Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

05 Jan, 2026

By John Wu and Uneeb Asim

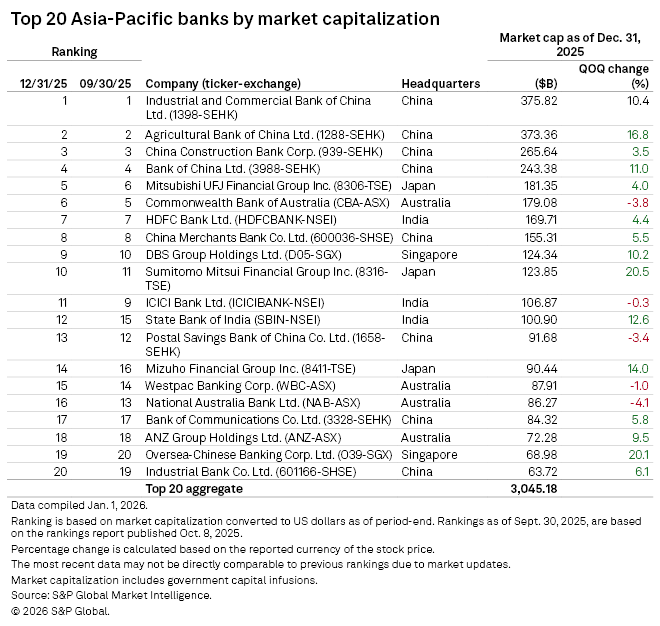

Chinese megabanks grew their market capitalizations in the final quarter of 2025, maintaining their dominance in the Asia-Pacific list of the top 20 largest lenders.

During the October-to-December quarter of 2025, the already outsized market capitalization of Industrial and Commercial Bank of China Ltd., the world's biggest lender by assets, increased by 10.4% from the prior quarter to $375.82 billion, according to S&P Global Market Intelligence data compiled on Jan. 1.

The market cap of Agricultural Bank of China Ltd., the second largest lender, jumped by 16.8% to $373.36 billion during the fourth quarter. China Construction Bank Corp. retained its third spot in the ranking with a quarter-over-quarter increase of 3.5%, bringing its market cap to $265.64 billion. Following closely, Bank of China Ltd. achieved an 11.0% gain, reaching a market cap of $243.38 billion.

"Compared to 2025, pressures on China's banking sector will likely ease with interest margin, which [has been] the biggest drag in recent years, expected to be significantly relieved in a more favorable interest rate environment," said Jiangsu-based Donghai Securities in a Dec. 28 note. In general, the growth rate of bank profits is expected to rebound slightly in 2026, according to the brokerage.

Chinese President Xi Jinping announced on Jan. 1 that the country's GDP is estimated to have grown around 5% in 2025, matching the government's target, as the world's second-largest economy remained on track amid external trade conflicts and a prolonged real estate sector downturn. Meanwhile, the People's Bank of China stayed on the sidelines over the past seven months after bringing policy rates to all-time lows in May, easing concerns over banks' net interest margins, a key component of banks' interest income.

The regional top 20 list of biggest lenders by market cap includes four more Chinese lenders: China Merchants Bank Co. Ltd., Postal Savings Bank of China Co. Ltd., Bank of Communications Co. Ltd. and Industrial Bank Co. Ltd.

The CSI 300 index, China's key equity benchmark, closed 2025 at a four-year high of 4,629, marking a 17.7% gain for the year to 17.7, following a 14.7% increase in 2024.

Biggest gainers and losers

Japanese and Singaporean lenders were among the best performers in the Asia-Pacific league table, according to Market Intelligence data. Tokyo-based Sumitomo Mitsui Financial Group Inc. grew its market cap 20.5% quarter over quarter to $123.85 billion, and Singapore's Oversea-Chinese Banking Corp. Ltd. jumped 20.1% to $68.98 billion.

On Dec. 19, the Bank of Japan (BOJ) raised its benchmark interest rate by 25 basis points to 0.75%, the highest in three decades, which raised expectations for Japanese banks' profit outlooks amid widening spreads between lending and deposit rates.

"Given that real interest rates are at significantly low levels ... the Bank, in accordance with improvement in economic activity and prices, will continue to raise the policy interest rate and adjust the degree of monetary accommodation," said BOJ in its Dec. 19 statement.

The market capitalization of Mizuho Financial Group Inc. increased by 14.0% during the quarter to $90.44 billion, while that of Mitsubishi UFJ Financial Group Inc. grew by 4.0% to $181.35 billion, moving the Japanese megabank to the fifth place from sixth among the region's largest banks.

Three Indian lenders entered the top 20 list, with HDFC Bank Ltd. ranking seventh, achieving a 4.4% quarter-over-quarter increase in market cap to $169.71 billion.

The exception was ANZ Group Holdings Ltd., whose market cap increased by 9.5% quarter over quarter to $72.28 billion.