Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Sep, 2025

By Brian Scheid and Nick Lazzaro

US Federal Reserve officials increased their projections for economic growth and inflation while lowering their unemployment forecasts, signaling that they still believe a soft landing is possible and a recession remains unlikely.

These forecasts, included in the Fed's quarterly economic projections, came as the rate-setting Federal Open Market Committee expectedly agreed to cut rates by 25 basis points, the first rate change since December 2024. Newly confirmed Fed Governor Stephen Miran was the lone dissenting vote, calling for a 50-bps cut instead, in line with President Donald Trump's push for the central bank to substantially cut rates to boost the economy.

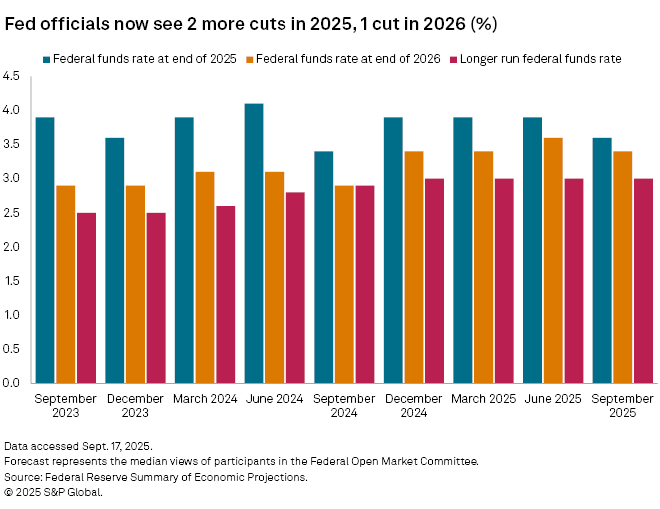

Fed officials expect an additional 50 bps of cuts before year-end, likely one 25-bps cut at their October meeting and another at their December meeting, but only one 25-bps cut throughout all of 2026, the projections show.

"The assumption is that the three cuts this year … are enough to head off labor market weakness," George Pearkes, a macro strategist at Bespoke Investment Group, said in an interview. "But they can't forecast more cuts with inflation still above target."

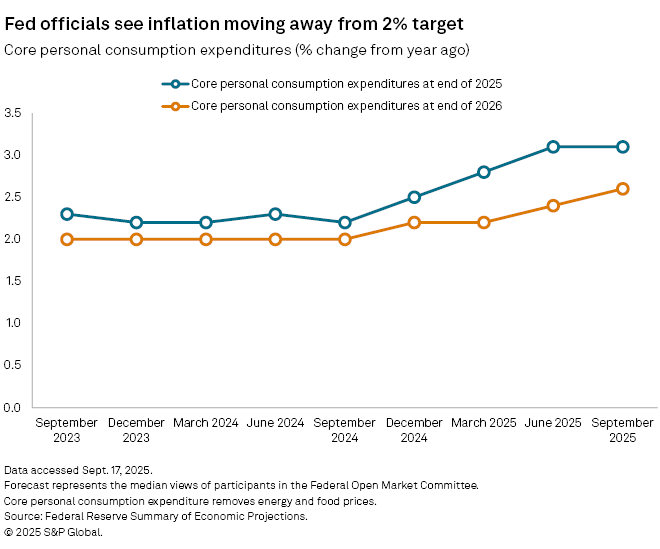

In their new projections, the median view among Fed officials is for annualized growth in core personal consumption expenditures, an inflation measure which strips out volatile energy and food prices, to rise 3.1% at the end of 2025, from a forecast of 2.2% a year ago, and to rise 2.6% at the end of 2026, from a forecast of 2.0% a year ago. Fed officials want this inflation measure, which rose 2.9% from July 2024 to July 2025, to fall to 2%, a policy target that the officials do not believe will be reached until 2028, the projections show.

"The takeaway for investors is that the Fed sees the same slowing labor markets that have started showing up in the data, but by not cutting by 50 bps, are not seeing anything worse than a slowdown and certainly not a looming recession," Steve Dean, chief investment officer at Compound Planning, wrote in an email. "At the same time, the continued above-target inflation seems to be considered largely 'temporary' as a result of tariffs."

The median view among Fed officials is for real GDP to grow 1.6% at the end of 2025, up from previous projections of 1.4%, and for growth of 1.8% at the end of 2026, up from 1.6%.

"Expectations for faster growth and somewhat higher inflation, but still a willingness to cut rates, show that they are willing to run the economy hot even with the tariff threats to inflation not completely behind us," Oren Klachkin, a financial market economist at Nationwide, said in an interview. "Their focus is squarely on the labor market now."

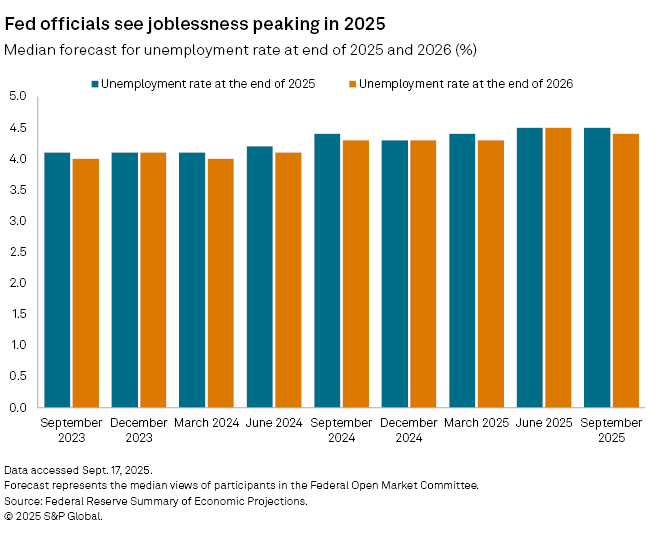

Fed officials also forecast the unemployment rate, which was 4.3% in August, to climb to 4.5% by year-end, just 10 bps higher than what they were forecasting a year earlier. The unemployment rate is expected to moderate from there, falling slightly to 4.4% by the end of 2026 and 4.3% at the end of 2027, both down 10 bps from projections in June.

"Much of what happens to the unemployment rate rests on what we do from an immigration standpoint and the impact on the size of the labor force," Steve Wyett, chief investment strategist at BOK Financial, said in an interview. "The forecast for unemployment to move up only marginally from here before declining marginally, to me, indicates the Fed doesn't have a strong sense of how changes to the labor market might be reflected in the data."

No preset path

During a Sept. 17 press conference, Fed Chair Jerome Powell defended the central bank's decision to hold rates steady since December 2024 as the impacts of tariffs and shifts in immigration policy on inflation and the jobs market became clearer. While Fed officials are now projecting only three more cuts by the end of 2026, rate decisions will likely shift with the data, Powell said.

"We're in a meeting-by-meeting situation," Powell said. "We're not on a preset path."

And while the median view is for just two more cuts this year, expectations amongst Fed officials for cuts this year diverged significantly, with 10 seeing at least two cuts and nine seeing one or fewer.

"The [projections] should always be taken with a grain of salt, and this one seems to warrant more than a few grains," Garrett Melson, a portfolio strategist with Natixis Investment Managers, said in an interview.

With so much dispersion among Fed officials, the new projections are "very messy and particularly useless," according to Melson. The path of future cuts will be a function of both labor market data and inflation prints, he said.

These data points are also particularly difficult to forecast as tariffs take root and the risk of stagflation rises as consumer confidence declines and the labor market weakens, said John Lash, group vice president of product strategy at E2open, a supply chain platform.

"While the Fed has a myriad of reasons to take a cautious and measured approach to rate cuts, uncertainty and a fuzzy crystal ball undoubtedly weigh heavily on their minds," Lash said in an interview. "There is no modern precedent for this."