Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Sep, 2025

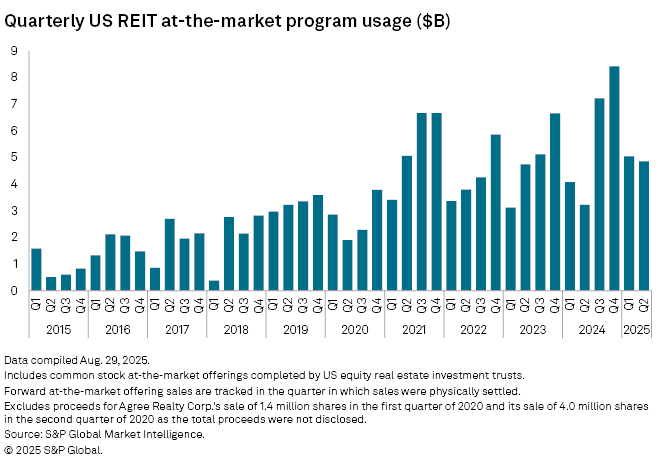

Beginning with S&P Global Market Intelligence's second-quarter 2019 analysis of at-the-market program usage by real estate investment trusts, Market Intelligence included forward at-the-market sales settled during the respective quarter as part of the total capital raised. Forward sales conducted during the quarter but not yet settled as of quarter-end were not included in the quarterly total. Because of this methodology change, prior quarterly totals presented in this article may not match historical articles published by Market Intelligence.

Proceeds raised by US equity real estate investment trusts through at-the-market offerings dipped sequentially in the second quarter of 2025.

Twenty-six US REITs utilized their at-the-market (ATM) programs during the quarter, raising $4.85 billion in aggregate, down a slight 3.9% from the quarter prior but up 50.7% year over year.

Welltower tops ATM program usage for Q2

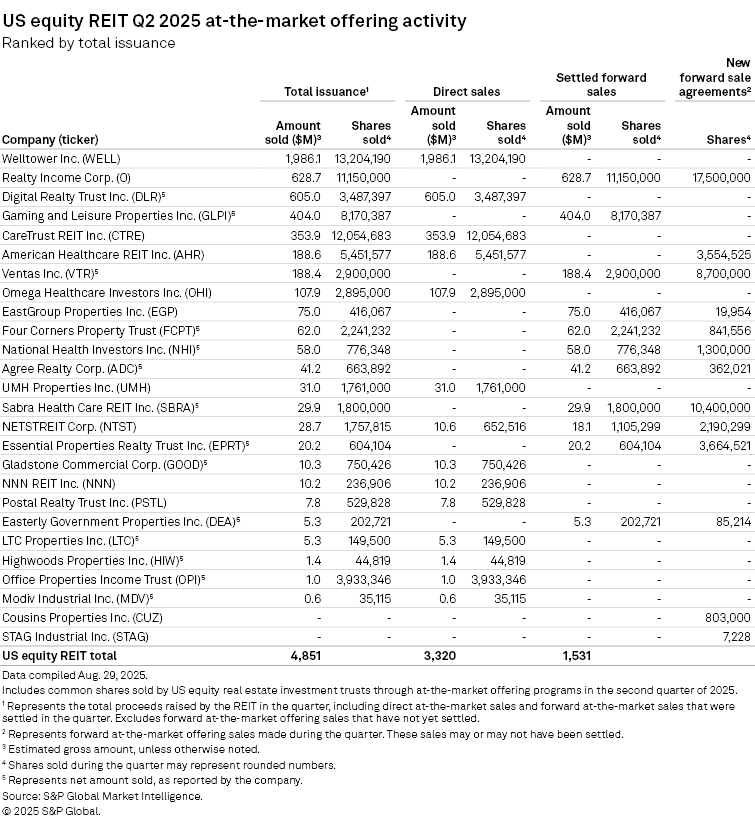

Healthcare REIT Welltower Inc. sold 13.2 million shares of common stock through its ATM program during the second quarter for $1.99 billion in gross proceeds, the most of any US REIT.

Realty Income Corp. ranked second. During the quarter, the single-tenant retail REIT sold 17.5 million shares of common stock through its ATM program on a forward basis, while also settling 11.15 million shares of its forward sale agreements in the quarter for $628.7 million of gross proceeds. As of June 30, 7.6 million shares of common stock subject to forward sale confirmations have been executed, but not settled. Realty Income expects to fully settle its outstanding forward sale agreements by Sept. 30, representing $422.8 million in net proceeds.

Datacenter REIT Digital Realty Trust Inc. followed, selling nearly 3.5 million common shares through its ATM program during the quarter for $605.0 million in net proceeds.

On June 2, casino REIT Gaming & Leisure Properties Inc. settled the roughly 8.2 million shares previously sold on a forward basis through its ATM program for a net sales price of $404.0 million.

Healthcare REIT CareTrust REIT Inc. rounded out the top five, selling more than 12 million shares of common stock through its ATM program during the second quarter for gross proceeds of $353.9 million.

– Download data featured in this story in Excel format.

– For further capital offerings research, try the Excel template for Global Real Estate Capital Offerings Activity.

– Set email alerts for future Data Dispatch articles.

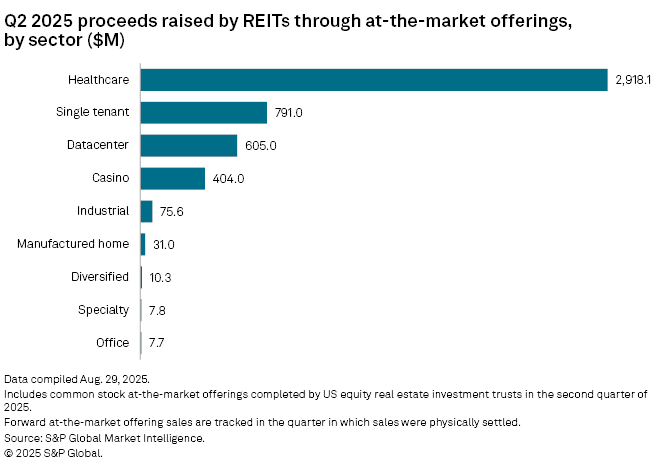

By property sector, healthcare REITs raised the majority of proceeds through ATM offerings during the second quarter, totaling $2.92 billion in aggregate.

Single-tenant retail REITs raised $791.0 million in proceeds through their ATM programs during the quarter, the second-highest of any property sector.