Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

15 Sep, 2025

By Nick Lazzaro and Umer Khan

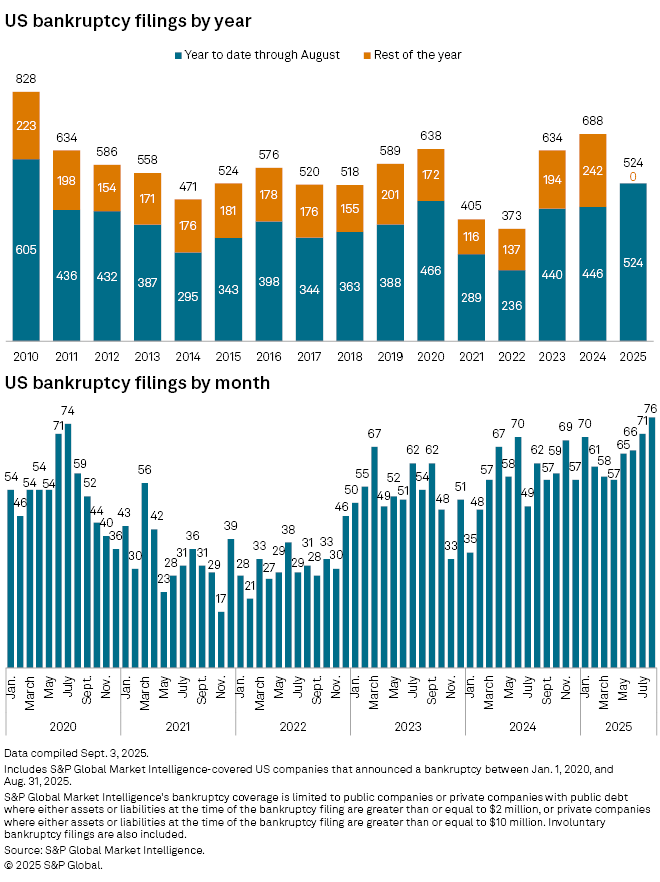

US corporate bankruptcies in August climbed for a fourth straight month to reach their highest level since at least 2020.

Monthly bankruptcy filings among large public and private companies rose to 76 in August from 71 in July, according to S&P Global Market Intelligence data. Year-to-date bankruptcy filings totaled 524 through the end of August, the most for this eight-month period since 2010. The data includes companies with public debt and assets or liabilities of at least $2 million or private companies with assets or liabilities of at least $10 million at the time of filing.

Firms this year are working to refinance large levels of maturing debt originally issued at lower interest rates over the previous decade, including very low rates that were available in 2020 and 2021 during the COVID-19 pandemic. The refinancing occurs as key interest rates such as the US Federal Reserve benchmark rate and US Treasury yields remain elevated, which has pressured highly leveraged companies with weak balance sheets or exposure to shifting consumer spending trends.

US corporations trimmed debt in the second quarter, according to Market Intelligence data, and debtors may get relief in the coming months as the Fed is expected to resume interest rate cuts. However, the impact from these cuts may be limited if yields for mid-dated and long-dated Treasurys do not decline alongside the Fed's easing monetary policy.

Still, bankruptcy filings have been concentrated in specific sectors, and investor demand for corporate credit has been robust due to high yields, solid corporate earnings and a perception of low risk. This investor appetite has included demand for debt issued by speculative-grade companies with credit ratings below BBB-.

The credit default swap market has mirrored this sentiment. The spread for the CDX North American High Yield index settled at 321 basis points at the end of August, down from 337 bps at the start of the month and well below levels over 400 bps reached in April. The index references credit default swap pricing for a basket of speculative-grade company debt. Credit default swaps are traded as insurance on bonds against the event of a default by the bond's corporate issuer. Spreads for these contracts represent a risk premium measuring the difference in their yields in relation to the yields on their underlying bonds, with narrower spreads signaling low risk and high demand.

Notable filings

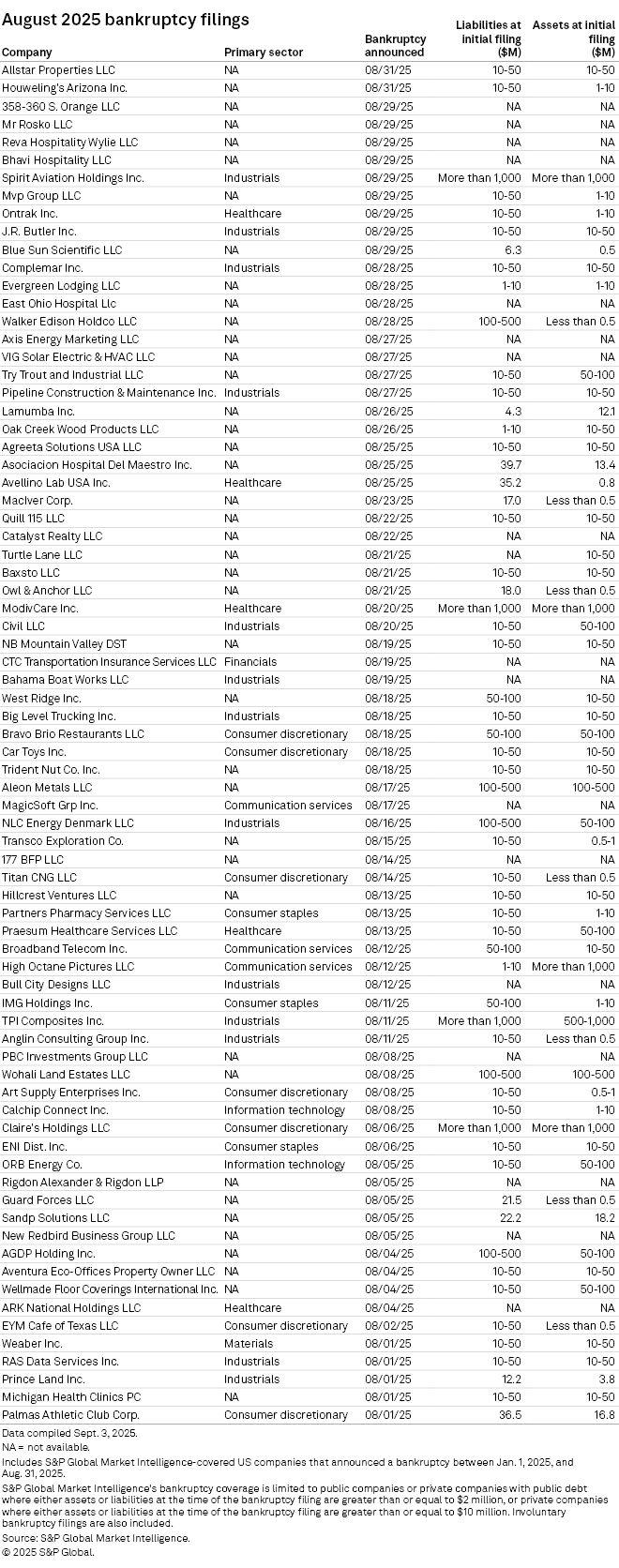

Four companies entered the bankruptcy process in August with more than $1 billion in liabilities at the time of filing.

Brick-and-mortar fashion retailer Claire's Holdings LLC announced its bankruptcy filing Aug. 6, with the intent to pursue a sale of its assets while reviewing alternatives to remain in business. Private holding company Ames Watson Capital LLC entered into an agreement later in the month to acquire the retailer's North American business operations.

|

Spirit Aviation Holdings Inc. filed for bankruptcy for the second time in the last 12 months. Through its bankruptcy reorganization process, the airline plans to redesign its flight network, optimize its fleet size, address its cost structure and expand options for customers.

The other large bankruptcies in August included filings from ModivCare Inc. and TPI Composites Inc.

Sector breakdown

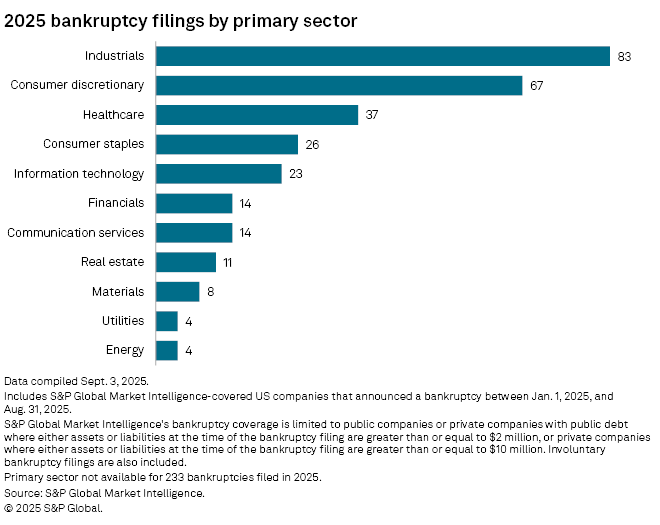

Bankruptcies were concentrated in the industrial and consumer discretionary sectors through the first eight months of the year and in August.

There were at least 13 bankruptcies in August among large companies in the industrial sector, bringing the total for the year to 83. Bankruptcies among large consumer discretionary companies now total 67 this year after seven new filings in August.

Of the 524 companies that filed for bankruptcy for the year through August, 291 had a primary sector designated by Market Intelligence data. There were 187 combined filings from companies in the industrials, consumer discretionary and healthcare sectors.

This Data Dispatch is updated regularly. The previous edition was published Aug. 6.

Bankruptcy figures include public companies or private companies with public debt with a minimum of $2 million in assets or liabilities at the time of filing, in addition to private companies with at least $10 million in assets or liabilities. S&P Global Market Intelligence may remove companies from this list if it discovers that their total assets and liabilities do not meet the threshold requirement for inclusion.