Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Jan, 2026

By Nick Lazzaro

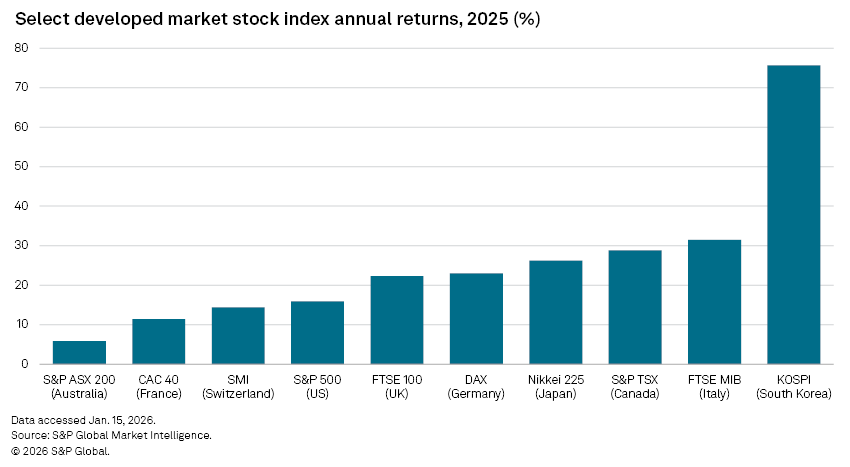

Currency dealers monitor exchange rates in front of a screen showing price movement in South Korea's benchmark stock index, the Korea Composite Stock Price Index, and other data Oct. 27, 2025, at the Hana Bank headquarters in Seoul. The index was one of the best-performing in the world during 2025, gaining more than 75% and setting multiple record highs. Currency dealers monitor exchange rates in front of a screen showing price movement in South Korea's benchmark stock index, the Korea Composite Stock Price Index, and other data Oct. 27, 2025, at the Hana Bank headquarters in Seoul. The index was one of the best-performing in the world during 2025, gaining more than 75% and setting multiple record highs. |

International stocks are set to extend a market rally from 2025 but may not outperform US equities again in 2026.

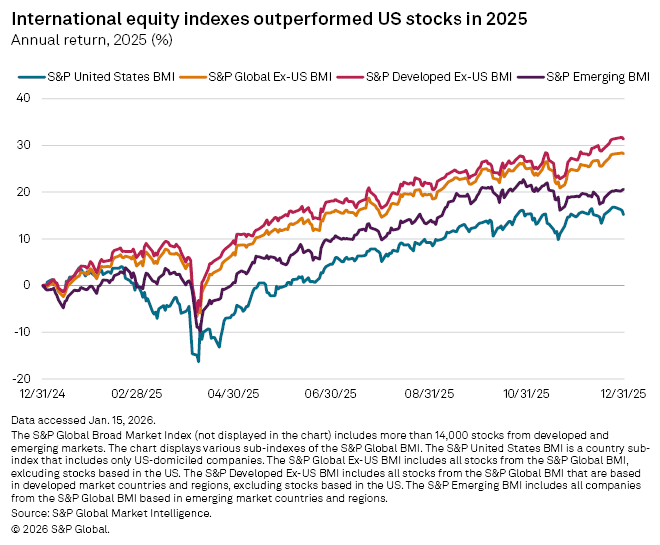

The S&P Global Ex-US Broad Market Index (BMI), which tracks over 12,000 non-US stocks, gained more than 28% in 2025, outpacing returns of nearly 16% from both the S&P 500 and the S&P United States BMI, according to S&P Global Market Intelligence data. The S&P Developed Ex-US BMI, which tracks stocks in developed countries outside of the US, and the S&P Emerging BMI, which tracks stocks in emerging markets, also recorded gains of more than 31% and more than 20%, respectively, in 2025.

Several factors contributed to the outperformance of international stocks over US stocks in 2025, including a weaker US dollar. Investors also increasingly diversified capital in international markets amid global trade tensions and expansionary fiscal policies in certain countries. Though strong returns are again expected for international stocks, the US market may regain its lead in 2026.

"I would not anticipate an outperformance to the US markets," Frank Windels, head of equity capital markets syndicate at Truist Securities, told Market Intelligence. "However, the trend of higher returns compared to average returns should continue for the European and Asian markets. In particular, the new issue market and sectors in growth technology, including defense technology, continue to be focus areas for investors."

Investors will also be attracted to global equities as they seek to diversify beyond the AI-driven dominance and elevated valuations in the US market, Windels said. Western European markets, for example, could present opportunities from technology and defense stocks, the healthcare sector and IPOs, Windels said.

"With that said, the US market remains the deepest and most liquid," Windels said. "Any volatility in the broader market over the year will drive higher performance for the US market compared to the international markets. A year with steady corporate earnings growth and limited geopolitical surprises or tariff reprises should drive both US and non-US markets evenly with a tight performance band between the two categories."

Potential for emerging markets to outperform US

Emerging markets are positioned to record strong gains again in 2026, although "matching the pace of 2025 will be challenging, given the strong returns over the last 12 months," according to Gary Pzegeo, managing director and chief investment officer for CIBC Private Wealth.

"Supporting factors include resilient earnings growth, attractive valuations relative to developed markets and macroeconomic tailwinds such as a softening dollar and a likelihood of more US Federal Reserve interest rate easing," Pzegeo told Market Intelligence. "Challenges include geopolitical risk, potential volatility from trade and policy uncertainty and vulnerability to shifts in global growth or commodity prices."

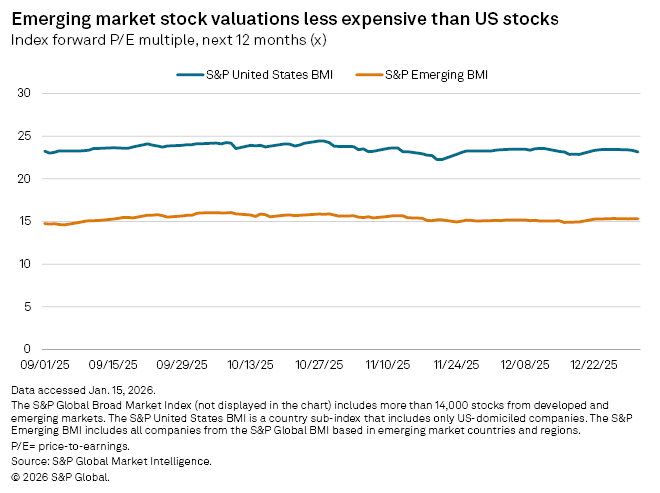

The S&P United States BMI's aggregate daily forward price-to-earnings ratio ended 2025 at 23.15x, higher than a 15.33x multiple for the S&P Emerging BMI, according to Market Intelligence data. The ratio divides a stock's current price by estimates of future earnings per share, giving an insight into its perceived potential and relative cost.

In addition to robust earnings growth, discounted equity pricing and a softer dollar, there are further tailwinds that may push emerging market equities to ultimately outperform US stocks in 2026, Arun Bharath, partner and chief investment officer for Bel Air Investment Advisors, told Market Intelligence. These factors include higher income per capita growth and more prudent fiscal policy in emerging markets relative to the US.

Emerging market equities may also have an opportunity to again outpace US equities in 2026 if foreign investors drive capital outflows from the US amid the Trump administration's "America first" policies or if performance cools among AI-related stocks in the US, according to Bharath.

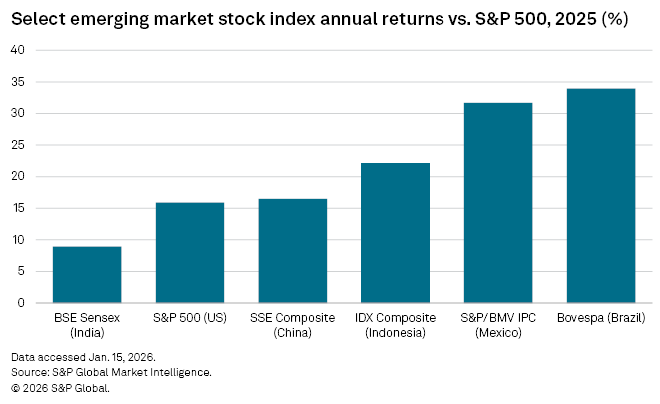

In particular, countries where stocks lagged global performance in 2025, such as India, could see stronger market performance in 2026.

"As a result of its underperformance, valuations on a forward multiple for Indian equities are more reasonable," Bharath said. "In the meantime, the Indian administration has enacted consumer-friendly policies that will likely boost economic growth in 2026."

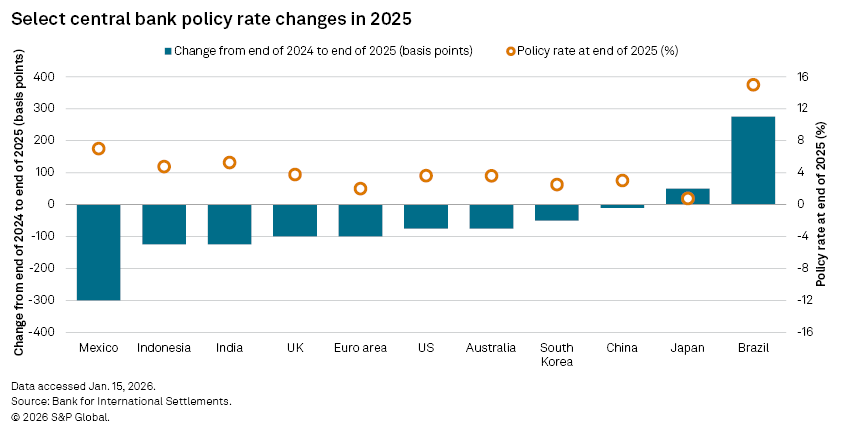

Brazil's stock market may also exhibit robust performance as the country's central bank has the ability to lower interest rates from elevated levels to boost economic growth, Bharath said.

The Central Bank of Brazil's policy interest rate was 15% at the end of 2025.

Weaker dollar, rate easing to benefit emerging markets

Emerging market equities would particularly get support from continued weakness in the dollar.

"A weaker dollar generally benefits emerging markets by lowering debt service costs for dollar-denominated liabilities and enhancing local currency returns for foreign investors," CIBC Private Wealth's Pzegeo said.

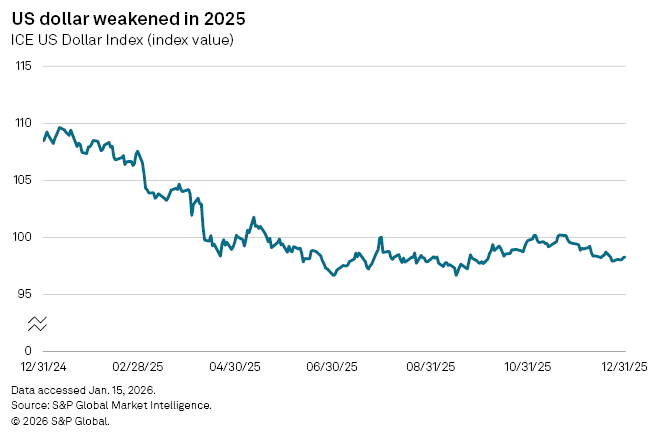

The US Dollar Index began 2025 above 108 but trended mostly between 96 and 100 during the second half of the year, according to Market Intelligence data.

Declining interest rates in the US will likely limit the dollar's upside in 2026.

The US Federal Reserve lowered its benchmark rate six times from September 2024 through the end of 2025 amid cooling inflation and stable employment trends. Expectations for further rate cuts are mixed this year as the Fed weighs risks from sticky inflation and weakening labor market signals.

Markets project the Fed's current rate will decline by 25-75 basis points this year, according to CME Fedwatch data.

"A US Fed tilting toward lower rates allows emerging market central banks to maintain expansionary policies," Pzegeo said.

US trade policy will add further pressure to the dollar in 2026, following a year in which emerging markets remained resilient despite new US tariffs.

"Hawkish trade policy in the US is pushing central banks to diversify their reserve exposure away from dollars," Pzegeo said. "This technical headwind drove the initial move lower in the dollar."

However, bouts of dollar strength may emerge periodically throughout the year.

"Episodes of dollar strength driven by risk aversion or unexpected macro surprises could temporarily pressure risk assets in emerging markets," Pzegeo said.