Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

03 Sep, 2025

By Nick Lazzaro

A customer shops at a home improvement store on Aug. 19, 2025, in Chicago, Illinois. Producer price gauges in the US have seen an uptick this summer, signaling that higher costs from tariffs may be emerging in wholesale prices and could renew pressure on consumer-level inflation in the months to come. Source: Scott Olson/Getty Images News via Getty Images. |

Tariffs are pushing up costs for businesses to supply goods and services, signaling the likelihood of higher consumer prices to come.

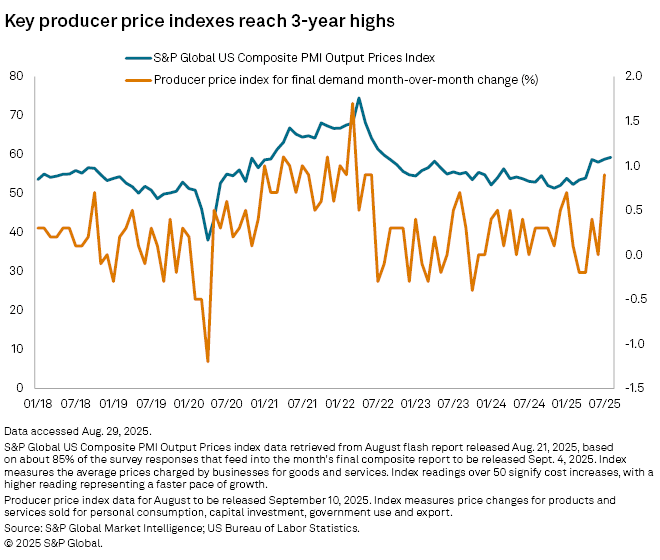

Two gauges of prices charged by producers are showing a clear acceleration of costs working through business supply chains. The US producer price index rose 0.9% month over month in July, the fastest single monthly gain since March 2022, according to US government data released Aug. 14. The index measures prices charged by producers, including transactions for goods and services sold to wholesalers and retailers for eventual resale to final consumers.

Meanwhile, the S&P Global US flash Purchasing Managers' Index (PMI) gauge output costs hit 59.3 in August, the highest in three years, as many businesses pointed to tariffs as a driver of higher selling prices, according to S&P Global Market Intelligence, which compiles the survey results. Full data for August is due in early September. The sub-index also measures average selling prices charged by producers, with any reading above 50 signaling expansion.

The US has adjusted its tariff policy several times since April, and duty rates, targeted products, exemptions and trade deals remain in flux for several of the nation's major trading partners. This has led markets to speculate about when tariffs will ultimately impact costs. Business survey data may offer the most significant indicator yet of tariff costs moving through the supply chain and signal that consumer price inflation, which remains above central bankers' target level, may rise further in months to come.

"If producers are now experiencing significantly higher costs of producing their goods, it seems very unlikely that businesses are going to absorb 100% of that increase," Donald Calcagni, chief investment advisor at Mercer Advisors, told Market Intelligence. "We've heard many CEOs on their earnings calls say that they're going to try to pass on some of those costs to consumers."

Manufacturing and service sector companies also reported the steepest rise in input costs since May and the second-largest increase since January 2023, according to PMI data.

Consumer price outlook

The timeframe in which higher costs ultimately reach consumers depends on industry-specific supply chain structures.

"There is always a lag between the producer price index and the consumer price index," said Paul Baris, principal for the North America division at supply chain and procurement consultancy Efficio, in an interview. "For complex supply chains, that could be six to nine months. For electronics and fast fashion, that could just be a couple of months."

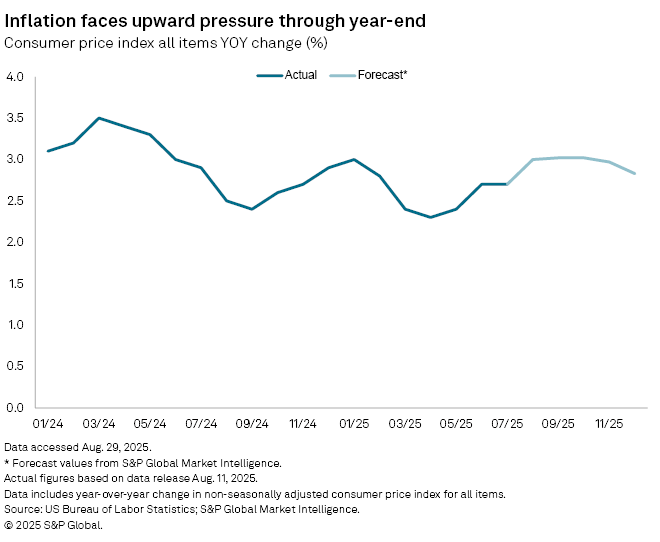

The consumer price index, a key inflation metric, rose 2.7% year over year in July, according to BLS data. Market observers were divided on whether this reading alleviated or stoked inflation concerns.

Market Intelligence economists project consumer price inflation to hover around 3% year over year from August to November. This trend diverges from the US Federal Reserve's 2% inflation target that would justify dovish monetary policy.

However, companies may limit cost pass-through to consumers if confronted with indicators of economic weakness.

"One thing that could offset this is if unemployment suddenly shoots up and demand softens," Baris said. "Then, we would see that in earnings announcements as suppliers don't pass on the price increases and take it to their bottom line."

The US unemployment rate was 4.2% in July, according to BLS data. The rate has remained historically low, between 4% and 4.2%, since May.

Companies respond

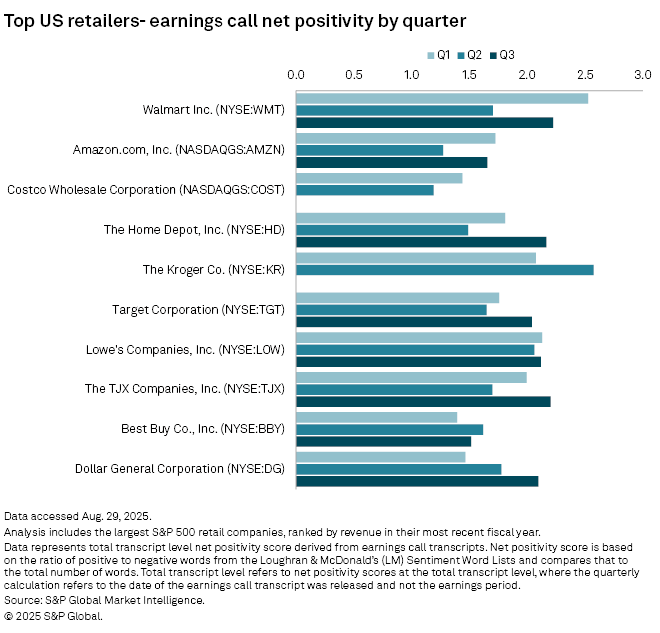

Walmart Inc., the largest brick-and-mortar retailer in the US, has tried to absorb tariff costs into its margins this year, but expects costs to keep rising.

"We're keeping our prices as low as we can for as long as we can," company CEO Douglas McMillon said in an earnings call Aug. 21. "But as we replenish inventory at post-tariff price levels, we've continued to see our costs increase each week, which we expect will continue into the third and fourth quarters."

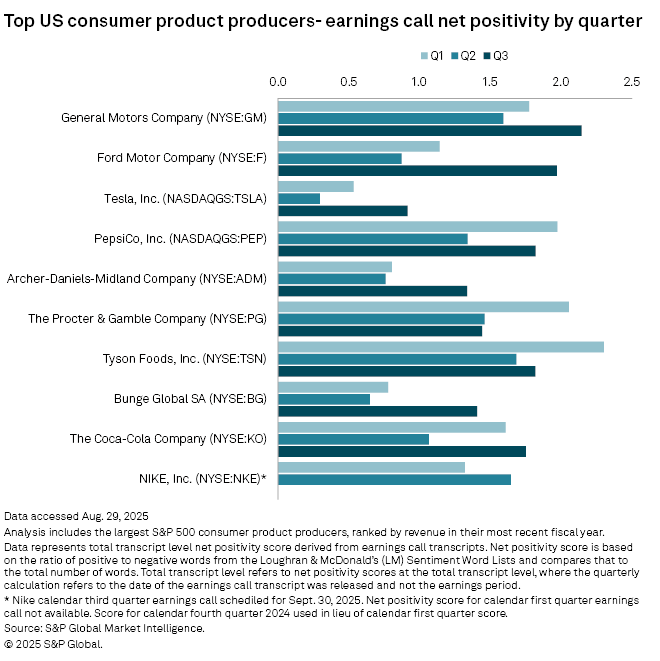

Executives at automaker General Motors Co. said the company's earnings before interest and taxes in the second quarter was pressured by a net tariff impact of about $1.1 billion, with a projected full-year impact of between $4 billion to $5 billion.

"We're still tracking to offset at least 30% of the $4 billion to $5 billion full-year 2025 tariff impact through strategic actions such as manufacturing adjustments, targeted cost initiatives and consistent pricing," CFO Paul Jacobson said in a July 22 earnings call.

While higher business costs are largely linked to US tariff policy, other factors are also involved.

"Energy prices and labor costs are going up in the US, and companies are still having issues in terms of logistics, so it isn't all just about tariffs," Martin Balaam, CEO and co-founder of product information management platform Pimberly, said in an interview.

Regardless, consumer-facing companies will only be able to absorb higher costs to a limited extent.

"Businesses are responsible to their shareholders to generate sufficient cash to invest for the future, and reduced margins ultimately means reduced investment, which means potentially reduced innovation and reduced growth for the future," Balaam said. "If this [tariff policy] is the new norm, businesses will need to find a way of moving this downstream towards the consumer. You are probably looking at a lag of three to six months out."