Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

05 Sep, 2025

By Allison Good

Even if the $5 billion Revolution Wind project under construction off Rhode Island manages to proceed through a political deal, the Trump administration's actions against offshore wind farms, even those in late stages of development, are injecting growing uncertainty into clean energy investment.

Following an Aug. 22 stop-work order for Ørsted A/S and Global Infrastructure Partners LP's Revolution Wind project, which is 80% complete, industry experts have suggested any path to completion for the wind farm may require some type of deal with the Trump administration similar to how a project in New York earned a green light.

When the US Interior Department lifted a stop-work order on Equinor ASA and BP PLC's 2,070-MW Empire Wind 1 in May, Interior Secretary Doug Burgum suggested the change was due to New York Gov. Kathy Hochul agreeing to facilitate the construction of gas pipelines in the state.

A Hochul spokesperson dismissed claims that the governor reached a quid pro quo with the Trump administration. But industry analysts see a similar political strategy at play for Revolution Wind.

"The Empire Wind case suggests President Donald Trump's administration uses stop-work orders to exert pressure on East Coast Democratic governors regarding specific issues," analysts at Morningstar wrote Aug. 25. "Another possibility is that the stop-work order is related to the spat between the US and Denmark over Greenland."

Trump has said the US should have "ownership and control" over Greenland for reasons including national security and the Arctic island's critical minerals.

Analysts at Jefferies agreed in an Aug. 23 report that "the question becomes if/what is the Trump Administration 'looking for' in return for lifting the halt against Revolution Wind," following up in a Sept. 2 note that "another angle raised of late includes the prospects of the US using the Revolution Wind as part of negotiations with Denmark in a variety of areas."

The US Bureau of Ocean Energy Management (BOEM) injunction cited concerns related to national security. In an Aug. 26 CNN interview, Burgum said Revolution Wind could interfere with radars detecting undersea swarm drone attacks.

Josh Kaplowitz, an attorney at Troutman Pepper Locke who served in the Interior Department's Office of the Solicitor as an attorney-adviser to BOEM's offshore wind program from 2015 to 2020, said cooperation between the Defense Department and BOEM in siting offshore wind projects is already comprehensive.

"I've seen firsthand the rigorous consultation process that goes on between BOEM and the Department of Defense," Kaplowitz said in an interview. "You actually have two layers of review because leases don't get issued without Department of Defense weighing in, and I've never seen any instance of BOEM disregarding a Department of Defense recommendation in siting of the lease and in the permitting of projects."

If the administration decides national security is "a legitimate novel concern," however, Dominion Energy Inc.'s 2,587-MW Coastal Virginia Offshore Wind "is more exposed considering the meaningful Navy presence" in the area, Jefferies analysts wrote.

Dominion management, as recently as Aug. 1, has maintained that the project remains "months away" from delivering power to customers in 2026, is on track for completion by the end of that year and will prove to be an asset that supports critical military and defense installations.

Project finance alarm

While the Trump administration's stance against offshore wind has been expected, its actions to stop or reevaluate even projects that are fully permitted — or more than half-built — is forcing a risk reappraisal by clean energy developers and investors.

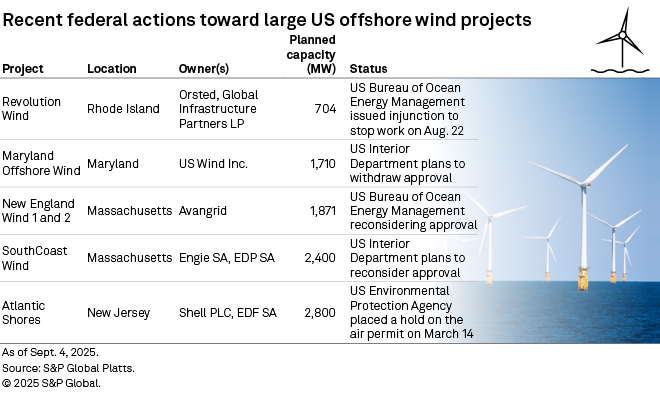

In addition to Revolution Wind and Empire Wind, the administration has moved against projects off Massachusetts, New Jersey and Maryland owned by developers including Iberdrola SA's Avangrid Inc., US Wind Inc., Engie SA, EDP SA, Shell PLC and Electricité de France SA.

"Undercutting these projects, each of which has billions of private investment dollars committed to it, is sending shock waves through all energy project financing, not just the wind industry," Dennis Wamsted, an analyst for the Institute for Energy Economics and Financial Analysis, wrote in a Sept. 3 report.

"The cost of this political uncertainty will raise the risks — and therefore, the costs — of developing other new power generation resources, including new nuclear facilities (both small modular and conventional large reactors), dispatchable battery storage, solar, and gas-fired plants," Wamsted added.

For offshore wind, financial services platform Karbone has taken "every ... project except Vineyard Wind out of our forecasting models over the last year," Peter Gardett, head of energy transition research at Karbone, said in an email. "The stranding risk for them is too high to appropriately model for the pricing impacts."

Jefferies analysts wrote in August that they do not expect Ørsted and Global Infrastructure Partners to abandon Revolution Wind. On Sept. 4, the developers sued the Trump administration over the stop-work order.

But Kaplowitz sees the entire industry at risk.

"What you're seeing here in terms of the disruption of business expectations, there is a reliance on the finality of government decision-making that every business needs across virtually every industry," Kaplowitz said. "If you can't make good on those commitments, people are going to stop investing."