Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Sep, 2025

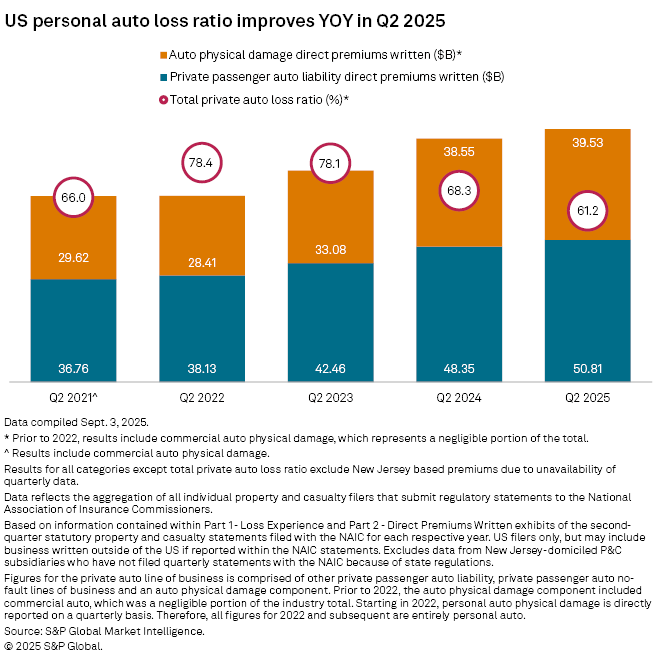

Private auto insurers in the US continued to benefit from earned-in rate increases in the second quarter and again pushed premiums to record levels.

Direct premiums written (DPW) came in at $90.34 billion, the highest second-quarter total on record, according to an S&P Global Market Intelligence analysis. That marked a $3.45 billion increase from a year earlier.

The highest quarterly total on record is the $93.5 billion posted in the first quarter of this year.

Loss ratios for the sector showed dramatic year-over-year improvement. The industry ratio fell 7.1 percentage points to 61.2% from 68.3% in 2024 and beat the ratio of 78.1% from 2023.

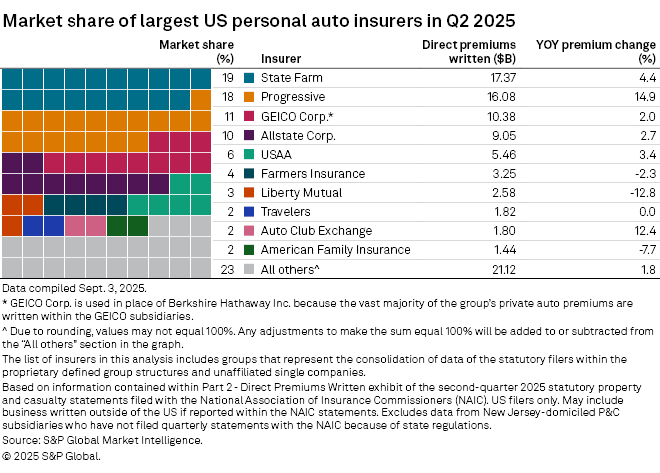

State Farm Mutual Automobile Insurance Co. remained the market leader even as it booked year-over-year premium growth of just 4.4% in the second quarter, which was weaker than recent years. The Bloomington, Illinois-based carrier's DPW increased to $17.37 billion in the quarter, representing a 19% market share.

The Progressive Corp., which had another quarter of solid growth in policies in force, had the second-largest market share at 18%. The Mayfield, Ohio-based insurer logged a 14.9% year-over-year increase in premiums to $16.08 billion.

Berkshire Hathaway Inc.'s GEICO Corp. and The Allstate Corp. posted slight increases in their market shares, maintaining the third and fourth positions, respectively. GEICO's market share hit 11% as it posted $10.38 billion in DPW, up 2% year over year. Allstate's market share hit 10% on DPW of $9.05 billion in the period, up 2.7% from the previous year.

United Services Automobile Association rounded out the top five with a 6% market share on DPW of $5.46 billion, a 3.4% year-over-year increase.

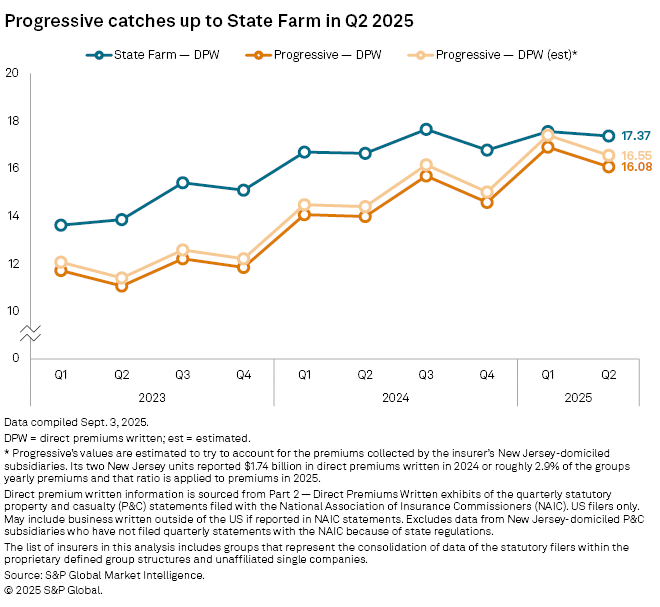

Progressive narrows the gap

Progressive crept even closer to market leader State Farm in the second quarter. While the premiums written gap between State Farm and Progressive was relatively narrow, it shrank even more when two New Jersey-domiciled insurers owned by Progressive, which surpassed GEICO for the No. 2 position in the market in 2022, were added to the equation.

S&P Global Market Intelligence calculates Progressive's reported statutory premiums as the sum of all of its reporting subsidiaries. However, the National Association of Insurance Commissioners has not released quarterly statements for insurers' New Jersey-domiciled subsidiaries since the third quarter of 2022.

Since 2010, the two Progressive New Jersey units have constituted between 2.7% and 4.1% of the group's annual reported private auto direct premiums written. In 2024, the New Jersey-based subsidiaries reported an aggregate of $1.74 billion in direct premiums written, or 2.9% of Progressive's total private auto premiums for the year.

If the two New Jersey subsidiaries accounted for similar percentages in the second quarter, the group's direct premiums written would have been approximately $16.55 billion, compared to State Farm's $17.37 billion.

Progressive took a conservative approach on rate changes in light of recently enacted tariffs. But as time goes on, the company has "more certainty" around their effect, CEO Tricia Griffith said during a second-quarter earnings call.

"[In states] where we need a little rate we'll go up a little bit, [and in states where] we believe we can grow, like Florida, we'll reduce rates," she said. "We're back to where we want to be ... taking small bites of the apple on either end. And that allows us to keep rates stable and competitive for our customers."

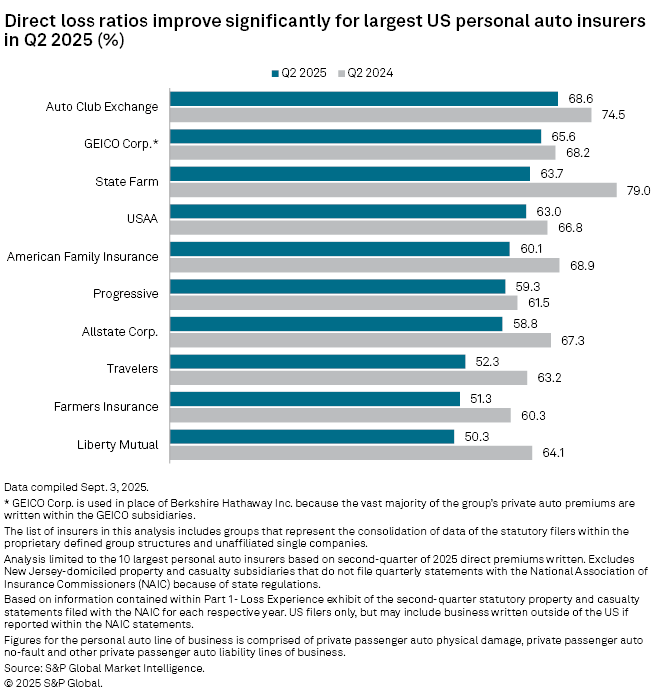

Loss ratios down across the board

Improvement in frequency and severity trends have led to an easing of loss ratios for companies in the analysis. All of the insurers in the top 10 of the analysis reported year-over-year decreases in their ratios, three of them by 10 or more percentage points.

State Farm had the steepest drop at 15.3 points, with its loss ratio improving to 63.7%. Liberty Mutual Holding Co. Inc. had the lowest ratio in this analysis at 50.3%, a 13.8-point improvement from the prior year, while The Travelers Cos. Inc. had a 10.9-point drop, down to 52.3% from 63.2%.