Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Jan, 2026

Editor's note: This article is published quarterly with current data available at that time.

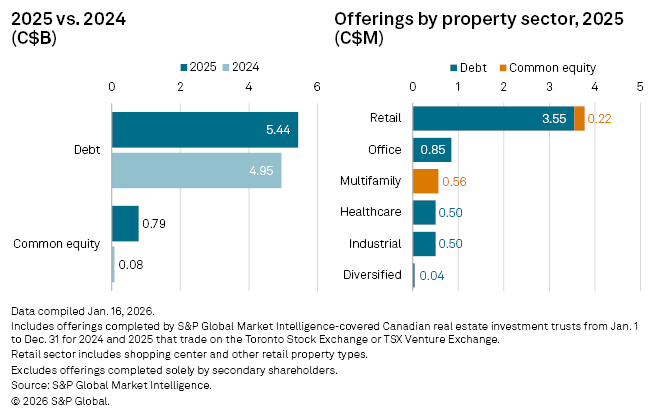

Publicly traded Canadian real estate investment trusts raised C$6.23 billion through capital offerings in 2025, an increase of more than 23% from the C$5.03 billion collected a year earlier.

Debt offerings accounted for C$5.44 billion of capital raised, and common equity offerings brought in about C$785.7 million.

Retail REITs account for 60% of total capital

Six property sectors in Canada raised capital in 2025. The retail sector, comprising shopping centers and other retail properties, accounted for the biggest share at C$3.77 billion, or more than 60% of the total for the year.

The office segment came in second, collecting C$850.0 million or 13.7% of total capital raised. The multifamily sector ranked third at C$561.9 million, about 9.0% of the total.

The healthcare and industrial sectors collected C$500.0 million each, while the diversified sector raised C$40.3 million.

– Set email alerts for future Data Dispatch articles.

– Access a spreadsheet listing the offerings completed in 2025 by publicly traded Canadian REITs.

– For further capital offerings research, try the Global Real Estate Capital Offerings Activity template.

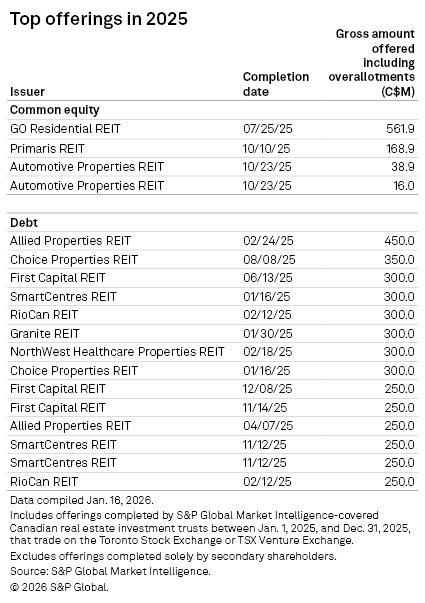

Allied Properties pulls in the most capital

The single largest common equity offering in 2025 was multifamily-focused GO Residential REIT's C$561.9 million IPO completed July 25. The REIT used the net proceeds from the offering in large part to fund the acquisition of the initial portfolio.

Office landlord Allied Properties REIT attracted the most capital overall in 2025 through three debt offerings totaling C$850.0 million. Its C$450.0 million offering, which wrapped up Feb. 24, 2025, was the largest debt issuance completed during the year. Part of the offering's net proceeds were intended to finance or refinance eligible green projects and fully repay the construction loan on 19 Duncan St. in Toronto.

Allied Properties' two other offerings were completed April 7, 2025: C$250.0 million of 4.312% series M senior unsecured debentures and C$150.0 million of floating rate series L senior unsecured debentures. Both series of debentures are due April 7, 2027.

Other retail REIT Choice Properties REIT and shopping center REITs SmartCentres REIT and First Capital REIT all tied for the second spot, each raising C$800.0 million in 2025 through debt offerings. Shopping center-focused RioCan REIT followed next with three debt offerings totaling C$750.0 million.

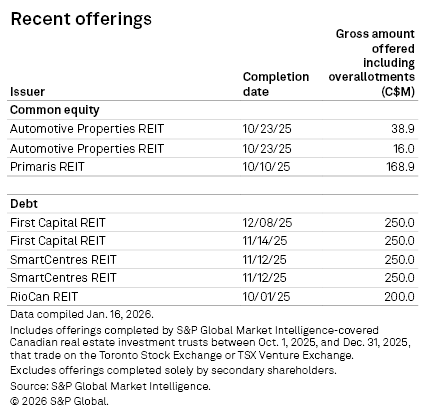

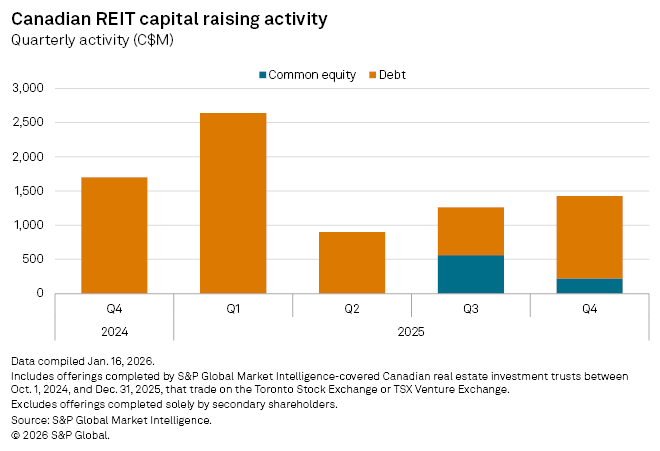

Capital offerings up over 12% sequentially in Q4 2025

Following a jump in the third quarter, capital market activity continued to increase during the fourth quarter of 2025, bringing in C$1.42 billion for Canadian REITs. The total represented a hike of more than 12% from the previous quarter; however, it was a drop of more than 16% from the C$1.70 billion raised during the fourth quarter of 2024.

During the fourth quarter of 2025, shopping center REIT Primaris REIT raised C$168.9 million through a follow-on common equity offering. The REIT said it would use the proceeds to pay down debt relating to the recently completed acquisition of Promenades Saint-Bruno.

Single tenant-focused Automotive Properties REIT completed a C$38.9 million follow-on common equity offering Oct. 23, 2025. The retail REIT said it intended to use a portion of the proceeds to repay indebtedness under its credit facilities, including the debt incurred to fund the cash portion of the acquisition of three automotive dealership properties in Dorval, Quebec.

Automotive Properties collected C$16.0 million through another common equity offering also completed Oct. 23.

SmartCentres and First Capital pulled in the biggest amounts of capital during the fourth quarter, both at C$500.0 million.

During the fourth quarter, SmartCentres sold $250.0 million of 3.599% series AC senior unsecured debentures due June 12, 2029, and $250.0 million of 4.318% series AD senior unsecured debentures due June 12, 2032. It intended to use the net proceeds to refinance existing debt and for general corporate purposes.

First Capital raised C$250.0 million through its 4.760% series G senior unsecured debentures due Feb. 15, 2035. The shopping REIT used the proceeds to repay, in part, the early redemption of C$300 million of outstanding co-issued 3.604% series T senior unsecured debentures due May 6, 2026, at the end of December 2025. The REIT also collected another C$250.0 million through its 4.461% series F senior unsecured debentures due Feb. 15, 2034, and intended to use the proceeds to repay existing debt and for general business purposes.

Meanwhile, RioCan sold C$200.0 million of 4.417% series AP senior unsecured debentures due Oct. 1, 2032. The shopping center REIT said it would use the net proceeds for debt repayment and general business purposes.