Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Sep, 2025

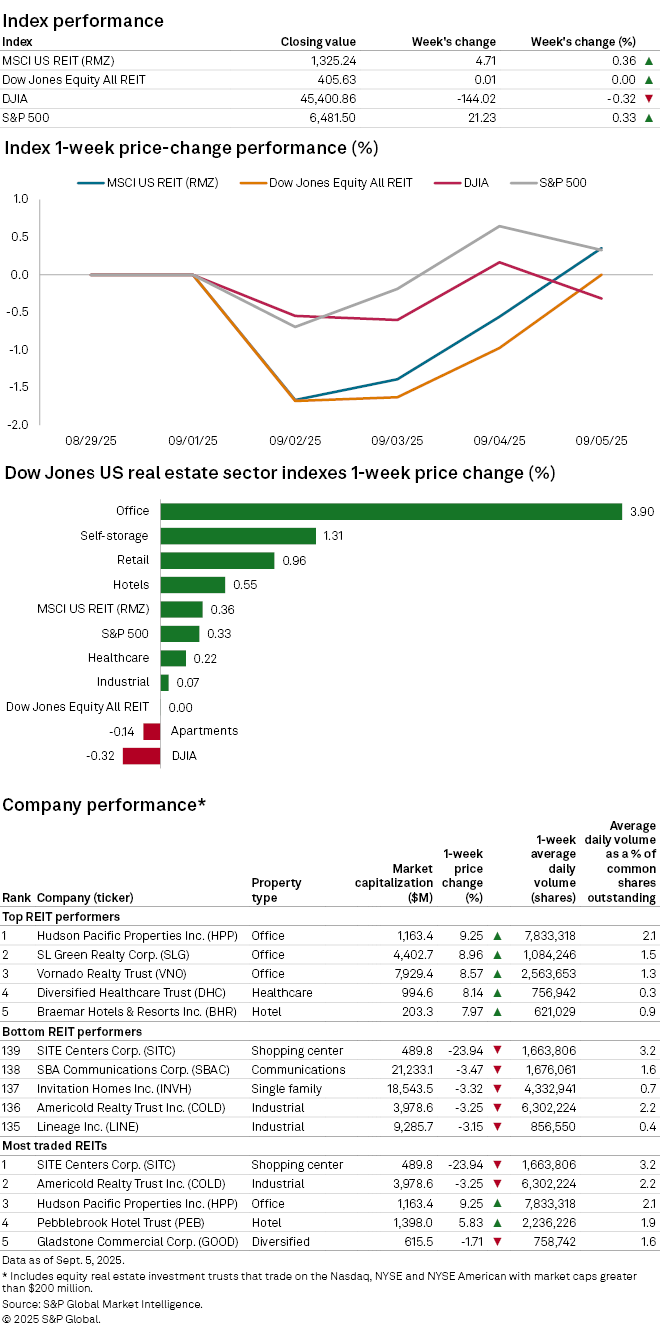

The broad US equity real estate investment trust indexes capped off the first week of September largely flat.

The Dow Jones Equity All REIT index closed the recent week flat at $405.63, while the MSCI US REIT (RMZ) index increased slightly by 0.36%.

The broader US stock market indexes also ended fairly flat for the week. The S&P 500 grew 0.33%, while the Dow Jones Industrial Average fell 0.32%.

The office REIT index jumped 3.90% over the past week, the largest increase of all the Dow Jones US real estate property sector indexes. The self-storage and retail REIT indexes followed next with increases of 1.31% and 0.96%, respectively.

The apartment REIT index was the sole real estate property sector index to close the recent week in the red, down a slight 0.14%.

The three top-performing US REIT stocks with at least $200 million in market capitalization all came from the office sector. Hudson Pacific Properties Inc. ranked in the top spot with a share-price increase of 9.25%, followed by SL Green Realty Corp. and Vornado Realty Trust with increases of 8.96% and 8.57%, respectively.

Shopping center REIT SITE Centers Corp.'s share price fell 23.94% over the week to $9.34 per share, the largest share-price drop of the group.

The drop in SITE Centers' share price coincided with the REIT's special cash distribution of $3.25 per common share, in conjunction with the sale of two shopping centers: Winter Garden Village in Florida for $165.0 million and Deer Valley Towne Center in Phoenix for $33.7 million.

Communications REIT SBA Communications Corp. and single-family rental REIT Invitation Homes Inc. followed next, with share-price declines of 3.47% and 3.32%, respectively.