Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

07 Jan, 2026

By Dylan Thomas and Gaurang Dholakia

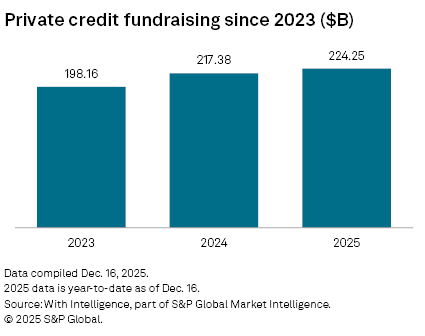

The global private credit industry's fundraising haul increased in 2025, even as the asset class's annual growth rate appeared poised to cool slightly.

As of Dec. 16, private credit funds closed in 2025 had raised $224.25 billion globally, a 3.2% increase over the $217.38 billion raised by funds in 2024, according to data by With Intelligence, part of S&P Global Market Intelligence. In comparison, global private credit fundraising rose by 9.7% year over year in 2024.

Private credit, a catchall term encompassing various nonbank lending strategies, increasingly competes for loans with traditional banks and provides a critical source of financing for private equity deals.

Nonbank lenders have faced scrutiny about the risks potentially lurking in their loan portfolios, particularly since the third-quarter bankruptcies of companies with links to the US auto industry, subprime auto lender Tricolor Holdings LLC and First Brands Group LLC, an auto parts business that tapped private loans before its collapse.

The scrutiny drew pushback from some prominent private credit firms, including alternative asset manager Blackstone Inc., whose president and COO, Jonathan Gray, said the bankruptcies were "erroneously linked" to private credit because the fast-growing industry is misunderstood.

"Private credit markets are expanding from their origins in non-investment-grade corporate credit and direct lending to become a key mechanism for financing the real economy, including commercial finance, consumer and residential finance, fund finance and, of course, infrastructure," Gray said.

Largest fund closing

At just over $20 billion, Ares Capital Europe VI LP, the sixth edition of Ares Management Corp.'s commingled European direct lending fund, was the largest private credit fund to hold a final close in 2025 as of Dec. 16. Ares launched the fund in 2023, according to S&P Global Market Intelligence data, and more than a third of the fund's capital already had been deployed into loans by the time it closed in January 2025, Ares said in a press release.

Ares reported $391.50 billion in private credit assets under management as of the third quarter. That ranked third among its peer group of large, publicly listed alternative asset managers, trailing Blackstone's $432.30 billion in private credit AUM and Apollo Global Management Inc.'s $723 billion in private credit AUM.

Ares struck a positive tone in its private credit 2026 outlook report, projecting that strong demand for private corporate credit would drive lending opportunities, even as private credit managers branch out into other strategies. Opportunities for bigger deals are increasing as larger companies begin to choose private credit over bank loans, the report said.

|

– Catch up on the decline in private equity portfolio company bankruptcies. |

At $16 billion, Oaktree Opportunities Fund XII LP was the second-largest private credit fund closing of 2025 as of Dec. 16. It is the 12th vintage of an Oaktree Capital Management LP fund targeting investments in the debt held by distressed businesses.

Focus on fund strategies

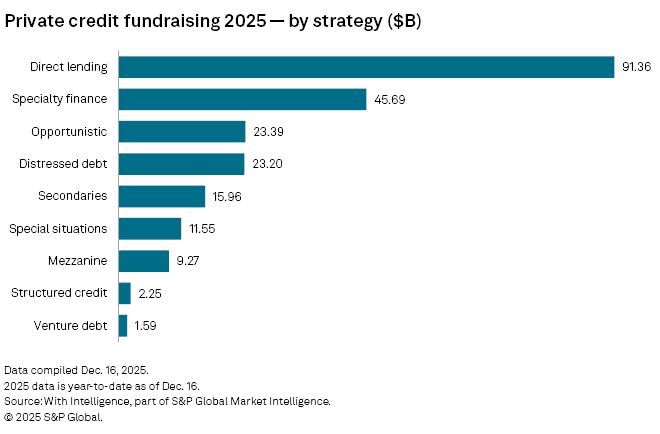

Investor commitments to private credit favored direct lending strategies. Direct lending funds closed on $91.36 billion in commitments in 2025, about twice as much as the next-leading strategy, specialty finance, according to S&P Global Market Intelligence data.

Specialty finance, which typically refers to asset-backed financing strategies, drew $45.69 billion in commitments through Dec. 16. Opportunistic lending and distressed debt were the next-most popular strategies, drawing commitments of $23.39 billion and $23.20 billion, respectively.

Geographic focus

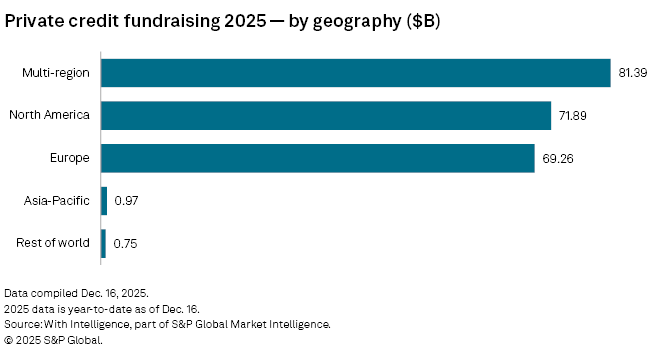

Multi-region private credit funds targeting investments across more than one geography drew the most investor commitments, totaling $81.29 billion as of Dec. 16, according to S&P Global Market Intelligence data. Funds targeting investments in North America came in second with $71.89 billion raised, followed by Europe-focused funds with $69.26 billion.

Fundraising for funds operating in other geographies was relatively modest, with $970 million committed to Asia-Pacific funds and $750 million raised by funds targeting other regions.