Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Sep, 2025

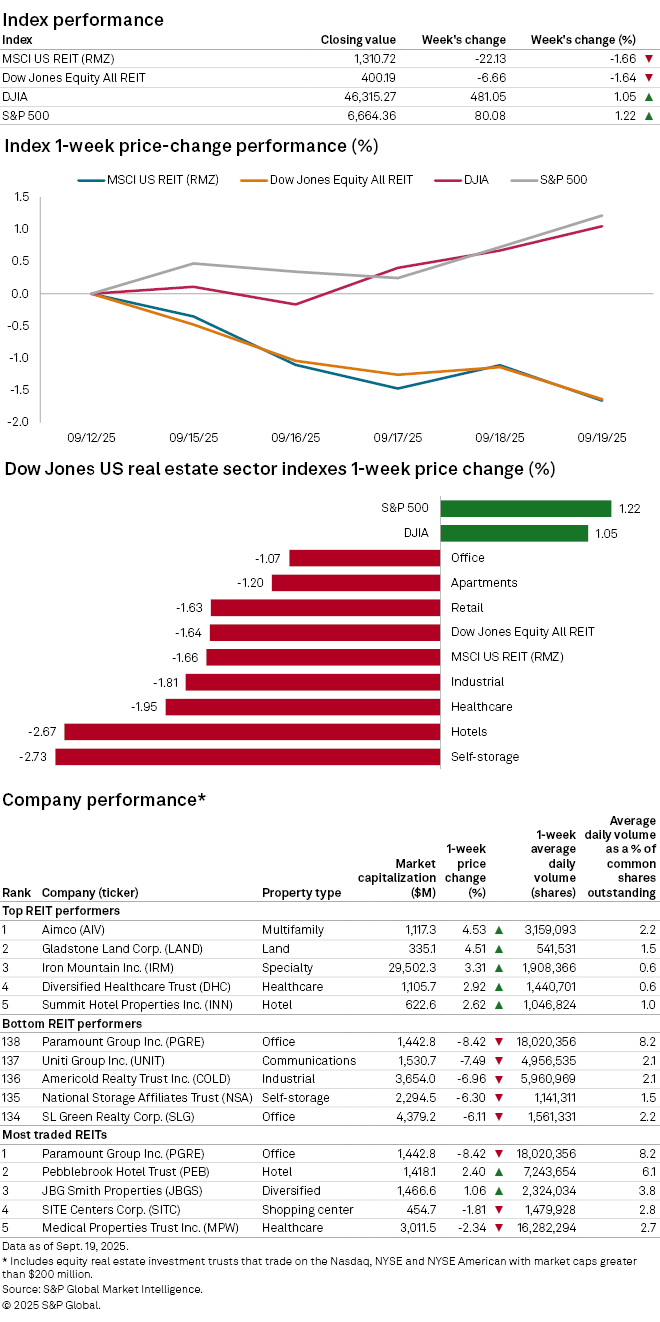

Indexes for US REIT stocks fell during the week ended Sept. 19, with the Dow Jones Equity All REIT index declining 1.64% and the MSCI US REIT (RMZ) index down 1.66%.

Meanwhile, the broader market indexes recorded gains, with the S&P 500 up 1.22% and the Dow Jones Industrial Average up 1.05%.

All Dow Jones US real estate property sector indexes logged declines this past week. The self-storage and hotel REIT indexes fell the furthest, down 2.73% and 2.67%, respectively, followed by the healthcare index with a 1.95% drop.

Office REIT Paramount Group Inc. recorded the largest share-price drop among US REIT stocks with at least $200 million in market capitalization, at 8.42%. The share-price drop followed a press release announcing that the REIT entered into a definitive agreement for Rithm Capital Corp. to acquire it for $1.6 billion, or $6.60 per fully diluted share. The office REIT's share price had risen over the last couple of months following its May 19 announcement that its board of directors has initiated a review and evaluation of strategic alternatives.

Communications REIT Uniti Group Inc. and cold-storage-oriented Americold Realty Trust Inc. followed next, with share-price declines of 7.49% and 6.96%, respectively.

Multifamily REIT Aimco logged the largest share-price increase for the week, up 4.53%. Farmland REIT Gladstone Land Corp. ranked second with a share-price increase of 4.51%, followed by data storage-oriented Iron Mountain Inc., up 3.31%.