Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Jan, 2026

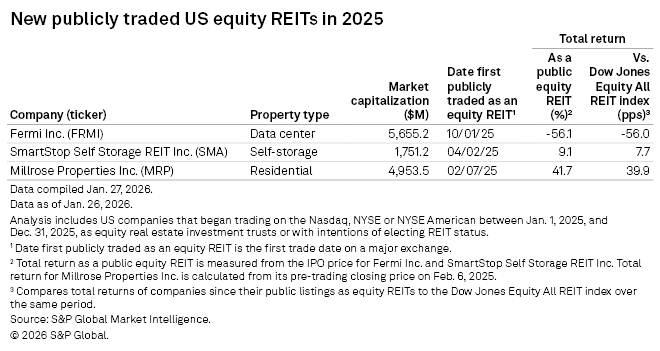

Three US equity real estate investment trusts debuted on the Nasdaq or NYSE in 2025: Millrose Properties Inc., SmartStop Self Storage REIT Inc. and Fermi Inc.

By comparison, six US REITs debuted on the public market in 2024: American Healthcare REIT Inc., Curbline Properties Corp., FrontView REIT Inc., Lineage Inc., MacKenzie Realty Capital Inc. and Sila Realty Trust Inc.

While the public US REIT universe recorded lower counts of new entrants in the preceding two years — three in 2023 and two in 2022 — a higher number of REITs made a public market debut in 2021 with seven and in 2020 with six, according to S&P Global Market Intelligence data.

Overall low valuations for the sector, coupled with general macroeconomic uncertainty throughout the year, served as headwinds for new REIT IPOs during the year.

– Set email alerts for future Data Dispatch articles.

– Read some of the day's top real estate news and insights from S&P Global Market Intelligence.

Millrose Properties completed its spinoff from Lennar Corp. on Feb. 7, 2025. The residential REIT engages in land purchases, horizontal development and homesite option purchase arrangements for Lennar and potentially other homebuilders and developers. Millrose Properties' share price has risen 41.7% since the completion of its spinoff through Jan. 26, outperforming the Dow Jones Equity All REIT index's return over the same time period by nearly 40 percentage points.

SmartStop Self Storage began trading on the NYSE on April 2 after completing its $931.5 million IPO early that month. Since its IPO, the self-storage REIT's stock has generated a total return of 9.1% through Jan. 26, outperforming the Dow Jones Equity All REIT index by 7.7 percentage points.

Fermi, the most recent equity REIT to debut on the public market, completed its roughly $784.9 million IPO on Sept. 30, 2025, with its first trading day Oct. 1 on the Nasdaq. The data center REIT's stock has seen rocky performance since its initial debut, spiking 54.9% on its first trading day to $32.53 per share before plunging to $9.21 as of Jan. 26, down 56.1% from its IPO price.