Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Sep, 2025

By Dylan Thomas and Karl Angelo Vidal

S&P Global Market Intelligence offers our top picks of global private equity news stories and more published throughout the week.

US private companies across all sectors have been shedding employees since July 2024, continuing a trend that likely started in 2022.

S&P Global Market Intelligence's head count analytics shows that industrials, consumer discretionary and information technology sectors had the highest employee reductions among all private company sectors during the measured period of July 2024 to June 2025.

The industrial sector was also the largest employer by head count, and its research and consulting services subsector accounted for 21% of the total.

Much discussion has been centered on AI eliminating jobs, but Cole Napper, a vice president at labor research firm Lightcast, told Market Intelligence that AI was not the driver. Instead, Napper explained that hiring in general has slowed, which led to a lower overall head count as departures exceeded hires.

Other factors such as uncertainty around tariffs played a role, making private and public businesses hesitant to expand and hire. AI is said to be another factor, though its impact has not been reliably determined across all sectors.

Read more about private company head count, which includes data on the trajectory of specific job positions in each sector.

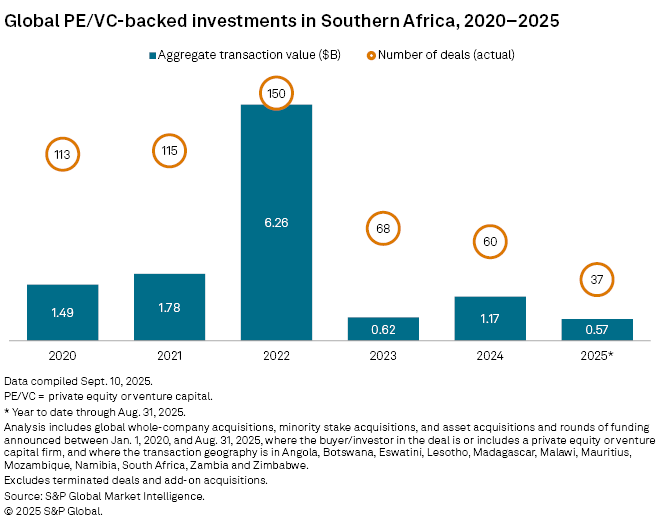

CHART OF THE WEEK: Private equity deals decrease in Southern Africa

⮞ Private equity- and venture capital-backed deal value in Southern Africa is tracking for a down year, recording $574 million in the first eight months of 2025 — about half the transaction value for full year 2024.

⮞ Across the 12-country region, Mauritius racked up the largest deal value through the end of August with $328.5 million, while South Africa had the most deals with 31.

⮞ The global multiyear fall in fundraising has also hit private equity firms raising money for the region, providing less dry powder to deploy, though a pickup is expected in 2026, said Graham Stokoe, private capital leader at EY Africa.

TOP DEALS

– Blackstone Inc.'s Blackstone Energy Transition Partners agreed to acquire Hill Top Energy Center LLC, a 620-MW natural gas power plant in Pennsylvania, from Ardian SAS for close to $1 billion.

– KKR & Co. Inc. acquired Japanese insurance distributor Hoken Minaoshi Hompo Group Inc. from Advantage Partners Inc. The investment is being made predominantly from KKR's Asian Fund IV and K-Series.

– General Atlantic Service Co. LP agreed to make a strategic growth investment in skin care brand Osea International LLC. The founders, Jenefer and Melissa Palmer, will continue to own a significant stake and lead the company. Following the close of the deal, CAVU Consumer Partners LLC will fully exit its investment.

TOP FUNDRAISING

– Crux Capital Ltd. raised more than $340 million for Crux Capital Fund I LP at final close. The fund will invest in consumer and commercial service companies with a strong presence in the US Sunbelt.

– BlueFive Capital expects to raise $1 billion at the close of its new fund by the fourth quarter, Reuters reported. The fund will focus on investments in Asia, particularly in aviation and mining assets in Indonesia, as well as ports and airports in China.

– EQT AB (publ) launched an evergreen European long-term investment fund (ELTIF) that allows retail investors across Europe to invest in private markets. EQT Nexus ELTIF Private Equity will provide investors with exposure to the firm's global private capital strategies in the healthcare, technology and service sectors.

MIDDLE-MARKET HIGHLIGHTS

– Astira Capital Partners LP completed the purchase of receivables management company Altus Receivables Management Inc. from BharCap Partners LLC portfolio company Armstrong Receivables Management Inc. Guggenheim Securities LLC was the financial adviser to Armstrong on the deal, while Greenberg Traurig LLP was legal counsel. Houlihan Lokey Capital Inc. was strategic adviser to Astira, and Kirkland & Ellis LLP was legal counsel.

– Keensight Capital bought a majority stake in orthobiologic products company Isto Biologics. Thompson Street Capital Manager LLC retains a minority stake in Isto, alongside the latter's management team.

– Platinum Equity LLC agreed to buy PlayPower Inc., a designer and manufacturer of recreational and outdoor living systems, in a deal with seller Littlejohn & Co. LLC.

FOCUS ON: PENSION FUND AUM

Assets under management of the 300 largest pension funds globally reached a record $24.4 trillion as of the end of 2024, up 7.8% year over year, according to a report from the Thinking Ahead Institute.

Of the 300 largest pension funds, 153 are based in the US, covering 41.4% of the total AUM.

The Government Pension Fund of Norway was the largest fund, taking over the Government Pension Investment Fund of Japan after more than 20 years as the world's biggest.

On average, the 20 largest funds invested 18% of their assets in alternatives and cash as of year-end 2024, down from 21.7% a year earlier.

______________________________________________

For further private equity deals, read our latest "In Play" report, which looks at potential private equity-backed M&A, including rumored transactions, each week.

For private credit news, see our latest private credit newsletter