Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Sep, 2025

By Iuri Struta

| Sports teams, including the Portland Trail Blazers, pictured above playing against the Miami Heat, have seen their valuations increase substantially in recent years. Source: Soobum Im/Getty Images Sport via Getty Images |

Sports team acquisitions are on track to hit record highs in 2025, with private equity fueling higher deal values and prompting some longtime owners to cash out.

Sports team deal values hit an aggregate $23.60 billion for the year through August, according to S&P Global Market Intelligence data. This puts 2025 on track to smash the full-year category record of $16.60 billion set in 2023.

The 2025 total includes two megadeals: the $10 billion sale of The Los Angeles Lakers, Inc., announced in June, and the $4.25 billion sale of the Portland Trail Blazers Inc., tentatively agreed to in August.

Beginning in 2019, major US leagues have increasingly allowed institutional investors to take ownership stakes in teams, expanding the field of potential buyers. The influx of investor interest drove up valuations, prompting more private team owners to sell. The Lakers, for instance, were owned by the Buss family since 1979, when the late Jerry Buss bought the team for $67.5 million. Nearly 50 years later, Jerry's daughter Jeanie Buss agreed to sell the team for $10 billion.

Given the market trends, dealmaking for sports teams is not expected to slow down any time soon, even as some are starting to question the rich valuations.

"There are actually even more deals done I'm aware of that aren't yet announced," said Gregory Bedrosian, CEO of global tech-focused investment bank Drake Star Partners Ltd.

Targets for investment

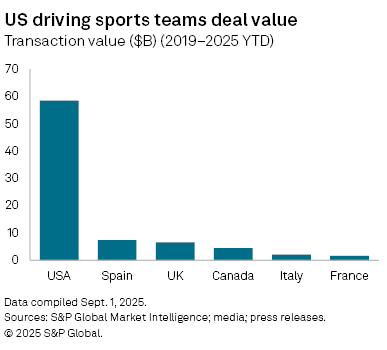

The US has led other countries in terms of total transaction value for sports teams, with $58.47 billion since 2019. Distantly following is Spain, with $7.38 billion, and the UK, with $6.55 billion.

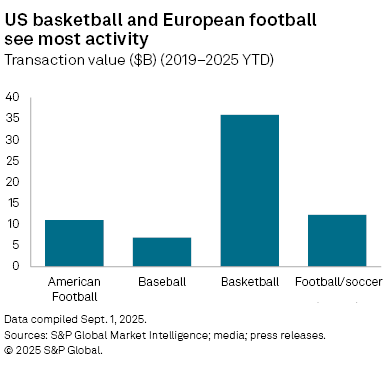

Looking at transaction value by sports type, basketball has seen the largest flows of M&A, driven by a few large deals. In addition to the announced sales of the Lakers and Trail Blazers, a consortium of investors in March agreed to acquire the NBA's Boston Celtics for $6.1 billion, plus potential earnouts. It was the largest deal in sports history before the $10 billion Lakers deal was announced in June.

Beyond basketball, European football has also seen strong interest, with major deals for AC Milan and Paris Saint-Germain. Football/soccer overall had the second-highest transaction value since 2019.

|

|

|

Relaxed rules, bigger rights fees

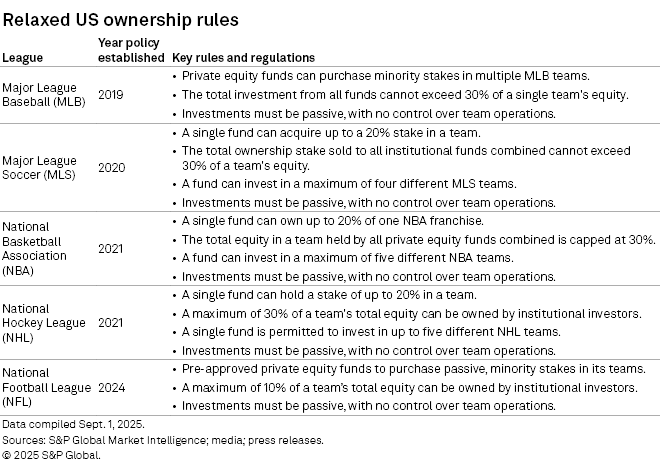

Major League Baseball was the first US league to allow private equity ownership in 2019. This established a precedent of capping total private equity ownership in single teams to no more than 30%, which other US leagues subsequently followed. Major League Soccer, for instance, rolled out its policy establishing a total private equity cap of 30% in 2020, though it also specified that an individual fund could own no more than 20% of a team. The NBA and the NHL similarly changed their rules in 2021.

The NFL, which represents the most popular sport in the US, was the last major US league to change its ownership rules in 2024. The American football league is also the most restrictive to investment: Only 10% of an NFL team can be held by institutional investors.

Following these rule changes, private equity firms like Silver Lake Technology Management LLC have been upping their sports investments. Silver Lake in 2021 purchased Diamond Baseball Holdings LLC, an acquirer of Minor League Baseball teams. Arctos Partners LP, a dedicated sports fund, buys minority passive investments in teams like the MLB's Los Angeles Dodgers and the NBA's Utah Jazz. Meanwhile, funds like Redbird Capital Partners Management LLC and 777 Partners LLC typically seek operational control.

Apollo Global Management Inc. is the latest private equity firm to join the fray, setting up a $5 billion fund dedicated to sports.

With the pool of investors growing bigger, price discovery for sports teams has become more efficient. Top sports teams with a long history behind them are unique, unrepeatable assets. At the same time, revenues are steady, offer predictable growth, and are believed to be recession-proof.

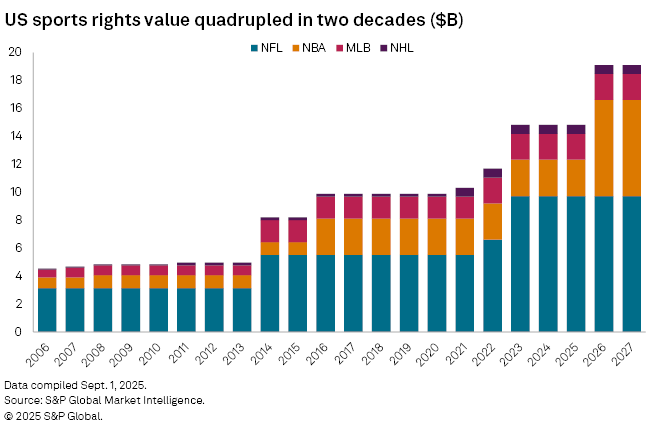

Sports rights growth has been strong, with the value of the rights doubling every seven years in the US. They increased at a faster rate in the recent past, as traditional TV network operators saw rising competition from streaming providers like Amazon.com Inc.'s Prime Video, Netflix Inc. and Apple Inc.

Over the past decade, the value of sports rights for the four American sports leagues has tripled. The NBA, for instance, renegotiated its contract for the 2026-2033 years to $6.9 billion per year, up from $2.6 billion in the previous 10 years.

But while sports revenues have grown steadily, valuations have increased much faster, raising concerns about a potential bubble.

"Anytime there is a major inflection point marked by explosive growth, where there is more capital to invest, some people might end up overpaying, and we'll see what the right valuation ends up being," said Drake Star's Bedrosian.

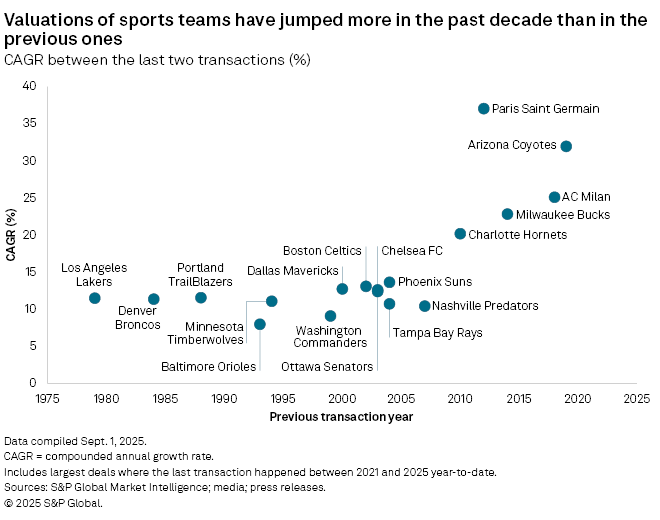

Most of the increase in valuations has taken place in the past 10 years or less. According to data compiled by Market Intelligence, team sales in the past three years involving a seller that bought the team after 2010 typically saw a compounded annual growth rate [CAGR] of more than 20%. If the seller had bought the team before 2010, the CAGR typically ranged from 10% to 15%.

Teams historically had price-to-revenue valuations in the mid- to low single digits. Today, price-to-revenue valuations for top-tier teams are in the low double digits.

The NBA's Milwaukee Bucks Inc., for instance, was valued at about 3.5x revenue when it was acquired in 2014. In 2025, the Bucks were sold for a price-to-revenue valuation of 9.9x. The Boston Celtics were valued at about 3.1x revenue when sold in 2002. In 2025, the team was valued at 13.3x revenue in a sale to a group of investors led by Bill Chisholm that included private equity firm Sixth Street Partners LLC.

Other leagues saw similar trends. The NFL's Washington Commanders had a 4.6x revenue multiple in 1999, and that figure more than doubled in a 2023 sale to 11.1x.

What it means to win

Some argue these higher valuations are warranted given that new ownership under PE could lead to operational improvements that will spur further growth. Most football clubs in Europe are losing money and have never been profitable, while profit margins in the US remain low.

"We are seeing growing interest from a new profile of investors who view the sports industry as an untapped market with significant potential to provide returns," said Amran Nawaz, associate director at business consultancy Secretariat International.

Revenue opportunities expand beyond team merchandise or traditional media rights, added Shalabh Gupta, associate director at Secretariat. "For example, stadiums are increasingly being used for concerts and other sporting events, as clubs look to generate revenue during the [about] 300 days a year when the venue would otherwise sit idle," Gupta said.

PE firms' interest and investment in sports, then, potentially to stands redefine what winning — and losing — means, focusing less on season records and more on margins.

"Private equity firms can drive efficiencies," said Mike Keenan, managing director at consultancy firm PwC. "Some franchises have been run the same way for 10 years, and PE's involvement could ultimately lead to increasing profits."