Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

04 Sep, 2025

By Kirsten Errick and Gaurang Dholakia

Solar power capacity additions in the US slowed in the second quarter of 2025 as developers adapted to a shifting policy environment, including an accelerated phaseout of federal tax credits and mounting import tariffs.

But the pipeline of photovoltaic power plants scheduled to come online this year until the end of the decade shows continued strength for the leading source of new US generating capacity in recent years.

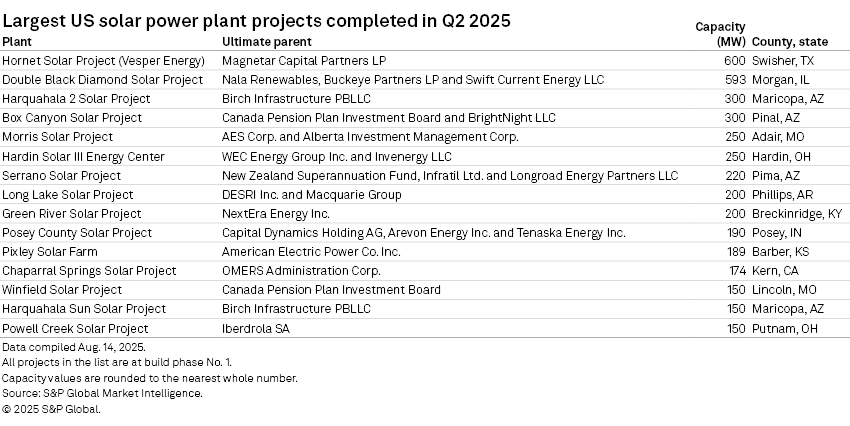

Developers completed 4.9 GW in the second quarter, pushing the cumulative installed large-scale solar capacity to 141.3 GW, according to S&P Global Market Intelligence data.

Second-quarter capacity additions were down 24.8% from the first quarter and 37.2% lower year over year. The result also marked the lowest volume of quarterly additions since the third quarter of 2023.

The slow second quarter came as solar developers awaited the outcome of key federal legislative and regulatory actions finalized over the summer.

On July 4, President Donald Trump signed a sprawling budget bill that included early sunsets for valuable clean energy tax credits and added new restrictions on qualifying for the incentives if projects are linked to certain foreign entities of concern.

"The reconciliation bill was not a wise move for energy policy in the country when there's immense demand for electricity that keeps going up," Pivot Energy Inc. CEO Tom Hunt told Platts, part of S&P Global Commodity Insights.

The president on July 7 issued an executive order for the Treasury Department to revise rules for renewable energy projects seeking tax credits. Treasury's guidance, released Aug. 15, revoked the 5% safe harbor rule for wind and utility-scale solar projects, removing one way for projects to reach the start of construction.

Now projects must meet a physical work test in order to qualify.

The guidance was "not as bad as it perhaps could have been," Hunt said, calling the result "generally workable."

'Constant state of construction'

Despite federal policy changes, the outlook for PV power plants in the US remains robust.

Developers plan to add approximately 52 GW of utility-scale solar in 2025, Market Intelligence data shows. Developer ambitions typically lag project completions, but at least 12.7 GW was already added this year as of Aug. 14, and at least another 19 GW is under construction with planned 2025 online dates.

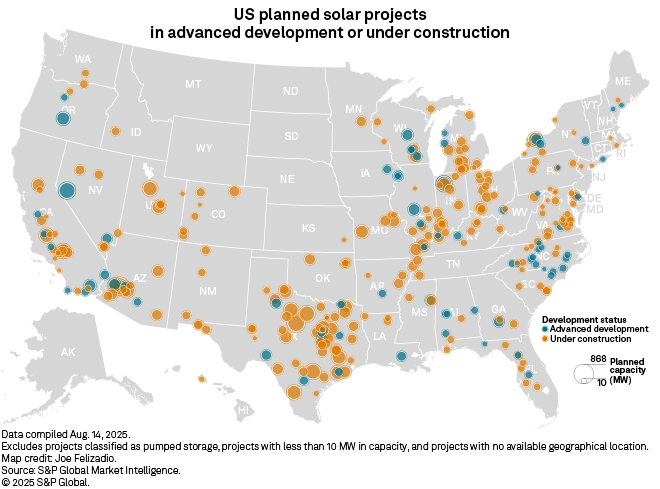

Through 2030, developers plan to energize over 260 GW of additional capacity, including 38.3 GW under construction and more than 7 GW in advanced development at over 470 projects or major phases.

"We are in a constant state of construction," John Ketchum, president and CEO of leading US solar developer NextEra Energy Inc., said during the company's July 23 earnings call. "And over the last few years, prior to the enactment of the [July 4 budget bill, we have] made substantial financial commitments to begin construction on renewable projects that we believe are sufficient to cover the projects we plan to place into service through 2029."

NextEra completed its 200-MW Green River solar project in Breckinridge County, Kentucky, in the second quarter. It was one of 15 solar farms with at least 150 MW that came online in the period.

Many of the PV power plants that were recently completed and in the near-term pipeline are paired with battery storage.

"There is still a strong need for solar and storage on the US electric grid," Hunt said. "The federal government is trying to make that more difficult and that is a real challenge, but we are still very much seeing at the state level, the utility level [and] corporate customer level that the demand is strong and people are continuing to move forward with procurement."

Texas has the largest near-term pipeline with more than 13 GW in advanced development or under construction, followed by Arizona with 4.3 GW and California with 3.9 GW. Other states with significant capacities under construction or in advanced development include Indiana, with 2.6 GW, and Michigan, with 2.3 GW.

Larger projects are generally in the South and Southwest, while smaller projects are in the Northeast and Midwest.

Developers highlighted that community engagement is critical, especially now.

"It makes an immense difference and it's critical for the long-term deployment trajectory for solar and storage," Hunt said. "That community engagement ... is even more important right now when over the summer, energy policy became so nationally politicized and, at the end of the day, these are really local decisions."

Market Intelligence considers a project as announced when it has a listing in an interconnection queue with an accompanying public announcement or permitting action. A project is considered in early development after permitting begins. For a project to be considered advanced development, it must meet two out of five criteria: financing is in place, power purchase agreements are signed, equipment is secured, required permits are approved or a contractor has signed on to the project. A project is under construction when building activity begins; site preparation does not qualify a project for this status.