Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Sep, 2025

By RJ Dumaual

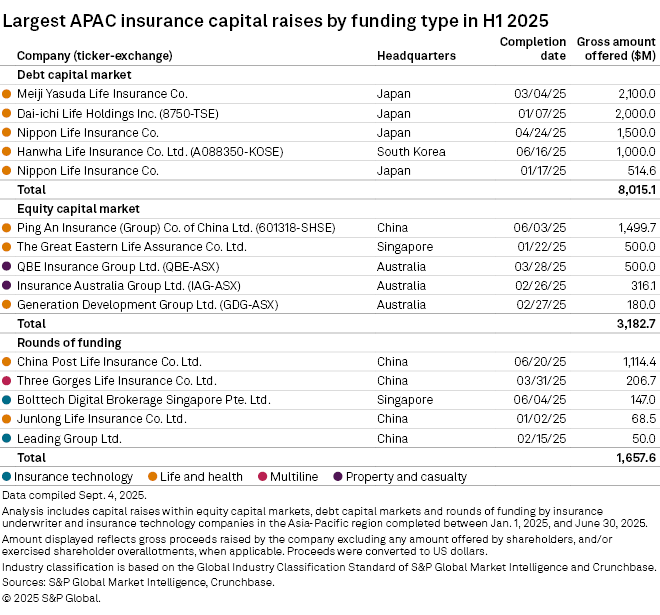

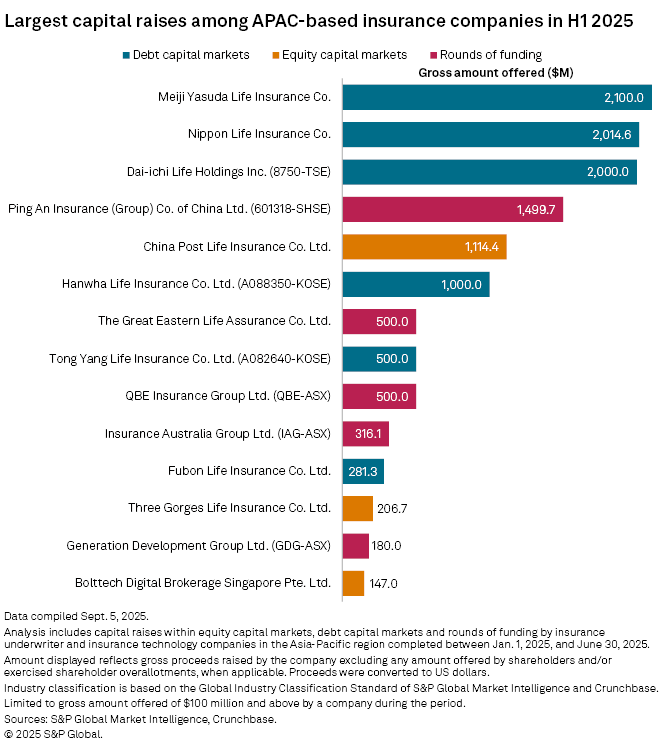

Meiji Yasuda Life Insurance Co., Nippon Life Insurance Co. and Dai-ichi Life Holdings Inc. each conducted debt issuances with a combined value of $2 billion or more in the first half of 2025, according to an S&P Global Market Intelligence analysis.

All three companies were recently involved in large acquisitions. Meiji Yasuda, which previously announced a pair of M&A deals with transaction values of over $2 billion with The Allstate Corp. and Legal & General Group PLC, in March issued $2.10 billion of US dollar-denominated subordinated notes due 2055 with interest deferral options. Later in March, Meiji Yasuda agreed to acquire an 85.1% stake in AEON Allianz Life Insurance Co. Ltd. from AEON Financial Service Co. Ltd. The AEON deal closed in July.

Nippon Life, which was involved in large M&A deals with Blackstone Inc. and American International Group Inc. in 2024, conducted two issuances in the first half of 2025. It issued $1.50 billion of US dollar-denominated subordinated notes due 2055 with interest deferral options in May, and €500 million of euro-denominated subordinated notes due 2055 with interest deferral options in January.

Also in January, Dai-ichi Life issued $2 billion of US dollar-denominated step-up callable perpetual subordinated notes with interest deferral options. In May, Dai-ichi Life announced it would acquire a 15% stake in the UK's M&G PLC.

The road ahead

Refinancing and new debt issuance may continue in Japan's insurance sector, S&P Global Ratings analyst Toshiko Sekine said in a research note.

As of March 31, hybrid capital balances of major life insurers increased from the previous year, while those of major non-life insurance groups remained unchanged. Life insurers issue new hybrids for general corporate purposes, including growth investments, and to expand their investor bases in Japan and overseas. Non-life insurance groups see less need to raise funds as they have additional capital due to the reduction in strategic equities, Sekine wrote.

China outlook

Ping An Insurance (Group) Co. of China Ltd. and China Post Life Insurance Co. Ltd. were also big fundraisers during the first half of 2025. Ping An Insurance in June issued HK$11.77 billion of zero-coupon convertible bonds due 2030. The group intends to apply the net proceeds to develop the group's core business, strengthen its capital position, support new strategic initiatives in the healthcare and elderly care sectors, and for general corporate purposes.

|

– Download a template to review M&A and IPO transactions for a selected sector. – Read an analysis of the largest insurance M&A deals in Asia-Pacific in the second quarter of 2025. – Read about potential M&A activity in the global insurance sector on In Play Today and a summary of recently announced deals on M&A Replay. |

In June, China Post Life drew big investments from AIA Group Ltd. and China Post Group Corp. Ltd.

"The mainland Chinese life insurance market is the second largest globally and presents immense long-term growth opportunities," AIA CEO Lee Yuan Siong said. "AIA's investment in China Post Life is highly complementary to our strategy for AIA China, enabling us to access new distribution channels and reach broader customer segments in this attractive market."