Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Sep, 2025

By Brian Scheid

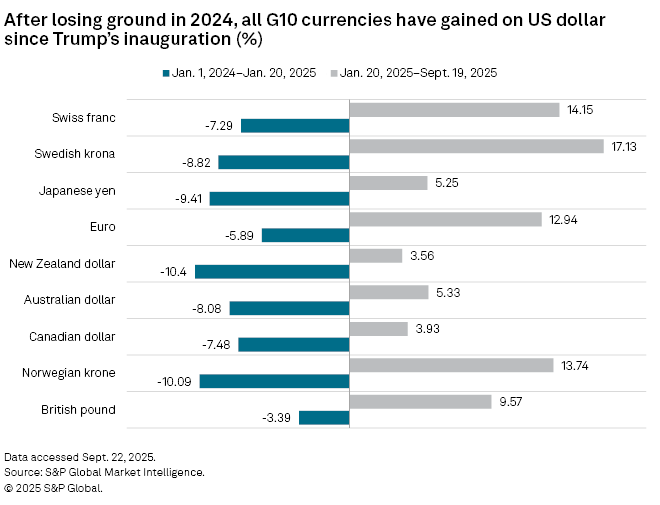

Forecasts for a weaker US economy, expectations for further rate cuts and fears of a less independent central bank have triggered one of the worst US dollar performances in decades, with the potential for further decline.

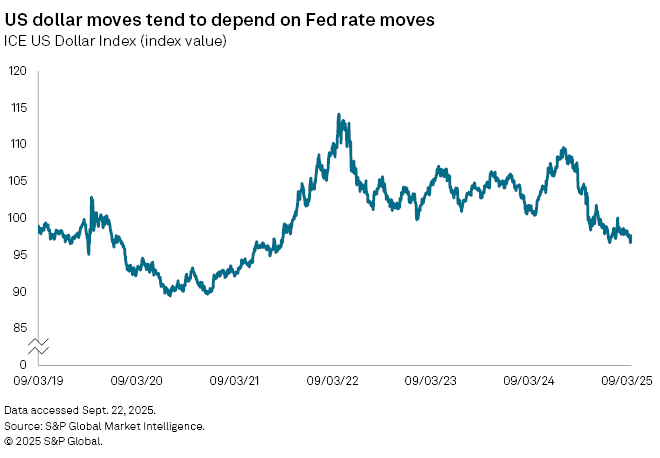

The US dollar index, which tracks the dollar against a basket of its currency peers, fell nearly 10% from the end of 2024 through Sept. 19, 2025, the worst performance for the index during that stretch since 2017, when it fell nearly 10.3%, according to an S&P Global Market Intelligence analysis.

"I don't think we've seen the bottom just yet," Kyle Rodda, a senior financial market analyst at Capital.com, said in an interview.

After keeping its benchmark interest rate unchanged since December 2024, the Fed last week cut it by 25 basis points. With the domestic economy forecast to slow, necessitating deeper cuts, Fed policy could quickly diverge from much of the world's central banks as the European Central Bank holds rates steady and the Bank of Japan starts to hike rates again, Rodda said.

In addition, US fiscal policy, President Donald Trump's historic increase in tariffs and a general loss in trust in the US government have caused a move away from US dollar assets, according to Rodda. The expected decline in the dollar may already be priced in as short positioning has built up, Rodda said, but monetary policy concerns and fears over the loss of Fed independence are driving the near-term outlook.

"The dollar's dominance is definitely precarious," Rodda said. "Reports of its demise are overstated. But looking at the margins, dollar supremacy is on the wane, meaning all else equal, it should weaken over time."

The Fed is likely to become more dovish before the end of this year to combat a weakening jobs market with even lower interest rates. That shift will likely further weigh on the US dollar and further the ongoing rally in equity markets, Elias Haddad, a senior markets strategist with the foreign exchange team at Brown Brothers Harriman, said in an interview.

If US inflation quickens and stagflation sets in, that could further drive the dollar down, according to Haddad.

"We see a large and sustained shift in offshore hedging [behavior] away from the dollar, further helped by a new Fed easing cycle and question marks around its independence," George Saravelos, head of foreign exchange research at Deutsche Bank, wrote in a Sept. 22 note. "At the same time, the global economy is resilient, characterized by fiscal and supply-side divergence that [favors] the rest of the world over the US for the first time since COVID."

Still, it is possible that the market has reached "some kind of equilibrium" with its expectations for Fed rate moves into next year, according to Jane Foley, head of foreign exchange strategy at Rabobank.

"A lot of easing was priced in during the approach to the September meeting and, given that [Fed Chair Jerome] Powell signaled that there was no strong urgency with respect to its policy easing, the market appears to have concluded that at least for now, there is no real need to price in even more," Foley said in an interview.

This has given some support to the dollar and there could be further short covering in favor of the dollar in the coming months if upcoming economic data fails to bolster the case for deeper cuts. However, there remains much uncertainty about Fed independence and the dollar's safe haven status which will likely determine whether non-US dollar-based investors increase their hedging ratios on dollar assets they already own, according to Foley.

"The dollar has essentially been in an uptrend since the [global financial crisis], which likely persuaded many investors to only lightly hedge dollar assets," Foley said. "If hedging ratios increase, this could pressure the dollar and potentially become a self-fulfilling trend. This underpins why the current moment is precarious for the dollar."