Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

05 Sep, 2025

By Gaby Villaluz and Zuhaib Gull

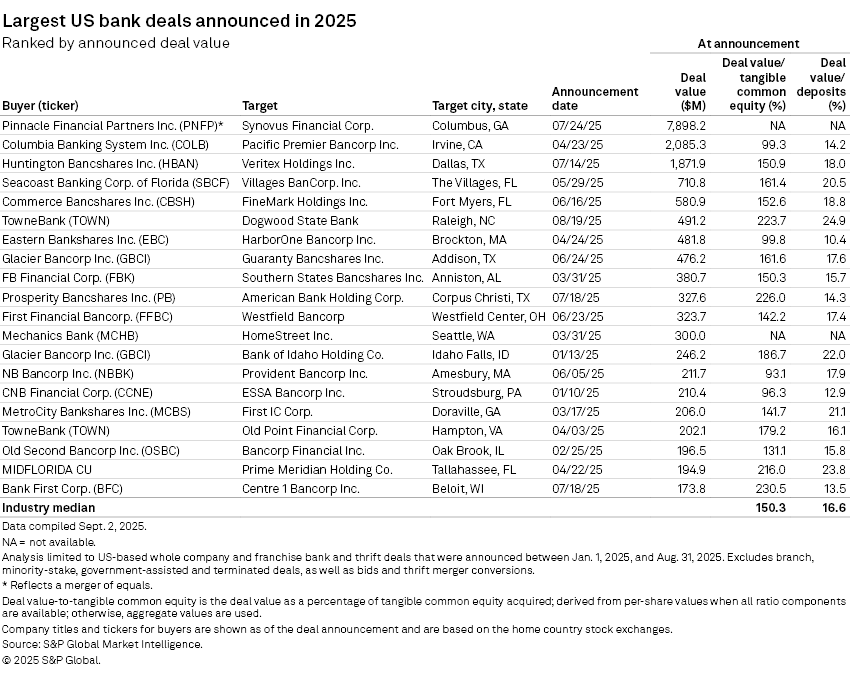

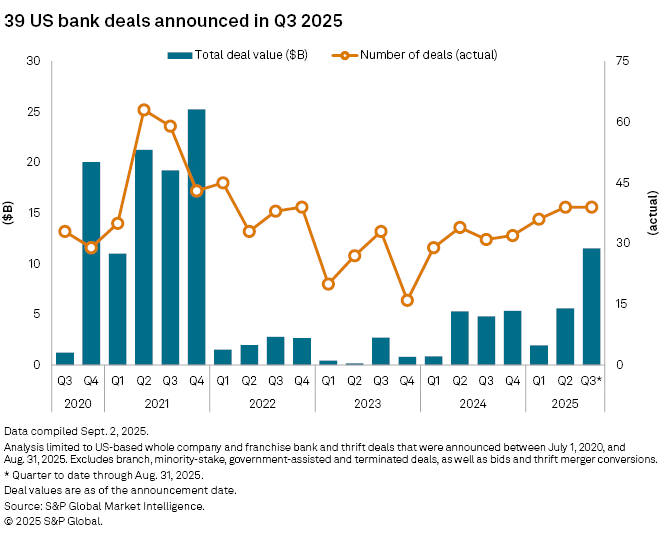

Eleven US bank M&A deals were announced in the second month of the third quarter, including TowneBank's acquisition of North Carolina-based Dogwood State Bank on Aug. 19.

This transaction, with a value of $491.2 million and a value-to-tangible common equity ratio of 223.7%, was the sixth-largest and third-most expensive US bank M&A deal of 2025, according to S&P Global Market Intelligence data.

Meanwhile, Portsmouth, Virginia-based TowneBank's acquisition of Hampton, Virginia-based Old Point Financial Corp., which closed Sept. 1, was the 17th-largest deal announced this year.

These deals means TowneBank joins the list of acquirers with at least two bank purchases in 2025, alongside Farmers Bancorp Inc., Cadence Bank, First Financial Bancorp., Glacier Bancorp Inc., Michigan State University FCU and Seacoast Banking Corp. of Florida.

First Maryland bank deal announced

On Aug. 13, Ephrata, Pennsylvania-based ENB Financial Corp. announced the acquisition of Elkton, Maryland-based Cecil Bancorp Inc. for $28.9 million, marking the first time a bank was targeted in the Old Line State this year.

The transaction is expected to close in the first quarter of 2026, with the combined entity projected to have pro forma total assets of $2.45 billion.

Banks targeted in the Midwest

Five bank deals were announced in the Midwest in August.

Two of the targets are headquartered in Illinois: Cincinnati-based First Financial Bancorp.'s $141.7 million purchase of Burr Ridge, Illinois-based BankFinancial Corp., announced on Aug. 11; and Decatur, Illinois-based Land of Lincoln CU's purchase of substantially all assets and liabilities of Williamsville, Illinois-based Williamsville State Bank & Trust, announced on Aug. 29.

Elsewhere, Perryville, Missouri-based Reliable Community Bancshares Inc. on Aug. 19 announced the purchase of Clayton, Missouri-based M1 Bancshares Inc., a boutique financial institution focused on lending for low- to moderate-income housing, renewable energy projects and historic tax credit developments.

The Midwest is the most targeted region so far this year, with 46 target banks. Illinois and Missouri are the second-most targeted states, with nine target banks each.

Texas leads as the most targeted state

On Aug. 1, Mercedes, Texas-based TNB Bancshares Inc. announced the acquisition Roma, Texas-based Citizens State Bank. The transaction is expected to close in the fourth quarter, with the combined company having approximately $1.1 billion in assets.

The Lone Star State has had a total of 13 target banks so far in 2025, making it the most-targeted. The increase in Texas M&A has been largely driven by smaller, rural bank deals, as many buyers see them as an attractive source of funding.

|

– Access a list of pending and completed M&A deals announced since Jan. 1, 2015. – Access the S&P Capital IQ Pro M&A summary page for US financial institutions – Read more M&A news. |

M&A outlook

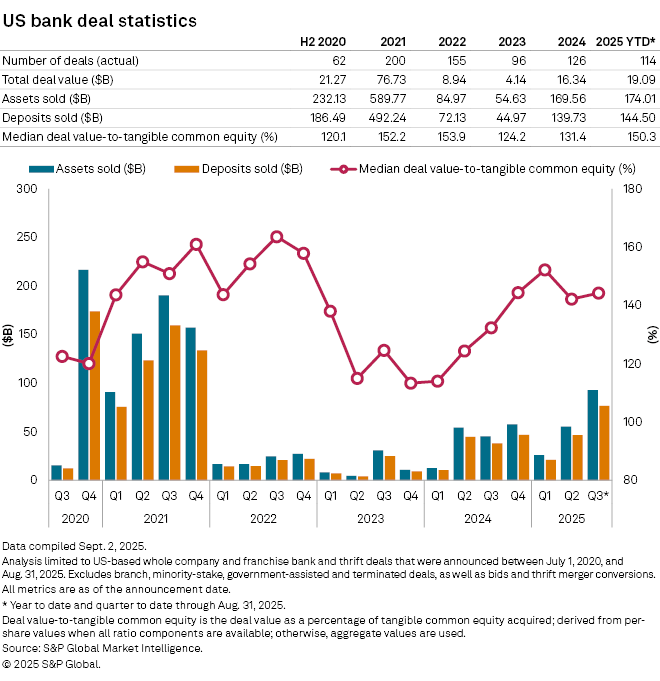

US bank M&A is experiencing the first of two expected waves of activity, according to Justin Hughes, managing director of Commerce Street Holdings LLC's financial institutions group.

Serial acquirers and large deals are making a comeback, creating advisory backlogs at top investment banking firms. Transactions that have been in the works for months or years are being announced as a window of opportunity opens, while new deal conversations begin.