Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Sep, 2025

By Tom Jacobs

|

Hurricane Erin churns off the coast of Florida on Aug. 18. The only major storm thus far in the Atlantic hurricane season, Erin did not make landfall on the US coast, but did generate storm surge and flooding along the Eastern seaboard. |

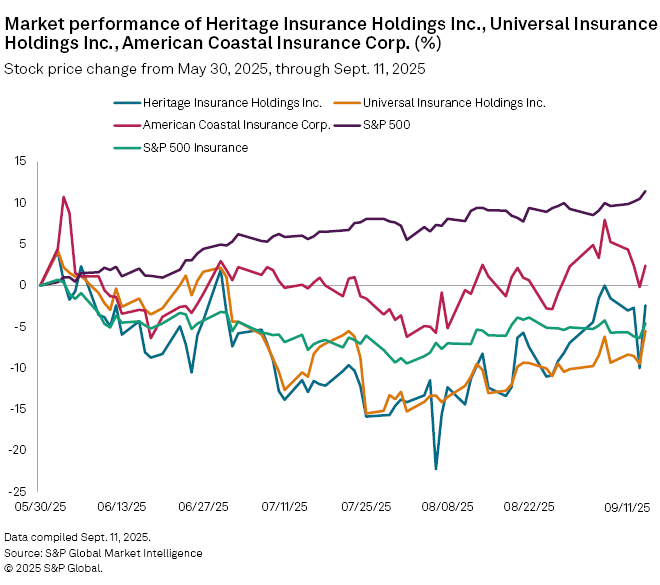

A milder-than-expected Atlantic hurricane season has not translated into market gains for Florida-domiciled property-casualty insurers.

As of Sept. 8, there have been six named storms and one major storm, Hurricane Erin, since the start of the season on June 1, with one storm, Tropical Storm Chantal, making landfall on US soil in the Carolinas. Colorado State said in its midseason discussion that eight named storms, including three hurricanes, were expected by Sept. 8.

The meteorological respite, however, has not been a big help for Sunshine State insurers. American Coastal Insurance Corp. had improved by 2.2% since June 1 as of market close on Sept. 11, but Heritage Insurance Holdings Inc. and Universal Insurance Holdings Inc. had fallen 2.4% and 5.5%, respectively. Piper Sandler analyst Paul Newsome said that the "softness" in the stocks reflects investors' reluctance during the hurricane season.

"You have investors who ... like the prospects of the company, but don't want to own [stock] right now because of hurricane exposures," Newsome said in an interview. "You just see less interest and fewer investors investigating or calling the company during the hurricane season."

American Coastal, Heritage and Universal did not respond to a request for comment.

The S&P 500 Insurance Index has dipped 4.58% since June 1, while the S&P 500 is up 11.43%.

Solid year for Heritage

The seasonal softness has also slowed what has been a solid year of growth in the market for Heritage. The Tampa, Florida-based insurer's stock is up 97.4% since the beginning of the year, rising to $23.88 from $12.10 as of market close on Sept. 11.

Heritage has had "an amazing run since the beginning of the year," said Citizens JMP Securities analyst Karol Chmiel, adding that it is where it should be in terms of stock value.

"At this point, if you compare them to the other peers in the market, they're trading at fair value," Chmiel said in an interview. "The Florida market continues to be dynamic and it's becoming a little more competitive. Performance might be stalled, but its valuation is at fair value."

Universal has also had a good year thus far, improving 21.8% to $25.65 from $21.06. Conversely, American Coastal has struggled, falling 18%, while Slide Insurance Holdings Inc., which had its IPO on June 18, has dropped 40.6% since June 20, its first day of trading.

Slide said in an email to S&P Global Market Intelligence that the company does not comment on its stock price, but that its recently announced stock repurchase program is indicative of management's strong confidence in Slide's business strategy, superior and disciplined underwriting, and well-capitalized balance sheet."

Newsome said that while Slide's IPO was successful, he said there was "a little bit more hype than there should have been." He said that the company was perceived as more of a tech company than it should have been, and they've been "very dependent" upon Citizens Property Insurance Corp. Depopulation Program for their growth."

"They haven't really proven yet that they can build a distribution system that will allow them to grow without takeouts," Newsome said. "So I think investors are sort of concerned about that transition point."

In the long run, Newsome said the Florida market has become "a fairly good environment" for its insurers, but that has not been reflected in their stocks. He said people are still remembering the many years of bad weather, bad competition and "a really bad tort environment."

"We can't do anything about the weather, but the competitive environment is far more rational than it was before," Newsome said. "The regulatory environment is very rational and tort reform seems to have had a significant impact on the environment, so I think it's a very good time to be a Florida writer."