Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Sep, 2025

By Robert Clark and Xylex Mangulabnan

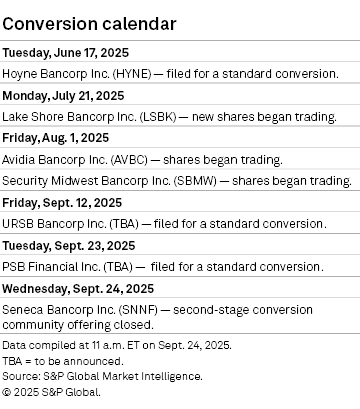

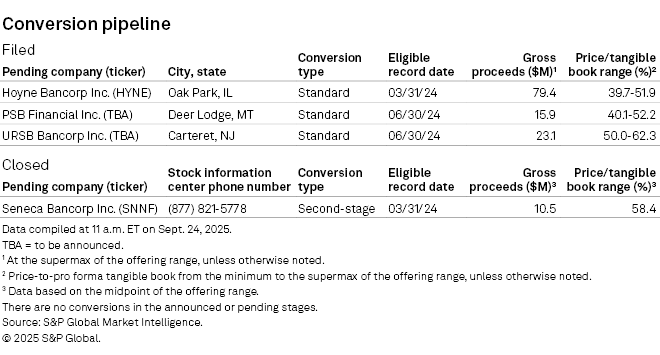

This feature has the latest news from the mutual bank conversion sector. As of Sept. 24, four conversions were in the pipeline.

The community offering for Seneca Bancorp Inc.'s second-stage conversion closed Sept. 24. In an 8-K filing, the Baldwinsville, New York-based bank disclosed that it received orders from the community offering, the subscription offering and the employee stock ownership plan that totaled about the midpoint of the offering range.

Seneca is expanding its branch network. It opened a branch in Manlius, New York, on June 2. The company disclosed in a prospectus that it expects to establish a branch in late 2026 in Camillus, New York; Seneca agreed to purchase 1.2 acres of land there on June 25.

Seneca also plans to open a branch in Clay, New York, where, in 2024, it bought 2.5 acres of land directly across from the future site of a semiconductor fabrication facility to be established by Micron Technology Inc. Seneca's property could be developed in late 2027 or 2028. "This strategic investment positions us to support the economic growth expected in the region and to provide financial solutions to businesses and families as this transformative development takes shape," Seneca said in the filing.

On Sept. 23, PSB Financial Inc. filed a registration statement for a mutual-to-stock conversion. PSB is the proposed holding company for Pioneer State Bank, the successor to Deer Lodge, Montana-based Pioneer Federal Savings and Loan Association. The price to pro forma tangible book value on June 30 is between 40.1% at the minimum of the offering range and 52.2% at the supermax.

In the filing, PSB said, "We are considering branching opportunities that may arise in our primary market area, including a potential branch office in western Montana in late 2026 or the first six months of 2027."

On Sept. 17, Oak Park, Illinois-based Hoyne Bancorp Inc. filed an amended registration statement for a standard conversion. The price to pro forma tangible book value as of June 30 is between 39.7% at the minimum of the offering range and 51.9% at the supermax. If the deal prices at the bottom end of the range, it would represent the second-lowest valuation among all US mutual bank conversions of the century.

On Sept. 12, URSB Bancorp Inc., the proposed holding company for Carteret, New Jersey-based United Roosevelt Savings Bank, filed a registration statement for a mutual-to-stock conversion. Gross proceeds are between $14.9 million at the minimum of the offering range to $23.1 million at the supermax.

According to the filing, many of United Roosevelt's one-to four-family, multifamily, commercial and industrial (C&I) and consumer loans have been purchased rather than originated internally. As of June 30, the balance of purchased C&I loans from BHG Financial, formerly known as Bankers Healthcare Group LLC, was $35.9 million, or 13.7% of the bank's loan portfolio. United Roosevelt began buying C&I loans from BHG in early 2016. The bank also started buying participation interests in syndicated leveraged lending loans in November 2023 from BancAlliance Inc.; the balance of that exposure on June 30 was $3.3 million. Additionally, United Roosevelt began purchasing consumer loans from BHG and Woodside Credit LLC in the second quarter this year and from LendingClub Corp. in the first quarter.

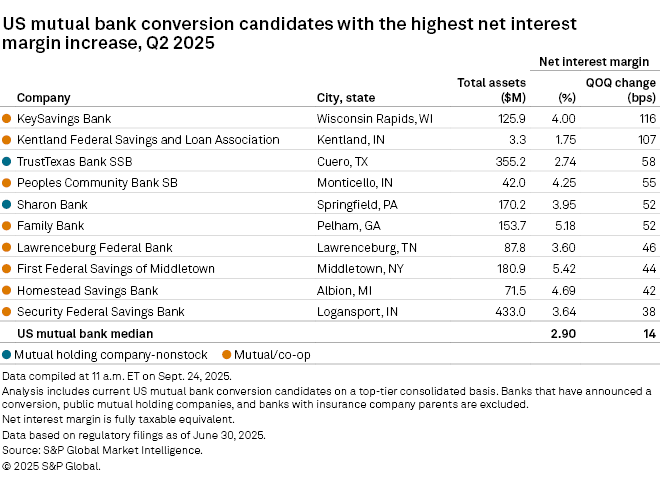

Download a template showing the conversion pipeline, market performance of recent conversions, valuations of mutual holding companies and a list of conversion candidates.

Other news stories about mutuals, mutual holding companies, recent conversions and activist investors

Mass. lender PeoplesBank CEO retiring; executive shuffle follows – BusinessWest

Piper Sandler survey finds investor support for activists in banking industry

Colony Bankcorp revised offer for TC Bancshares twice before deal announcement

We encourage reader participation and feedback. Please forward any suggestions to ConversionNews@snl.com.