Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Sep, 2025

By Audrey Elsberry and Xylex Mangulabnan

Several recently hired investment bankers at Wells Fargo Securities LLC worked on the firm's biggest US bank M&A advisory assignment in years, PNC Financial Services Group Inc.'s acquisition of FirstBank Holding Co.

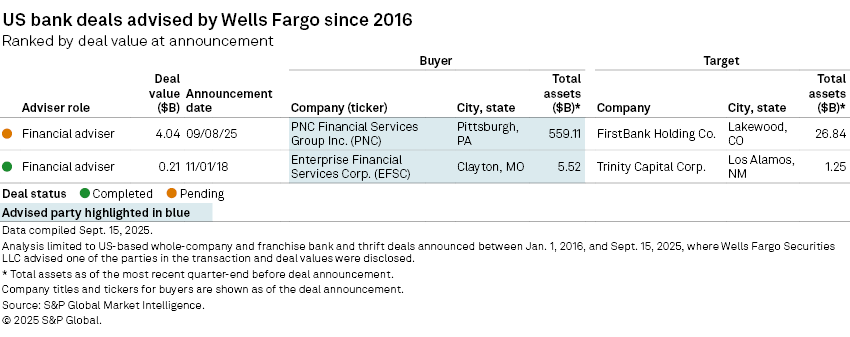

The $4.04 billion transaction, announced Sept. 8, is one of the largest US bank M&A deals of 2025 and Wells Fargo's first whole-bank M&A advisory assignment since 2019 with a disclosed deal value, according to S&P Global Market Intelligence data.

Wells Fargo's team on the deal included CEO of Corporate and Investment Banking Fernando Rivas, co-Head of the Financial Institutions Group Andy Rosenburgh, and managing directors David Ferro and Kyle Heroman, according to a Wells Fargo spokesperson.

Three of those advisers joined Wells Fargo within the past three years and brought extensive financial advisory resumes. Wells Fargo hired Rivas from J.P. Morgan Securities Inc. as co-lead of the firm's investment bank in May 2024, and he became the sole CEO of the business earlier this year. Before that, the company hired Rosenburgh, who started with Wells Fargo in 2023 after the investment banker spent some 28 years at Credit Suisse, according to records from the Financial Industry Regulatory Authority. Heroman started at Wells Fargo in September 2024 after 13 years with Sandler O'Neill, two years with Credit Suisse and one year with UBS, according to FINRA records.

Goldman Sachs & Co. LLC and Morgan Stanley & Co. LLC jointly advised FirstBank. Goldman Sachs had not advised on a US bank-to-bank M&A deal since 2021, while the transaction was Morgan Stanley's third time advising on a bank acquisition in 2025.

PNC used Wells Fargo as the sole adviser on its purchase of FirstBank, but the company has historically brought in multiple investment banks to advise on its bank deals larger than $1 billion in deal value, according to S&P Global Market Intelligence data.

When PNC purchased BBVA USA Bancshares Inc. in 2021 in a deal worth $11.57 billion, it used four financial advisers. In 2008, when PNC purchased National City Corp. in a deal worth $5.6 billion, the bank hired three financial advisers, including J.P. Morgan. Rivas advised PNC on the deal as J.P. Morgan's Head of North America Investment Banking.

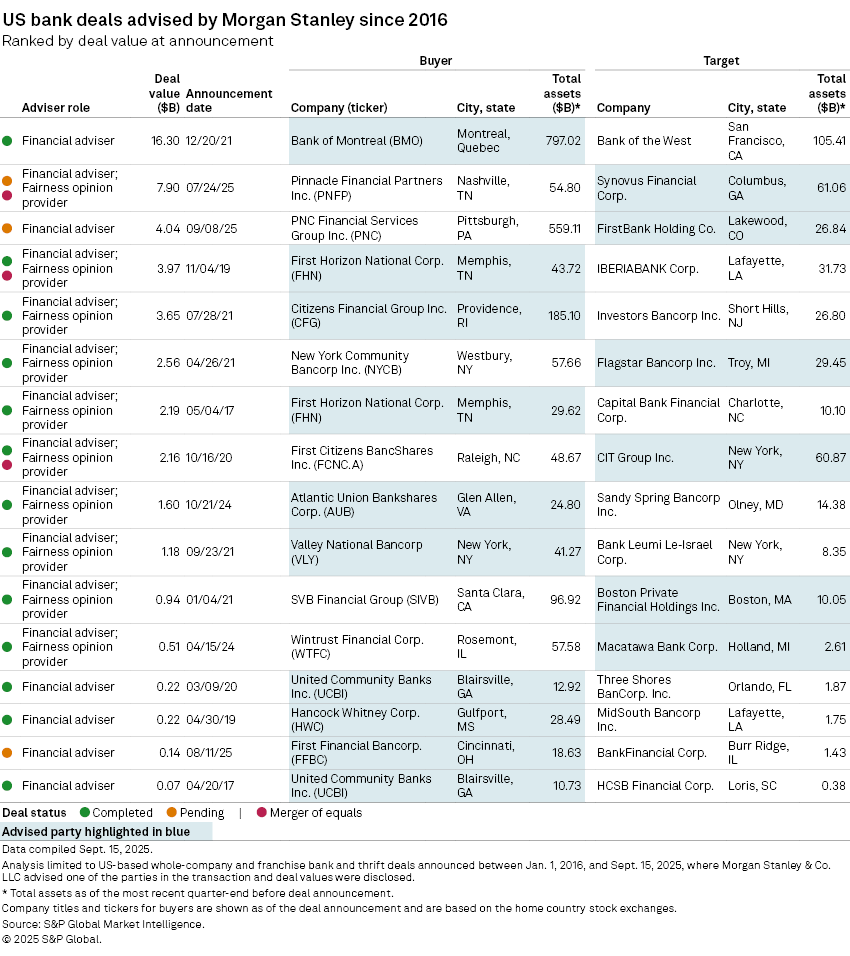

Morgan Stanley has been busier in the bank M&A space than Wells Fargo, including advising on the largest bank deal of 2025, Synovus Financial Corp.'s $7.90 billion merger of equals with Pinnacle Financial Partners Inc.

Morgan Stanley is the financial adviser with the third-largest deal value total on $500 million-plus bank M&A transactions announced since the start of 2022. Advising Synovus and FirstBank has given Morgan Stanley two of its largest bank deal assignments in recent years. Since 2016, the firm has advised on only one larger bank deal: Bank of Montreal's purchase of Bank of the West for $16.3 billion in 2021.

FirstBank has worked with Morgan Stanley before, when it sold four branches to California Bank & Trust in 2024.

The PNC-FirstBank deal is Goldman Sachs' fifth-largest advised bank deal since 2016.

Goldman Sachs has also been expanding its FIG advisory team: In November 2024, the firm hired Matt Beitzel, who was previously Head of North American Banks for Citigroup, to serve as its head of Americas banks and specialty finance.

Morgan Stanley and Goldman Sachs did not disclose the names of the advisers working with FirstBank.