Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

24 Sep, 2025

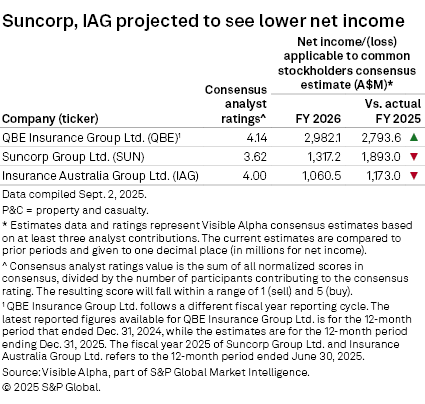

Two of Australia's largest property and casualty insurers by market capitalization are expected to report a decline in net income in fiscal year 2026.

Suncorp Group Ltd.'s net income applicable to common shareholders for fiscal year 2026 is expected to decrease sharply year over year to about A$1.32 billion, according to analyst consensus estimates from Visible Alpha, a part of S&P Global Market Intelligence. The decline follows strong fiscal year 2025 results, which benefited from one-time items, including the sale of Suncorp Bank and New Zealand Life, higher investment returns, and favorable weather costs in Australia and New Zealand, according to an earnings release.

Insurance Australia Group Ltd. is projected to report net income applicable to common shareholders at A$1.06 billion for the fiscal year 2026, slightly lower year over year. This follows higher net income in the previous fiscal year, driven by double-digit percentage growth in insurance profit.

QBE Insurance Group Ltd. is expected to move in the opposite direction, with analysts projecting an increase in net income to A$2.98 billion from A$2.79 billion for its fiscal year ending Dec. 31, 2025. QBE's reporting cycle differs from those of Suncorp and IAG, whose latest fiscal years ended June 30. QBE reported strong growth in underwriting and investments for the fiscal first half ended June 30, executives said during an Aug. 7 earnings call.

– Read about Chinese life insurers' equity investments.

– Use the screener to access Asia-Pacific insurance data.

– Read about potential M&A activity in the global insurance sector on In Play Today, and a summary of recently announced deals on M&A Replay.

Mixed underwriting performance

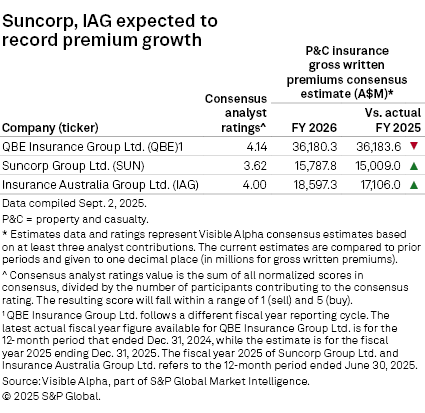

Analysts expect Suncorp and AIG to report higher P&C insurance gross written premiums, which are a significant component of overall gross written premiums.

Suncorp's P&C insurance gross written premiums are projected to climb to A$15.79 billion in fiscal year 2026 from A$15.01 billion, while IAG's are expected to rise to A$18.60 billion from A$17.11 billion.

Suncorp, which expects mid-single-digit growth in overall premiums for fiscal year 2026, plans to manage both price and volume while pursuing growth across its portfolio, CEO Steven Johnston said during an Aug. 14 earnings call.

IAG anticipates low- to mid-single-digit growth in overall premiums for fiscal year 2026. The outlook excludes the impact of its recently closed acquisition of The Royal Automobile Club of Queensland Ltd.'s (RACQ) insurance underwriting business and the pending purchase of RAC Insurance Pty. Ltd. The RACQ business is expected to boost premium growth to about 10%, according to the company.

QBE's P&C insurance gross written premiums for its fiscal year 2025 are expected to be nearly unchanged year over year at A$36.18 billion.

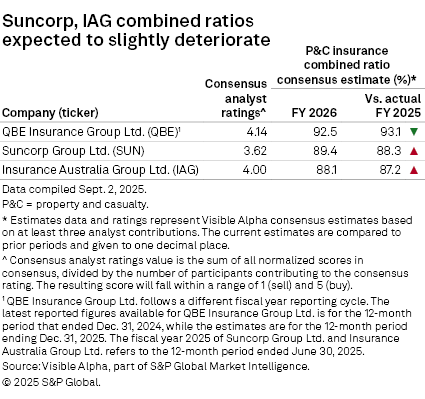

Analysts, however, project the P&C insurance combined ratios of Suncorp and IAG to slightly deteriorate. Both companies rely on their reinsurance arrangements and increased allowances for natural catastrophes to effectively manage and mitigate potential losses.

CFO Jeremy Robson said Suncorp's reinsurance program for fiscal year 2026 has become more efficient, maintaining a similar level of risk retention as the previous fiscal year's program while reducing costs. Robson also highlighted the resilience of the insurer's natural hazard allowance after it was increased to A$1.77 billion to account for portfolio growth and inflationary pressures.

IAG's conservative strategy for reserving and managing reinsurance prepares it for claims or volatility in the investment market, CFO William McDonnell said during an Aug. 13 earnings call. IAG also raised its natural perils allowance by 2.6% to A$1.32 billion.

Analysts see a slightly improved combined ratio for QBE in fiscal year 2025, as catastrophe costs remained below allowance for the first six months. CFO Inder Singh expressed confidence in QBE's catastrophe risk management given its portfolio profile and the structure of its reinsurance program.