Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Sep, 2025

By Melissa Otto

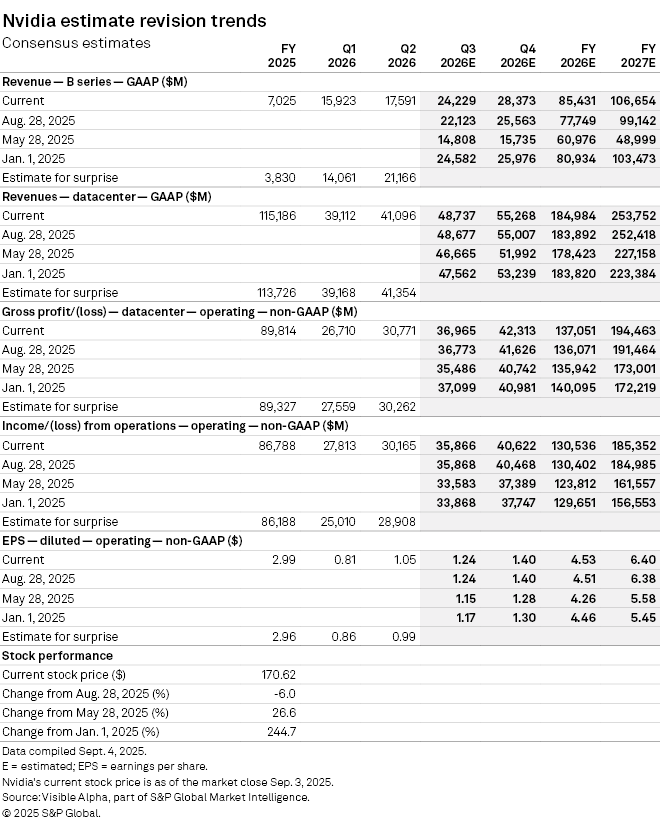

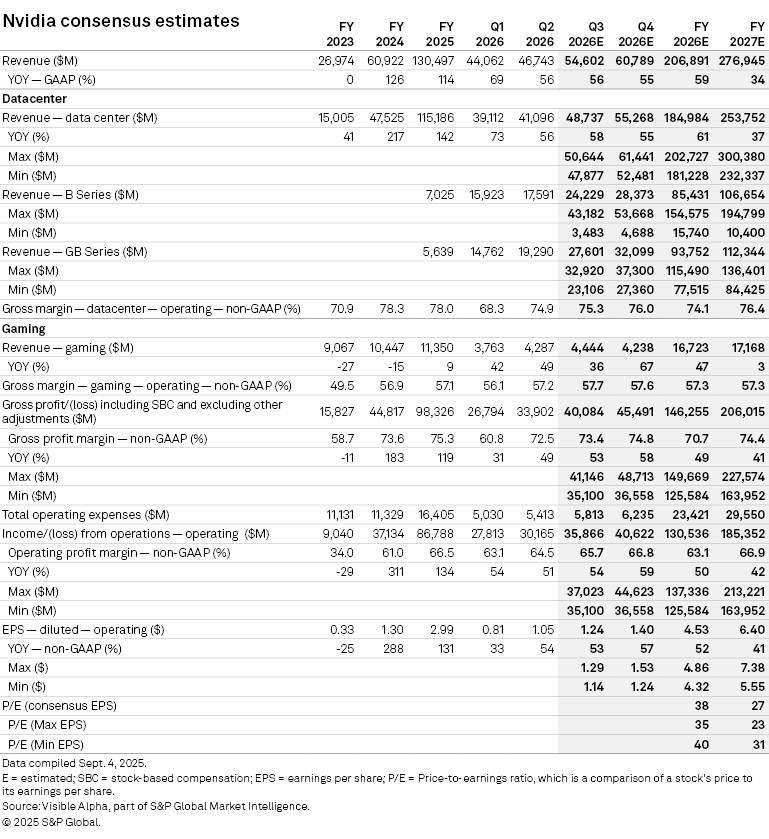

NVIDIA Corp. delivered total revenues for the second quarter of $46.7 billion, edging out Visible Alpha's consensus estimate of $46.35 billion. This was driven by continued revenue growth in the data center segment, which saw its revenue grow to $41.1 billion, though that was a bit short of the expected $41.4 billion.

This revenue growth has continued to be driven by strong demand for Nvidia's GPUs, particularly from cloud service providers. Management highlighted that the company saw a $4 billion decline in H20 revenue in China. Blackwell grew 17% sequentially with the Blackwell Ultra platform generating tens of billions of dollars revenue in the quarter. That is expected to accelerate. Management during the earnings call said Blackwell Ultra demand is "extraordinary."

The data center segment's non-GAAP gross margin dipped to 74.9% in the quarter, slightly above consensus of 74.6%, but lower year over year. This muted the magnitude of the surprise to the EPS line with non-GAAP diluted EPS coming in at $1.05, exceeding the consensus of $1.02.

Gaming revenue was a bright spot, delivering $4.3 billion and 57.2% gross margin, ahead of consensus. While this segment generates around one-tenth the revenue of the data center business and a lower gross margin, there may be opportunities going forward for more significant growth.

For the fiscal third quarter of 2026, Nvidia guided in line with current expectations of about $54.5 billion in total revenue and noted that the outlook does not include any revenue from H20 in China. This outlook disappointed the market, as some analysts were expecting guidance to exceed $56 billion. The China business remains challenging in the current environment.

Analysts are now projecting the data center business to make up $48.7 billion, up from $47.7 billion. However, as Blackwell ramps, gross margin is expected to moderate year over year to the mid-70s in the third quarter.

"To support the ramp of Blackwell and Blackwell Ultra, inventory increased sequentially from $11 billion to $15 billion in the second quarter," executives said during the earnings call.

When Blackwell is fully ramped, the company expects gross margin to be in the mid-70s later in the year, suggesting it may not tick back to the high-70s. In addition, there continue to be questions about the timing of Blackwell's trajectory and how that will be reflected in the quarters.

This commentary in the earnings call put the data center gross margins for fiscal year 2026 at 74.1% and 76.4% the following year, below the 78% levels of fiscal years 2024 and 2025. Sentiment seems to be a bit more conservative on the magnitude of the earnings impact from Blackwell. It is worth noting that the timing of the Blackwell ramp will be a critical dimension to the investment thesis.

There continues to be debate among analysts about the quarterly pace and timing of the B-series and GB-series ramps and how much the long-term expected growth is projected to add to revenues in the next two years. However, estimates for Blackwell have moved higher since the earnings release.

According to Visible Alpha consensus, data center revenues for fiscal 2027 are now expected to be $253.8 billion, up from the $250.1 billion consensus estimate last month. The EPS consensus increased to $6.40 on Blackwell revenues ramping and data center gross margin moving up 230 basis points. The consensus target price is $212, which would establish Nvidia's market cap at more than $5 trillion, an implied return of 25% from the current $4.1 trillion level.

– Learn about Visible Alpha | S&P Global.

– Explore Visible Alpha Add-On for Cap IQ Pro.

– Access Visible Alpha estimates on Nvidia.

– To receive email alerts for future Visible Alpha articles, select Melissa Otto under the Authors section.