Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

06 Jan, 2026

By Allison Good

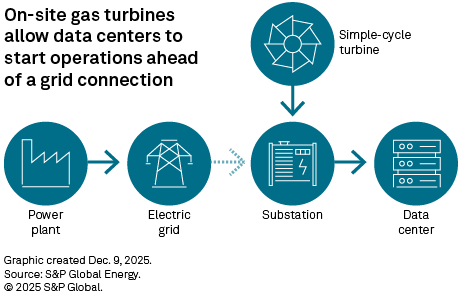

Providers of modular, behind-the-meter power generation are gaining a substantial foothold in the race to energize large load customers, offering bespoke solutions across the data center value chain while independent power producers struggle to connect large loads to the grid.

Interconnection queue bottlenecks, regulatory processes and yearslong wait times for large gas turbine deliveries have prevented Constellation Energy Corp., Vistra Corp., Talen Energy Corp. and NRG Energy Inc. from bringing new generating capacity online quickly, particularly in the PJM Interconnection LLC region, where data center development is booming.

Some independent power producer (IPP) CEOs have said that the "bring your own power" model will not meaningfully challenge their businesses. However, an increased focus on protecting ratepayers from transmission build-out costs and hyperscalers' near-term electricity needs is weighing on those large merchant generators.

"The IPP thesis for the last year has been about maximizing market on the current megawatts these companies own, and I think that given the various calls across the nation for affordability and an increased focus from governors nationally on additionality, I do think that kind of challenges the overall free cash flow value proposition for the IPP sector," Barclays Senior Research Analyst Nicholas Campanella said in an interview.

Turning to companies that offer various configurations of small gas turbines, reciprocating engine generators, battery storage and renewable energy "effectively takes some of the market share away from utilities and IPPs," Jefferies Managing Director Paul Zimbardo said in an interview.

"As the grid has tightened and the data centers want to speed up development, you've seen increased competition that wasn't something that people were thinking about before ... weighing on IPP stocks," Zimbardo added.

Specific expertise

A data center campus in Abilene, Texas, for example, is using 10 GE Vernova Inc. 30-MW aeroderivative gas turbines as a primary power source.

The first phase of the Stargate joint venture, formed by Oracle Corp., OpenAI LLC, SoftBank Corp. and cloud infrastructure provider Crusoe Energy Systems LLC, began operating in September.

"There's originally about 200 MW of load approved for the grid from an American Electric Power Co. Inc. substation and there's demand from Oracle on the site to go to 300 MW of peak load, and obviously that 200 MW on the grid was not going to be able to support the full, initial two-building design," Andrew Likens, Crusoe vice president of energy business development, said in an interview.

Those 300 MW will be used as backup power once more grid capacity becomes available, Likens added.

Crusoe also offers multiple combinations and configurations of battery energy storage systems, carbon capture technology, renewables and natural gas, tailoring each solution to a customer's specific requirements.

"We really understand what the data center end customer needs, and we can design a more efficient system from land and power all the way to compute and token output, and so our ability to really speak energy but also speak compute positions us well," Likens said. "It's another level of complexity that IPPs just don't have a ton of experience in."

Caterpillar Inc. Senior Vice President of Electric Power Melissa Busen agreed that "many factors go into the actual configuration for prime power," including whether a data center is being used for AI training, AI inference or cloud computing.

The construction giant, which has worked with data center developers since the 1990s, can provide both small gas turbines and gas generator sets as behind-the-meter power, Busen said in an interview.

IPPs, in comparison, usually only have one form of technology at a generation site, according to Duncan Campbell, vice president of data center solutions for Scale Microgrid Solutions LLC.

Customer experience also gives companies like Scale Microgrid Solutions a leg up, Campbell said in an interview.

"When you're an IPP, your customer is just the power market ... in this space, you have an actual customer, a corporation that is depending on you to keep the lights on, that you're working on construction and maintenance with and want to leave happy," Campbell added.

The distributed energy company entered the data center space in 2025, applying its integration of batteries, natural gas generator sets and solar energy to those customers. Scale Microgrid Solutions has a project under construction that will be operational in less than two years.

Competition from oilfield services

In addition to companies like Crusoe, Caterpillar and Scale Microgrid Solutions, oilfield services companies are also competing with IPPs to power data centers on an expedited timeline.

In October, Halliburton Co. announced a strategic collaboration with gas-powered microgrid supplier VoltaGrid LLC to provide behind-the-meter electricity for data centers worldwide.

Tailwater Capital LLC-backed Frontier Infrastructure Holdings, meanwhile, purchased 16 small gas turbines from Baker Hughes Co. in May to energize data center projects in Texas and Wyoming.

The sector has expanded into supplying data centers with modular power solutions "pretty aggressively" because they are using the same equipment to power oilfield operations, Jefferies' Zimbardo said.

"You don't have to change your business model," Zimbardo added. "You just sell the equipment at higher prices and get longer."

Oilfield services companies can also provide that equipment efficiently, moving small turbines and reciprocating internal combustion engines across Texas to data center developers directly from local drilling hot spots such as the Permian Basin, Barclays' Campanella noted.

"They can get you up and running in 2026 or 2027," Campanella said.