Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Sep, 2025

By Brian Scheid and Annie Sabater

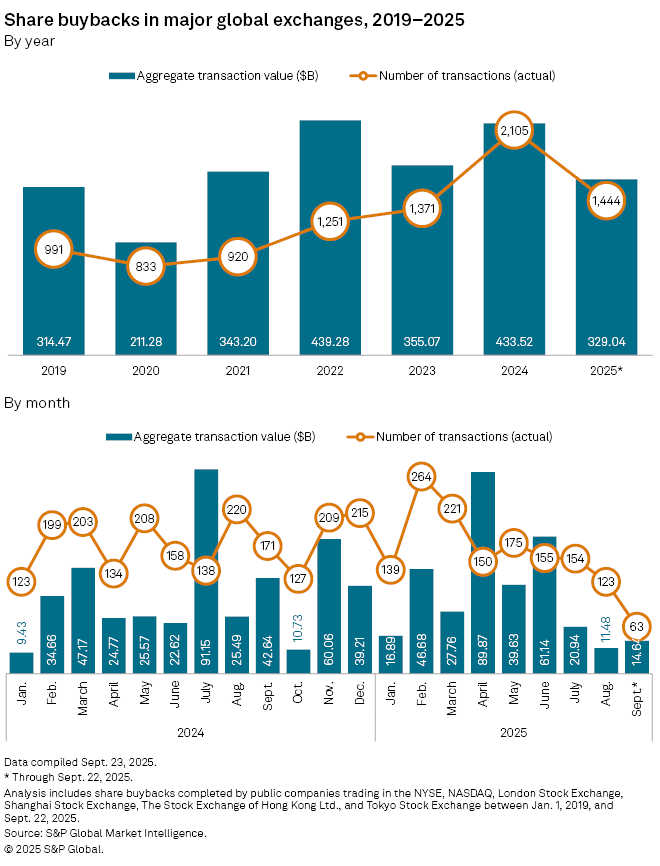

After a strong first half of 2025, global share buybacks slowed in the third quarter amid new US tariffs and historically high stock valuations.

The aggregate value of 2025 share buyback transactions by public companies trading on major global exchanges was $329.04 billion through Sept. 22, according to S&P Global Market Intelligence data. While this is above the aggregate value of buybacks worldwide through the first nine months of 2024, the monthly aggregate value of buyback transactions fell sharply between June and July 2025 and remained lower in August and September.

The global share buyback activity for 2025 to date is roughly comparable to the first nine months of 2022, which saw an aggregate value of $329.35 billion in share buyback transactions. The aggregate value of share buyback activity ultimately totaled $439.28 billion for full year 2022, a post-pandemic high and slightly more than the $433.52 billion reported for full year 2024.

Public companies use repurchases in an attempt to lower the number of shares outstanding, boosting earnings per share and inflating stock prices. Share buybacks are also seen as a signal that companies have ample cash.

After averaging $43.27 billion a month for the first seven months of 2025, the worldwide aggregate transaction value of buybacks fell to $11.48 billion in August, the lowest value since October 2024. It then climbed modestly to $14.64 billion in September, still well below the $42.64 billion reported in September 2024.

The number of transactions also fell sharply in the third quarter after surging in early 2025. Transactions hit a high of 264 in February before falling to 221 in March and 150 in April, when US President Donald Trump unveiled his administration's most substantial increases in tariffs. Transactions slid to 123 in August, the lowest level since January 2024. September appears poised for a new low, as there were only 63 buyback transactions through the first three weeks of the month, according to Market Intelligence data.

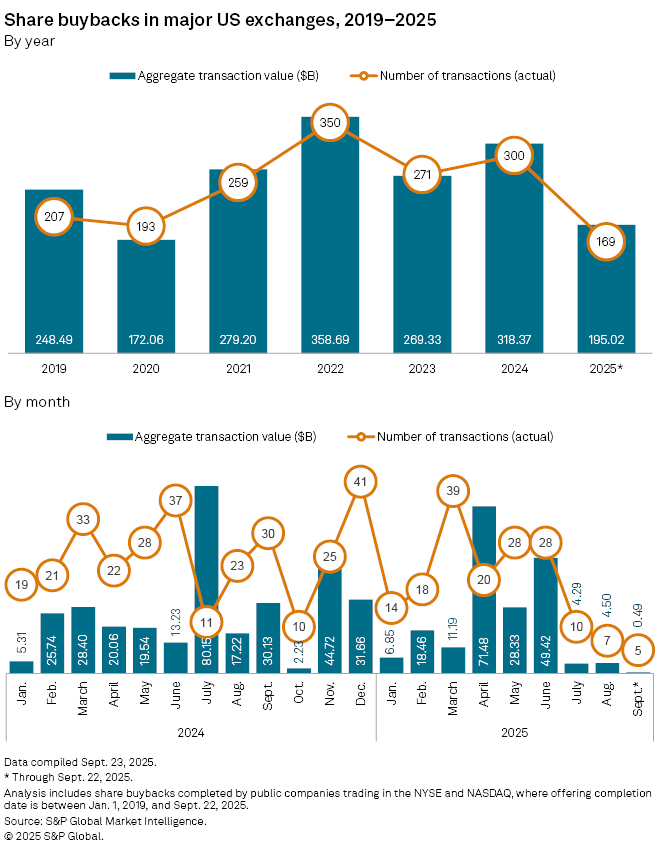

US activity

In the US, there were 169 buyback transactions with an aggregate value of $195.02 billion for the year through Sept. 22, compared to 224 transactions with a total value of $239.76 billion through the first nine months of 2024.

Through the first six months of 2025, there were an average of 25 buyback transactions each month in the US with a total monthly aggregate value of $31 billion. Transactions dropped to 10 in July, with an aggregate value of $4.29 billion, seven in August with an aggregate value of $4.5 billion, and five through the first three weeks of September with less than $500 million in aggregate value.

High valuations

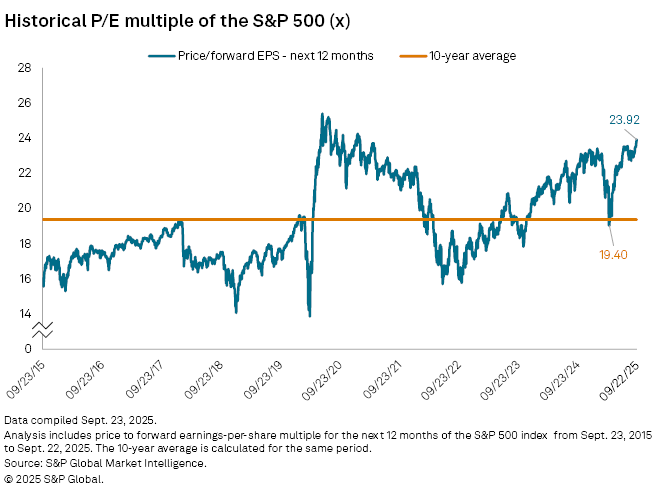

Buybacks in the US are cooling as the S&P 500's price-to-earnings ratio has remained above the 10-year average for the entire year, outside of a three-day stretch in April when the stock market plunged after President Trump unveiled higher tariffs on nearly all US global trading partners. The price-to-earnings ratio is used as one measure of the value of a given stock.