Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jan, 2026

By Iuri Struta

Spending on technology and media M&A surged in 2025, propelled by a number of large multibillion-dollar deals, and expectations are high for robust activity in 2026.

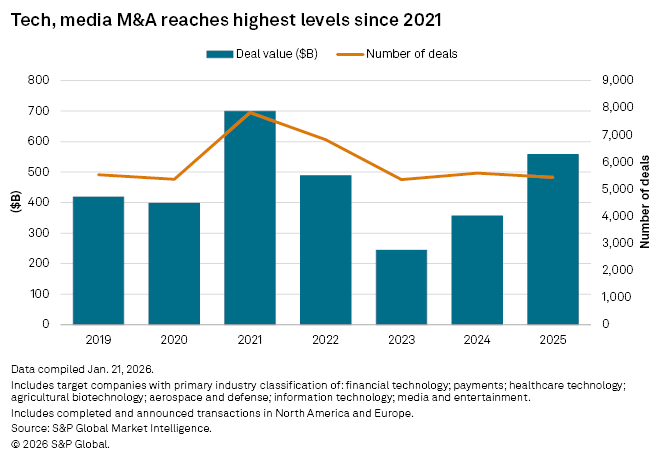

Tech and media buyers spent $557 billion on acquisitions in 2025 across more than 5,400 transactions, according to S&P Global Market Intelligence data. The total deal value rose more than 56% from 2024 and more than doubled compared to 2023.

Dealmaking was driven by large deals and focused on key themes such as AI, defense, parts of the financial technology sector, media and sports. Investment bankers expect M&A activity to broaden into small- and mid-market segments and across sectors in 2026.

"The megadeals always capture headlines, but there is an indirect trickle down from the mega deals to the more rank and file deals, in the mid-market. And we are seeing that already happening," Gregory Bedrosian, CEO of Drake Star, a tech-focused investment bank, said in an interview with S&P Global Market Intelligence.

Big is back

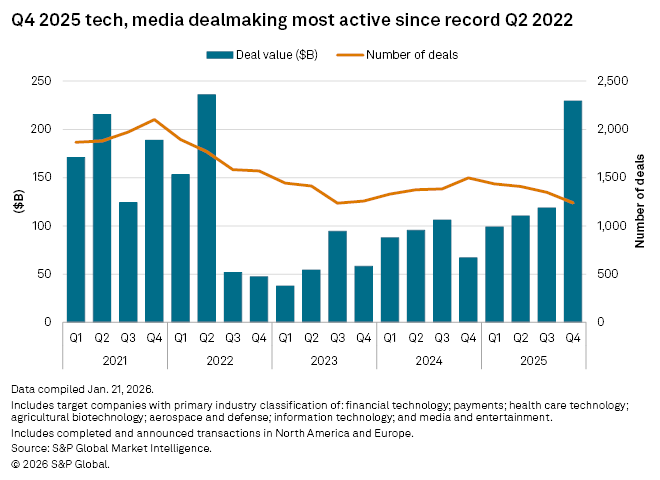

M&A activity in 2025 started slowly, as US tariff policy unsettled global markets in the first quarter. Markets recovered as the US reached trade agreements with other countries, and M&A activity rose steadily in subsequent quarters. The last three months of 2025 in particular saw a significant uptick in spending.

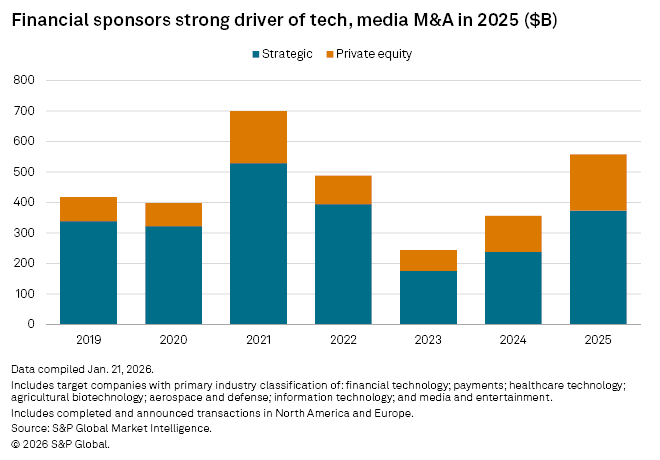

Private equity firms and financial sponsors accounted for an unusually high proportion of deals, particularly in large transactions that drove the overall increase. The pending $55.2 billion acquisition of video game company Electronic Arts Inc. is the largest private equity deal on record. The investor group, led by Silver Lake Technology Management LLC, includes Saudi Arabia's Public Investment Fund and Jared Kushner's A Fin Management LLC. The deal also includes $20 billion in debt financing fully committed by JPMorgan Chase Bank NA.

Meanwhile, the high cost of AI infrastructure investments has prompted increased collaboration between strategic buyers and private equity firms to acquire and build data centers. BlackRock Inc.'s Global Infrastructure Partners Inc. and MGX Fund Management Ltd. teamed up with companies such as NVIDIA Corp., Microsoft Corp. and X.AI Corp. to buy Aligned Data Centers LLC for $40 billion, making it the second-largest deal in the fourth quarter of 2025.

"Deal size is back in a meaningful way. Buyers have a mindset of, 'If we make a move, we need to make a scale move …. a transformative move,'" said Anuj Bahal, US deal advisory & strategy leader for technology media & telecom at KPMG LLP.

Thematic, not broad

The recovery in technology, media & telecom M&A has centered on key themes. For instance, the emergence of AI has prompted a series of deals focused on data centers, semiconductors, data management and observability and AI applications.

Geopolitical tensions, combined with demand for space exploration, have contributed to increased dealmaking in the aerospace and defense sector. The US is on track to substantially increase its defense budget, while Europe is ramping up defense spending.

Of the largest 30 transactions in the fourth quarter of 2025, eight were in aerospace and defense, including the private equity acquisition of Smiths Detection Group Ltd. and CACI International Inc's buyout of ARKA Group LP.

Some of the largest deals occurred in the media and entertainment sectors. In particular, the maturation of the US streaming industry combined with the related decline of the pay TV market, has led to a jump in M&A interest, most notably resulting in the battle for Warner Bros. Discovery Inc. In December 2025, Warner Bros. Discovery agreed to a deal with Netflix Inc. in an $82.7 billion transaction, under which Netflix will acquire Warner Bros. assets, including its television and film studios, HBO and subscription streaming service HBO Max. Warner Bros. Discovery's remaining assets, namely its cable networks, would then be spun out into a separate publicly traded entity, Discovery Global.

Meanwhile, Paramount Skydance Corp. launched a hostile bid for Warner Bros. Discovery, offering $30 per share for the entire company, including the cable networks, with a gross transaction value of $112.61 billion. Paramount Skydance has touted its offer as more "strategically and financially compelling" than the Netflix deal, while Warner Bros. Discovery's board continues to prefer the Netflix transaction.

A key driver of consolidation in media is the desire among platforms and networks to increase their sports media rights, as live sports attract large audiences. Increased competition for these rights has led to higher rights fees, which in turn has spurred greater interest in owning professional sports teams.

"M&A activity has been uneven across tech, you certainly had a lot of AI and AI-adjacent buyouts, and media and the sports media side," Bedrosian said.

Listen to a panel of S&P Global Market Intelligence Kagan analysts delve into the M&A whirlwind reshaping the media landscape in the below "MediaTalk" episode:

What's ahead in 2026

Despite geopolitical turbulence that could affect markets, investment bankers remain optimistic about 2026.

"We're seeing some good momentum going into 2026," said KPMG's Bahal. "Our pipelines are growing and are fuller versus the past few months."

On the macroeconomic level, the US Federal Reserve is expected to continue decreasing interest rates, which will have a positive impact on M&A, especially for private equity firms. Meanwhile, a deregulatory push in the US is expected to fuel further dealmaking, especially among broadcast station owners.

Bedrosian also noted that large deals typically are conducive to additional M&A in the midmarket, as they can result in spinoffs, asset sales and add-on acquisitions by acquirers, as well as competitive responses through M&A.

For instance, if Paramount Skydance does not succeed in buying Warner Bros. Discovery, it could pursue acquisitions of other network groups. Comcast Corp. recently completed the spinoff of most of its cable networks, creating the publicly traded Versant Media Group Inc., while A+E Global Media is reportedly seeking a buyer.

"Strategic buyers are playing offense again. One competitor's move can force a ripple of reactive dealmaking across others in the sector," Bahal said.