Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Sep, 2025

By Karl Angelo Vidal and Shambhavi Gupta

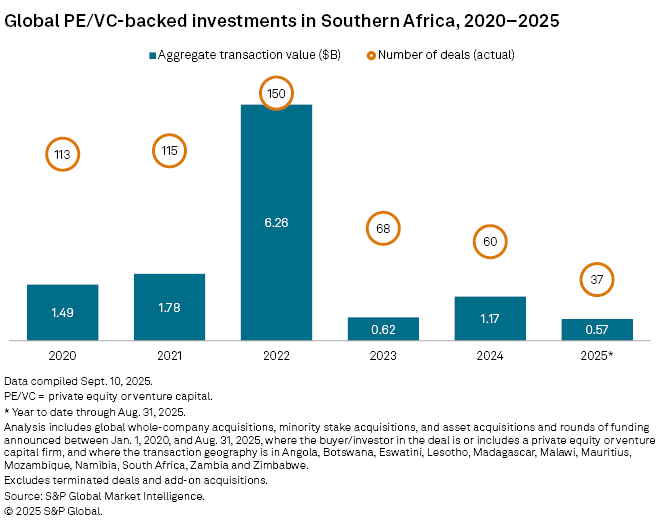

Deals backed by private equity and venture capital firms in Southern Africa totaled $574 million in the first eight months of 2025.

That number was down 24% from $752.7 million in the same period a year earlier. The number of deals declined to 37 from 44 during the measured period, according to S&P Global Market Intelligence data.

The analysis includes deals across Angola, Botswana, Eswatini, Lesotho, Madagascar, Malawi, Mauritius, Mozambique, Namibia, South Africa, Zambia and Zimbabwe.

Private equity dealmaking in the region slowed from January to August as investors were rattled by macroeconomic uncertainties related to tariffs, said Graham Stokoe, private capital leader for EY Africa.

Private equity firms in the region also had less dry powder to deploy in 2025 after a lull in fundraising the previous year.

"For the first time, funds under management declined in 2024 because the [capital] returned to limited partners was more than the funds raised," Stokoe said.

Funds under management among Southern African private equity firms dropped to 233.3 billion rand as of the end of 2024, compared with 237 billion rand a year earlier, according to a survey conducted by the Southern African Venture Capital and Private Equity Association (SAVCA) in partnership with EY.

However, private equity activity in Southern Africa is expected to bounce back in the latter part of 2025 and into 2026. According to the SAVCA survey, 60% of Southern African private equity firms anticipate increased deal activity in 2026, driven by easing inflation and improved economic outlook with declining interest rates.

– Download a spreadsheet with data in this story.

– Read about US private company head count.

– Explore more private equity coverage.

Largest deals

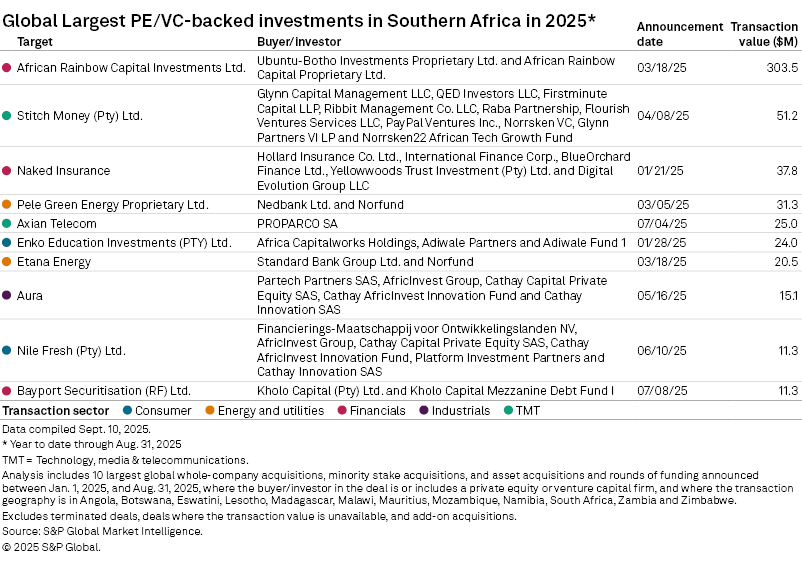

In the largest private equity-backed deal in Southern Africa through August, African Rainbow Capital Pty. Ltd. and Ubuntu-Botho Investments Pty. Ltd. acquired 95,776,797 shares in investment company African Rainbow Capital Investments Ltd. for $303.5 million.

The second-largest deal was the series B round of funding for fintech company Stitch Money (Pty) Ltd., raising $51.2 million from investors led by Flourish Ventures Services LLC, Glynn Capital Management LLC, Norrsken VC and QED Investors LLC. Firstminute Capital LLP, PayPal Ventures Inc., Ribbit Management Co. LLC and The Raba Partnership also participated.

Biggest markets, sectors

South Africa, the largest market in Southern Africa, recorded the highest number of deals in the region, with 31 transactions between January and August, Market Intelligence data shows. Total deal value in the country stood at $244.4 million.

"The exit opportunities for private equity investments in South Africa are greater because of more corporate and private equity buyers," Stokoe said.

In terms of transaction value, Mauritius had the largest total among Southern African countries with $328.5 million, driven by the African Rainbow Capital deal.

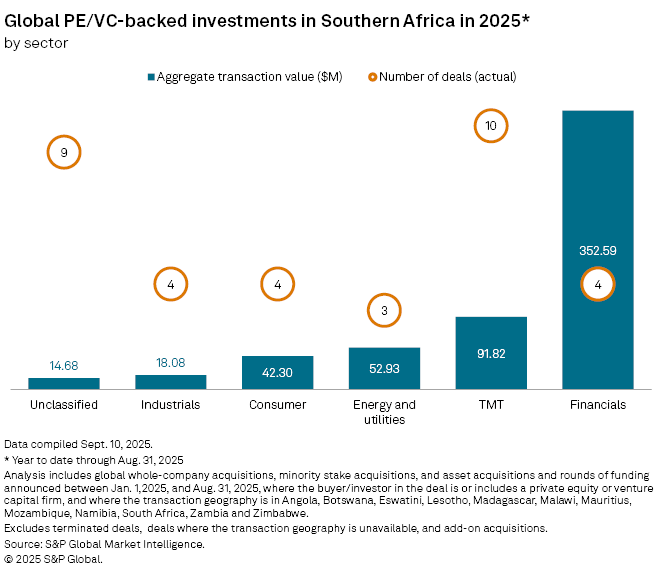

Turning to sectors, financials secured the largest amount of private equity-backed deal value in Southern Africa, with $352.6 million across four deals.

The technology, media and telecommunications sector had 10 transactions, with total deal value at $91.8 million.