Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

02 Sep, 2025

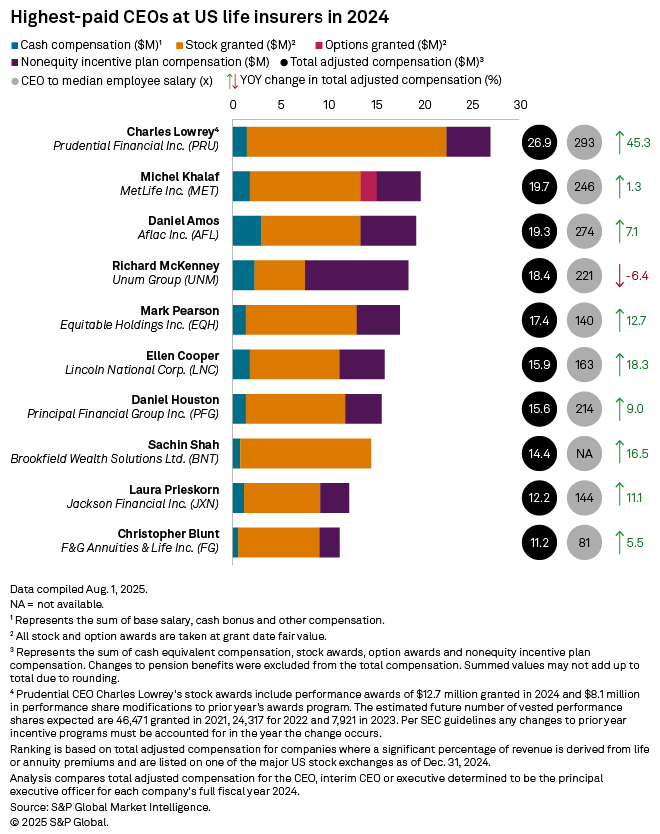

Prudential Financial Inc.'s Charles Lowrey was the best-compensated CEO of a publicly traded US life insurer in 2024, according to an analysis by S&P Global Market Intelligence.

Lowrey's total adjusted compensation for the year was approximately $26.9 million, consisting of about $1.5 million in cash, $20.9 million in stock and $4.6 million from a nonequity incentive plan. The $20.9 million in stock includes performance awards of $12.7 million granted for 2024 as well as roughly $8.1 million in “performance share modifications” that the company’s board approved in January 2024. The modification impacts the number of shares he is expected to receive under the performance plans for the calendar years 2021, 2022 and 2023.

A spokesperson for Prudential Financial said: “In accordance with SEC guidelines, the summary compensation table in Prudential’s proxy detailing Mr. Lowrey’s total compensation includes accounting charges to the company which were not reflected in the actual compensation awarded to Mr. Lowrey.”

The company reported that Lowrey’s 2024 performance year compensation was roughly $19.96 million. The Prudential CEO's total adjusted compensation in 2024 was roughly 293x the median employee salary at the company.

Top paid life CEOs

MetLife Inc. CEO Michel Khalaf ranked second on the list of the most highly compensated life CEOs. He made about $19.7 million in 2024, which consisted of $1.8 million in cash, $11.6 million in stock, $1.7 million in options and $4.6 million from a nonequity incentive plan. Khalaf's compensation was about 246x the median employee salary at MetLife.

Aflac Inc. rounded out the top three with CEO Daniel Amos making around $19.3 million in 2024. Amos' total compensation included approximately $3 million in cash, $10.4 million in stock and $5.8 million in a nonequity incentive plan. The Aflac CEO's total compensation was about 274x the median employee salary at the insurer.

All of the top 10 best-paid US life insurance CEOs made more than $11 million in 2024; only two on the list are women.

|

– Find out who are the highest paid insurance CEOs across the US: – – NeueHealth's Mikan tops insurtech CEO pay list in 2024 |

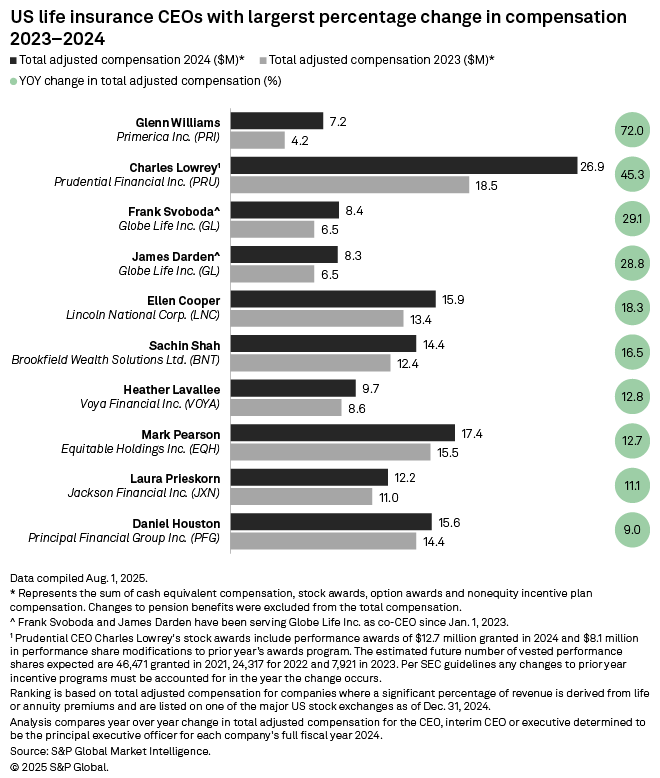

Biggest compensation increases

Primerica Inc. CEO Glenn Williams saw the largest year-over-year percentage jump in pay in this analysis. Williams' total compensation grew $7.2 million in 2024, a 72% increase from $4.2 million in 2023. The sharp rise was mainly driven by the CEO's stock compensation rising to $4.7 million from $2.2 million in 2023.

Prudential's Lowrey had the second-highest year-over-year increase as his compensation grew 45.3% from $18.5 million in 2023.

Globe Life Inc. co-chairs and CEOs Frank Svoboda and James Darden received the highest pay bumps when compared to 2023 year-over-year increases of about 29%. Svoboda and Darden had total compensation of about $8.4 million and $8.3 million, respectively. A substantial portion of their pay hikes can be attributed to stock compensation rising to about $3 million in 2024, from roughly $2 million a year earlier.

Globe Life shares suffered in 2024 as the insurer faced a number of scandals including short-seller accusations of misconduct and inquiries launched by both the Securities and Exchange Commission and the Department of Justice. Globe Life's independent audit review found "no merit" to the short-seller allegations; both the SEC and DOJ concluded their investigations in July with no enforcement actions recommended.

Out of US insurers across sectors, Globe Life has had one of the best-performing stocks this year, rising around 25% from the start of 2025.

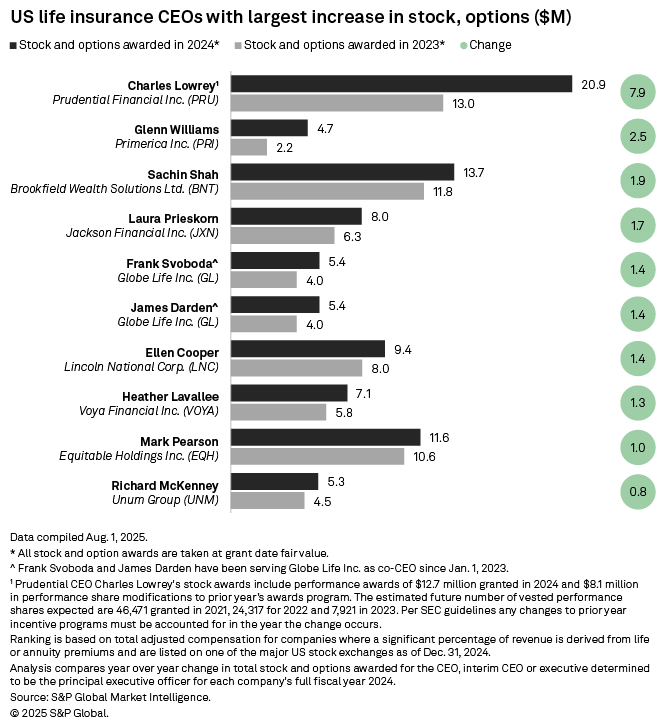

Shifts in stock compensations

Prudential's Lowrey saw the largest increase in stocks awarded with a $7.9 million year-over-year jump to $20.9 million in 2024, from about $13 million in 2023.

Primerica's Williams had the second-largest increase in stock compensation, which grew $2.5 million year over year.