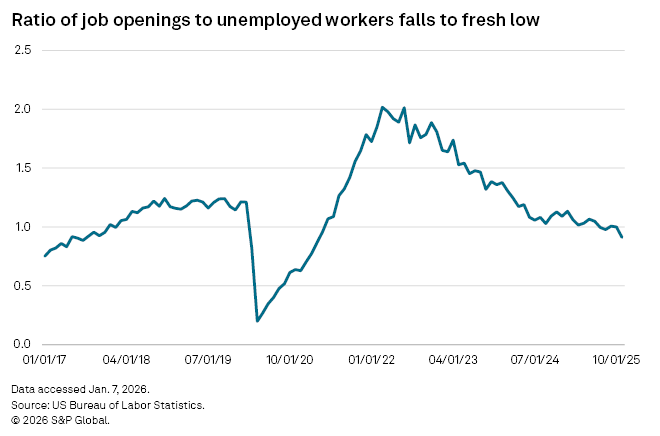

The ratio of job openings to unemployed workers was close to 0.9 in November 2025, which, excluding the pandemic, was the lowest since 2017. The ratio indicates that there was fewer than one job available for every unemployed worker. In March 2022, there were more than two jobs available for every unemployed worker.

"This shows labor demand is clearly cooling," said Gregory Daco, chief economist at EY-Parthenon.

Job openings and hiring are considered leading indicators of labor market weakness, since companies often pull back on new hires about six to nine months before making job cuts that result in higher unemployment, Daco said.

Wage impact

The decline in open jobs for unemployed Americans will likely put downward pressure on wages as the excess supply of workers grows, said James Knightley, chief international economist with ING.

"That's good news for inflation pressures, but not great for those of us hoping for a pay rise," Knightley said.

While recent jobs data is likely "muddied" by the government shutdown, which delayed and even cancelled some data releases, the sluggish hiring best exemplifies the "angst" workers are feeling about the current job market, said Daniel Zhao, chief economist with Glassdoor LLC.

"Low hires mean the unemployed and new grads feel frozen out of the job market while the employed are frustrated by the lack of opportunities to move up," Zhao said.

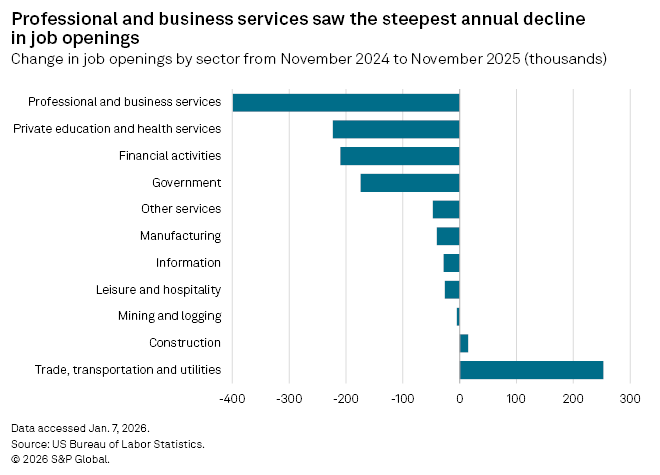

While job openings in trade, transportation and utilities increased by 253,000 year over year in November 2025 and openings in construction increased 15,000 over the period, openings in all other sectors declined.

Job openings in professional and business services fell by 399,000 over the year.

If some of the job listings are inactive, the market could be even worse than the data indicates, said Knightley with ING.

"There is a question mark over whether these listings are truly active. Are employers notionally advertising, but not actively pursuing?" Knightley said. "They want to keep the headcount on their books, just in case. It is easier to remove that headcount rather than having to decide who to fire."