Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Jan, 2026

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

Private equity megadeals set a record in 2025, but that record is not expected to stand for long.

There were 22 private equity- and venture capital-backed acquisitions worth at least $5 billion in 2025, according to S&P Global Market Intelligence data. The combined value of these megadeals reached a record $311.08 billion, eclipsing the previous record set in 2021.

The supersize deals are fueled by near-record levels of private equity dry powder and a flight-to-quality trend by large, institutional investors, resulting in concentration of dry powder with a small number of bulge bracket private equity firms. Managers of multibillion-dollar buyout funds have the capital to pay top dollar for prized assets. By targeting well-known, brand-name businesses, the dry powder gets deployed into what looks like safe bets.

The pending $55.2 billion acquisition of video-game maker Electronic Arts Inc., announced in September 2025, stands alone as the largest private equity buyout of all time. More of these deals are likely, according Scott Voss, a managing director at HarbourVest Partners LLC.

"I think we're going to see multiple $50 billion buyouts," Voss said.

Read more about private equity megadeals setting a record in 2025.

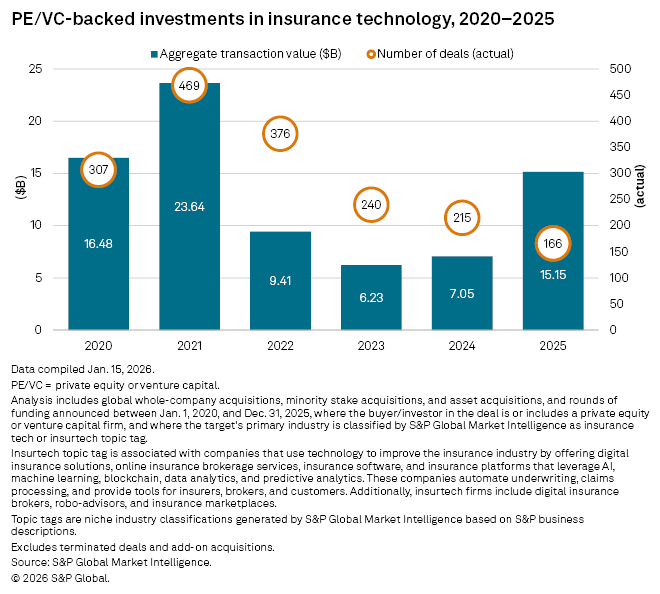

CHART OF THE WEEK: Insurance tech investments more than doubled in 2025

⮞ Private equity- and venture capital-backed investments in insurance technology (insurtech) companies totaled $15.15 billion globally in 2025, more than double the $7.05 billion total for 2024, according to Market Intelligence data.

⮞ As the aggregate transaction value surged higher, the number of insurtech deals declined to 166 in 2025 from 215 in the previous year.

⮞ Value is rising on lower deal volume because the ongoing consolidation of the industry means acquirers are competing over a smaller set of targets, while the most sought-after insurtech firms are now commanding valuation multiples that are comparable to the software sector, according to David Crofts, director of insurance M&A at West Monroe Capital.

TOP DEALS

– EQT AB (publ) agreed to acquire London-based secondaries firm Coller Capital Ltd. for $3.2 billion. Coller Capital minority shareholder State Street Corp. will become a shareholder in EQT as part of the deal. The transaction is expected to close in the third quarter. EQT's financial adviser is UBS, and its legal advisers are Ropes & Gray and Vinge. Morgan Stanley & Co. International PLC is Coller Capital's financial adviser, while Kirkland & Ellis and Roschier are legal advisers to the firm and its selling shareholders.

– KKR & Co. Inc. made an additional investment in fungal biotechnology company Sylvan Inc. The KKR-led funding round included commitments from global investors such as TPG NewQuest, Ping An Capital Co. Ltd., China Post Life Insurance Co. Ltd., Schroders Capital and Tsao Pao Chee Group Pte. Ltd. Existing investor Novo Holdings A/S increased its ownership stake as part of the deal.

– KKR agreed to increase its stake in aircraft leasing firm Altavair LP and its sister company, AV AirFinance Ltd.

TOP FUNDRAISING

– Black Bay Partners LLC raised $425 million for its Black Bay III LP fund at final close. The firm invests in the energy industry and adjacent chemical and industrial sectors.

– Blueprint Equity LLC raised $333 million at the close of its third fund. The fund will make initial investments of up to $15 million in enterprise software, business-to-business and technology-enabled service companies.

– Growth Street Partners closed Growth Street Partners III LP at $200 million. The firm targets software-as-a-service and tech-enabled service companies.

– Adams Street Partners LLC launched Aspen Lux, a Luxembourg-domiciled evergreen fund for non-US investors. The fund targets small and midmarket buyouts in the technology and healthcare sectors.

MIDDLE-MARKET HIGHLIGHTS

– Alta Semper Capital LLP agreed to buy a majority stake in United Arab Emirates-based sports nutrition and dietary supplements company Nature's Rule. The founders will keep a significant stake in Nature's Rule and continue to lead the business.

– SouthWorth Capital Management added furniture-maker American Furniture Manufacturing Inc. to its portfolio.

– BV Investment Partners LP acquired Alacrity Network Solutions, the managed repair unit of insurance claims management services company Alacrity Solutions Group LLC.

FOCUS ON: EQT's ENTRY INTO SECONDARIES SPACE

EQT's proposed acquisition of British secondaries platform Coller Capital is expected to accelerate the Swedish private equity firm's fee-related revenue growth "from day 1," CFO Kim Henriksson said during the firm's full-year 2025 earnings call.

"Entering the secondaries space with Coller represents a natural and important step in EQT's strategic development," EQT CEO and Managing Partner Per Franzén said in a news release.

Coller is expected to add roughly €28 billion of fee-generating assets under management to EQT, Franzén said, adding that the firm aims to double the amount in less than four years.

"This means that 5 years from now, the mix of EQT's business will be much more well balanced across our business lines, private capital, infrastructure, real estate and secondaries," Franzén said.

EQT's recent earnings call recorded a net positivity score of 2.15%, higher than 1.77% during the third-quarter 2025 earnings call and 0.90% during the full-year 2024 earnings call.

______________________________________________

For further private equity deals, read our latest "In Play" report , which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private debt news, see our latest private debt newsletter