Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Jan, 2026

Green bond issuance by US equity real estate investment trusts slowed in 2025, according to an S&P Global Market Intelligence analysis.

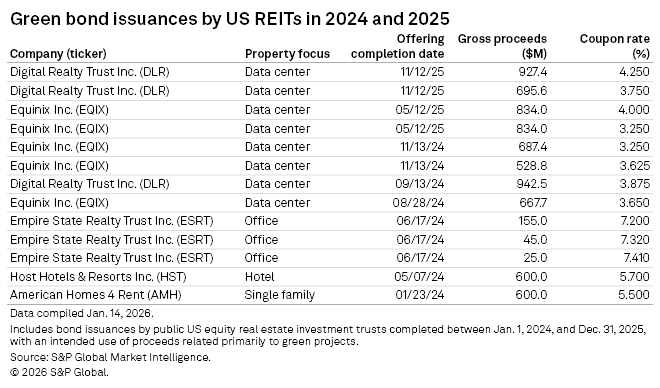

All green bond offerings in 2025 were issued by data center REITs.

Equinix Inc. raised approximately $1.67 billion through two euro-denominated offerings in May, consisting of €750 million of 3.25% senior notes due 2029 and €750 million of 4.0% senior notes due 2034.

Additionally, Digital Realty Trust Inc. raised roughly $1.62 billion in November through its two euro-denominated green bond offerings, comprising €600 million of 3.75% notes due 2033 and €800 million of 4.25% notes due 2037.

– Download the full list of green bonds issued by US REITs since 2018.

– Set email alerts for future Data Dispatch articles.

Collectively, the two data center REITs raised $3.29 billion through green bond offerings, representing approximately 6.3% of total bond proceeds raised by REITs in 2025.

The 2025 total represents a 22.6% decline from the $4.25 billion raised through green bonds the year prior. It is down significantly from its peak in 2021, when REITs raised $14.38 billion, representing 18.2% of the total proceeds raised by REITs through bonds during that year.

Green bond proceeds surpass $44B

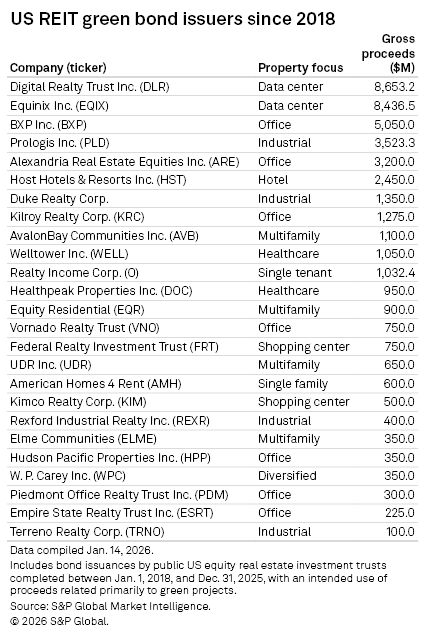

Twenty-five US REITs have issued green bonds since 2018, aggregating nearly $44.30 billion in proceeds.

Digital Realty raised the most proceeds through green bond offerings of any US REIT over the eight-year period, at $8.65 billion in total. Digital Realty also sold $500 million of green bonds in 2015.

Equinix followed next, raising nearly $8.44 billion through green bonds over the analyzed period.

Office REIT BXP Inc. rounded out the top three, raising $5.05 billion through green bonds over the period. Industrial REIT Prologis Inc. followed with $3.52 billion raised.