Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

25 Sep, 2025

By Karin Rives

| Sheep graze next to a Dominion Energy solar plant in Virginia. Owner of the nation's third-largest solar fleet, Dominion is also building new gas-fired generation that will come online in the mid-2030s to meet data center power demand. Virginia law calls for a carbon-free economy by 2045. Source: Dominion Energy. |

Decarbonizing the US power sector has become a rare talking point for utility executives, with calls for more electricity generation, service reliability and affordability dominating the public discourse.

"We are firmly aligned with the administration's goal to unleash American energy dominance," NextEra Energy Inc. CEO John Ketchum told investors in July. "And to do so, we need all of the electrons we can get on the grid."

NextEra's high-profile "real-zero" plan, unveiled in 2022, is no longer visible on the company's main website. Yet, NextEra maintains its 2045 carbon-free target and remains a top investor in renewable resources.

Meanwhile, some power industry players are adjusting their actual greenhouse gas emission reduction goals and energy investment strategies, a survey by Platts, part of S&P Global Commodity Insights, showed.

The shift comes as the Trump administration and Republican-led Congress dismantle policies that sought to transition the nation away from fossil fuels — including tax credits that sent clean energy investments soaring.

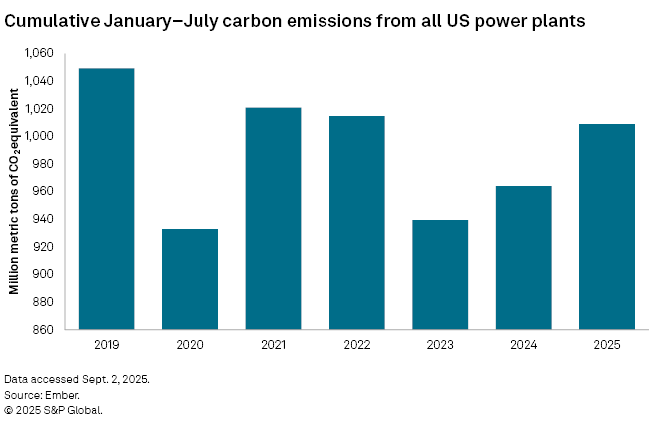

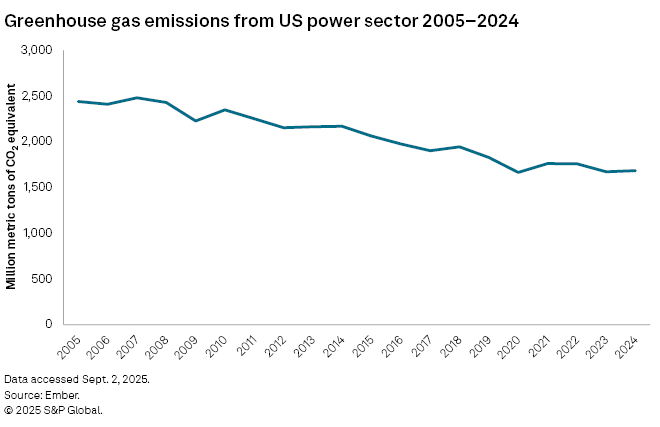

The US power sector's carbon footprint shrank 31% between 2005 and 2024, but data from the energy think tank Ember suggests progress may be slowing. An ongoing build-out of natural gas-fired generation is contributing to a rise in emissions, Nicolas Fulghum, an Ember senior data analyst, said in an email.

With President Donald Trump in office, power companies are reframing climate commitments and how they talk about them, noted Jonathan Foley, an atmospheric scientist and executive director of the nonprofit Project Drawdown, which promotes science-based climate solutions.

"I think that there's been a recalibration of tone and expectations, but not an abandonment of principle," Foley said. "Companies are still looking to drive down costs."

The power sector will continue to invest in renewable energy sources, Foley predicted, because "they're cheaper, easier to deploy, easier to permit, they have lower capital costs and just make more sense, especially compared to things like nuclear."

Other observers believe the energy transition as a concept has evolved into something new.

"The earlier narrative was that we're going to transition out of something," said Stanley Porter, vice chairman and industry leader for Deloitte's energy, resources and industrials practice. "What you're seeing now is that we're going to continue to transition with something that is 'all of the above.'"

The power companies Deloitte consults with are still on a journey toward what his firm terms "a low-carbon future," Porter said in a recent interview. Few could have predicted in 2020 that the sector five years later would see a 4% annual growth in demand for electricity, he noted.

"That changes your transition," Porter said.

Accessible by S&P Capital IQ Pro clients only

|

|

EXPLORE FURTHER: Click HERE |

Mixed progress

Nearly all of the 30 largest US electric utilities by market cap continue to maintain their net-zero emission goals, the Platts survey showed, but at least four have recently dialed back their climate ambitions.

FirstEnergy Corp., which in late 2023 canceled its 2030 interim target, has a new caveat replacing its net-zero commitment with an "aspirational" goal. Pinnacle West Capital Corp. subsidiary Arizona Public Service Co. loosened its aspirational target, while Sempra scrapped its Scope 3 emissions target.

Meanwhile, Eversource Energy — long held up as a utility industry climate leader — has backtracked on its ambitious 2030 carbon neutrality goal. After assessing whether to set a formal science-based target for indirect Scope 3 emissions, Eversource said in June it will instead reach net-zero for all three scopes by 2050. The Scope 3 goal covers emissions from customers' energy use.

Several companies have made significant progress toward their climate goals, highlighting the sector's uneven trajectory, the Platts survey found.

By the end of 2024, for example, Xcel Energy Inc. had cut carbon emissions 57% from 2005 levels to reach a 52% carbon-free energy mix. During the same period, WEC Energy Group Inc. cut emissions by 56%, and Ameren Corp. achieved a 46% reduction — up from 34% in 2023. FirstEnergy's operational Scope 1 emissions, which make up more than half of the utility's carbon footprint across all three scopes, had dropped 84% since 2005.

The power generation fleet of Public Service Enterprise Group Inc. has been carbon-free since 2023, the same year PG&E Corp. first delivered 100% clean electricity.

At the same time, at least four utilities since 2024 have eliminated interim emission reduction targets that companies set to ensure they stay on track with their climate goals.

Near-term goals canceled

In 2024, Wisconsin-headquartered WEC projected that it would reduce carbon emissions from its power generation resources by 60% by the end of 2025 and by 80% by 2030. In this year's survey, the company said it can no longer meet those short-term targets even as it continues to aim for net-zero emissions by 2050.

"We are reconsidering our near-term goals due to a combination of factors, including tightened energy supply requirements in the Midwest power market and the need to serve our customers with safe, reliable and affordable energy," Brendan Conway, a WEC spokesperson, said in an email.

Arizona-headquartered Pinnacle West also canceled its interim target to provide 65% carbon-free electricity by 2035, citing the state's growing energy needs.

"Clean energy remains an important consideration for us," Pinnacle West Chairman, President and CEO Ted Geisler said in early August, "but always with a focus on a balanced energy mix that best serves reliability and affordability."

NiSource Inc., which operates an electric utility in Indiana, scrapped a 2030 goal to reduce Scope 1 emissions 90% from 2005 levels by 2030, and Evergy Inc., with utilities in Kansas and Missouri, canceled its plan to cut carbon emissions by 70% during the same time frame.

Companies are taking a big risk by not setting and trying to meet interim emission reduction goals, said Nate Hultman, a public policy professor at the University of Maryland who served as a senior adviser in the Office of the Special Presidential Envoy for Climate under President Joe Biden. Hultman has been involved with international climate negotiations for nearly three decades.

"It's very, very challenging to just say, 'Well, I have a long-term goal, and I'll get there eventually,' and to not to know which steps to take now and in which directions so that you find yourself at the finish line, at the right time, when you said you would," Hultman said.

Other companies have indicated that their overall plans to decarbonize power generation and operations may have to be dialed back, depending on what markets and government policies look like in the coming years.

"Our goals remain the same, however, increasing customer energy needs, reliability and resource adequacy requirements and tax policy changes may result in delays … or revisions to our goals," Alliant Energy Corp. spokesperson Melissa McCarville wrote in a response to the survey.

FirstEnergy pointed to uncertainties over the next 25 years in its latest sustainability report published in July.

"Transition risks, including federal and/or state policy and regulation, technology availability and affordability, market demands, and customer needs could have an impact on our progress over that time horizon," the utility warned.

Added American Electric Power Co. Inc. spokesperson Tammy Ridout in her survey answer: "While we aspire to be at net-zero ... by 2045, our performance will ultimately be driven by the needs and desires of the states we serve."

Accessible by S&P Capital IQ Pro clients only