Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Jan, 2026

By Brian Scheid

Job growth is plunging, long-term joblessness is on the rise, and younger workers are facing near-historic struggles to find employment, but the jobs market is holding strong for prime-age workers.

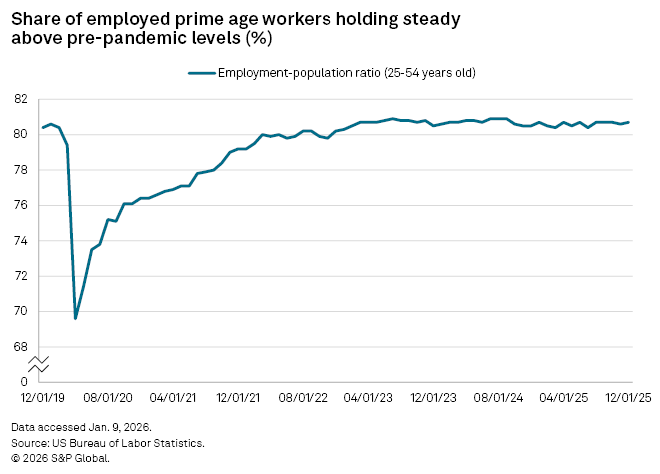

The employment-population ratio for prime-age workers — those aged 25 to 54 — reached 80.7% in December 2025, up about 20 basis points year over year, the US Bureau of Labor Statistics reported Jan. 9. It was also 30 bps higher than its pre-COVID-19 pandemic level in December 2019 and near its highest point in roughly 25 years.

The overall employment-to-population ratio, which reflects the percentage of the working-age population with a job, was at 59.7% in December, 20 bps below where it was a year earlier and down 140 bps from prior to the pandemic.

"I think what this represents is that labor supply remains healthy, perhaps in response to the stronger labor market of previous years," Preston Mui, a senior economist at Employ America LLC, said in an interview. "People got pulled into or pulled back into the labor market, perhaps those that would otherwise have been on the sidelines. But it also means that labor demand isn't keeping up, which is why the unemployment rate has been going up."

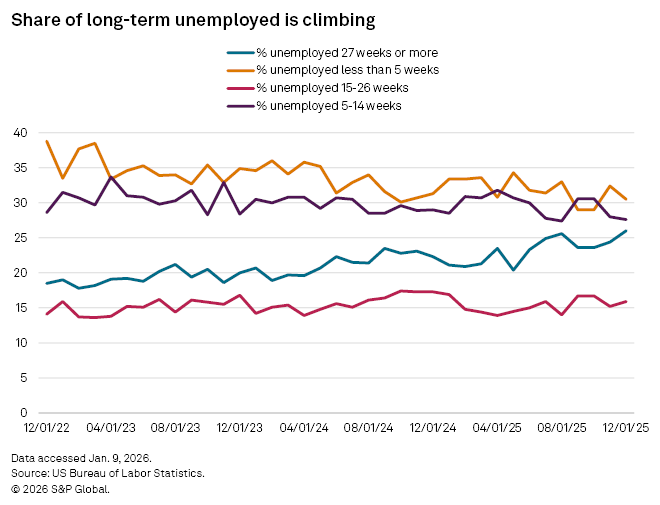

People unemployed for 27 weeks or longer represented 26% of the total unemployed in December, the highest share since February 2022.

Rising unemployment

While the labor market remains relatively robust for prime-age workers, those on the margins of the domestic workforce are seeing conditions further weaken, according to Sam Kuhn, an economist at Appcast Inc.

"Prime-age workers are doing fine right now," Kuhn said in an interview. "If you have a job and you're not looking for work, you're fine. But if you're unemployed, if you're on the sidelines, it's a much more difficult labor market than in previous years."

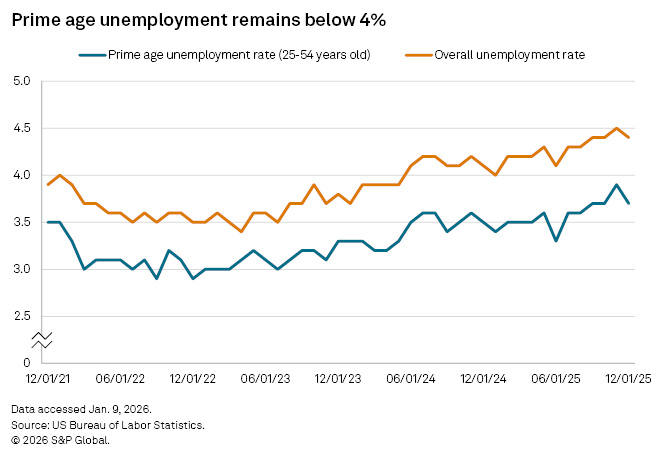

The unemployment rate for prime-age Americans was 3.7% in December, up from 3.5% a year earlier. However, the rise in jobless has been steeper for those outside the prime age group.

Overall unemployment was 4.4% in December, but 8.2% for workers 20 to 24 years old, up 70 bps from December 2024. Among people aged 16 to 19, unemployment reached 15.7%, compared to 12.3% in the year-ago period.

"We really have seen diminished hiring demand for younger workers," said Kuhn, pointing to the rise of AI, tariffs and shifts in immigration enforcement all playing a role in the increase in joblessness for this group.

Overall, the civilian prime-age labor force increased by 2.6 million people in 2025, but the number of employed prime-age workers rose by only 2.3 million, boosting the total number of unemployed people in this age group by about 300,000.

"I would say that joblessness for these individuals is growing simply because we did not create many jobs in 2025," Laura Ullrich, director of economic research at Indeed Hiring Lab, said in an interview.

There were only 584,000 jobs added in 2025, compared to nearly 1.9 million in 2024 and nearly 2.2 million in 2023.

"There aren't enough positions for these individuals to move into in this low-hire/low-fire environment," Ullrich said.

Layoffs and unemployment claims remain relatively low, but there are few opportunities for those entering the labor force, outside of the healthcare and social assistance sectors that continued to grow in 2025, Ullrich added.