Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

09 Jan, 2026

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Fewer private equity portfolio companies filed for bankruptcy protection in the US in 2025 as fund managers instead tapped private credit to solve liquidity issues and opted for out-of-court restructurings to keep distressed businesses out of the spotlight.

Bankruptcy filings by US portfolio companies totaled 66 in 2025 as of Dec. 14, down from 81 filings in all of 2024, according to S&P Global Market Intelligence data. Portfolio company filings were set to come in lower in 2025 despite an increase in the overall number of bankruptcy filings, which stood at 749 as of Dec. 14, already nearly 9% higher than the 2024 full-year total of 688 bankruptcy filings.

Private credit managers' willingness to lend to distressed private equity-backed companies played a role in holding the number of bankruptcy filings lower, Matthew Roose, co-head of the business restructuring group at Ropes & Gray LLP, said in an interview. Staying out of bankruptcy court and avoiding the glare of public scrutiny that comes with it "also reduces the noise around the company," Roose said.

The consumer discretionary sector produced the most private equity portfolio company bankruptcies in the Jan. 1–Dec. 14 period at 14, followed by the healthcare sector with 13 bankruptcies.

Read more about private equity and venture capital portfolio company bankruptcy filings in 2025.

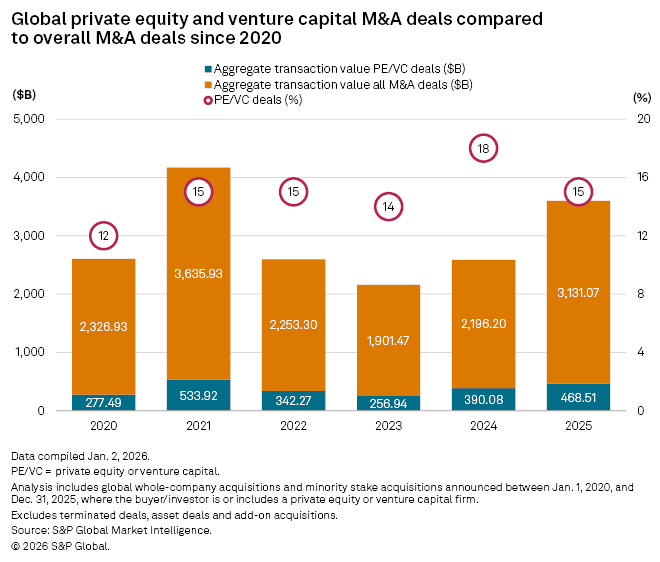

CHART OF THE WEEK: Private equity and venture capital deal value hits highest total since 2021

⮞ Global private equity and venture capital deal value jumped 43% in 2025 to $468.51 billion from $390.08 billion in 2024, according to S&P Global Market Intelligence data.

⮞ It was the largest annual total since private equity entries hit an all-time high of $533.92 billion globally in 2021.

⮞ Private equity deals accounted for about 15% of global mergers and acquisitions activity by value in 2025, down from 18% in 2024.

TOP DEALS

– HgCapital LLP agreed to acquire OneStream Inc. in an all-cash transaction that values the enterprise finance management platform at $6.4 billion. As part of the deal, General Atlantic Service Co. LP and Tidemark Capital Inc. will take minority stakes. JP Morgan Securities LLC and Goldman Sachs & Co. LLC are the financial advisers of OneStream and Hg, respectively. The legal advisers of the deal are Skadden Arps Slate Meagher & Flom LLP to Hg and Wilson Sonsini Goodrich & Rosati to OneStream.

– Quantum Energy Partners LLC agreed to sell about 90% of Cogentrix Energy Power Management LLC's natural gas generation assets to Vistra Corp. for approximately $4.7 billion. Evercore is the financial adviser to Cogentrix Energy, while King & Spalding LLP is legal adviser. Vistra's legal advisers are Latham & Watkins LLP, Sidley Austin LLP and Cleary Gottlieb Steen & Hamilton LLP, while Goldman Sachs & Co. LLC is its financial adviser.

– Blackstone Inc. acquired Madison Dearborn Partners LLC's remaining stake in Air Control Concepts Parent LLC, a provider of heating, ventilation and air conditioning solutions. Terms of the transaction were not disclosed. Centerview Partners and RBC Capital Markets LLC were Blackstone's financial advisers, while Simpson Thacher & Bartlett LLP acted as the firm's legal adviser. Kirkland & Ellis LLP was the legal adviser to AIR and Madison Dearborn.

TOP FUNDRAISING

– Lindsay Goldberg LLC raised $4.9 billion at the close of Lindsay Goldberg VI LP and related vehicles. The vehicle seeks investments in family-owned companies.

– Banner Ridge Partners LP secured $4.2 billion in total commitments, including $200 million from the firm itself, for Banner Ridge Secondary Fund VI.

– Warburg Pincus LLC raised $3 billion at the close of Warburg Pincus Financial Sector III LP. The fund invests in the financial services sector.

– BV Investment Partners LP closed BVIP Fund XII at its hard cap of $2.47 billion. Evercore Private Funds Group was placement agent for the fund and Ropes & Gray provided legal counsel.

– Eir Partners Capital LLC raised $1 billion in aggregate capital commitments at the close of Eir Partners III LP fund, exceeding its $800 million target. The firm invests in health technology and tech-enabled services.

MIDDLE MARKET HIGHLIGHTS

– Main Capital Partners BV is set to acquire IQ Messenger BV, a communications platform for healthcare institutions, from Anywhere365 Group BV. Terms of the deal were not disclosed. Lazard is serving as sole financial adviser and NautaDutilh is acting as sole legal adviser to Anywhere365.

– Levine Leichtman Capital Partners LLC acquired mediation and arbitration services company Signature Resolution for an undisclosed amount. Honigman LLP was legal adviser for Levine Leichtman. Stubbs Alderton & Markiles LLP was legal adviser for Signature Resolution.

– Grant Avenue Capital LLC acquired ambulance company PatientCare Logistics Solutions LLC. Terms of the transaction were not disclosed. Citizens Capital Markets & Advisory was Grant Avenue's financial adviser, while McGuireWoods LLP acted as its legal counsel.

FOCUS ON: BUYER-SELLER VALUATION GAP

The valuation expectation between buyers and sellers is expected to remain far apart in 2026, according to a report from law firm White & Case.

"With conditions unlikely to shift materially in the near term, the timing of true convergence remains uncertain, a dynamic that will continue to shape deal flow and keep dealmaking selective as we move into 2026," the law firm said in its private equity and investment funds outlook for the year.

Buyer and seller agreement on valuation still seemed far from settled in 2025. Private equity and venture capital buyouts recorded longer holding periods across most industries in end-2025 compared with 2020, according to an analysis by S&P Global Market Intelligence.

______________________________________________

For further private equity deals, read our latest "In Play" report , which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private debt news, see our latest private debt newsletter