Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

18 Sep, 2025

By Brian Scheid

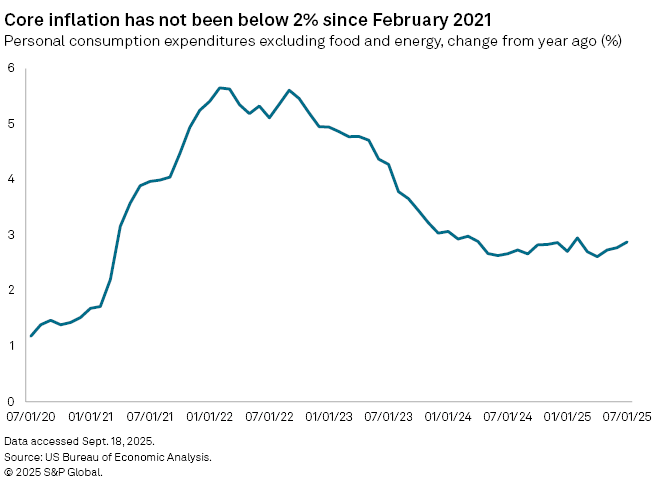

The US Federal Reserve's target of returning inflation to 2% annual growth seems to be moving further away. That is fueling concern that the central bank might be quietly giving up on that goal.

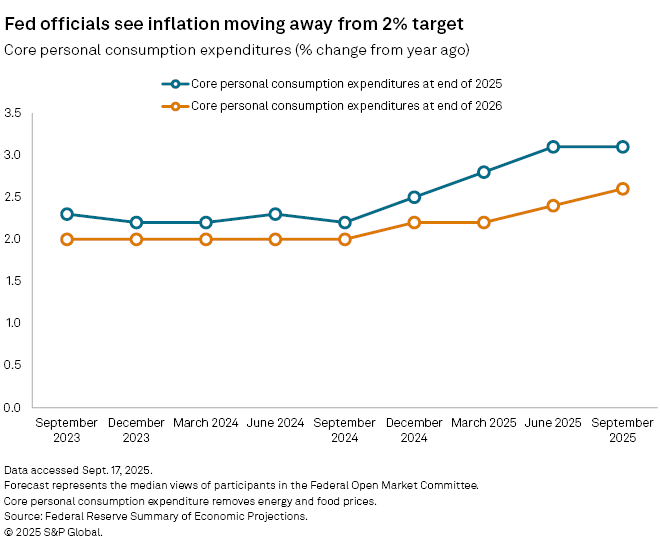

Fed officials projected this week following a two-day rate setting meeting that their preferred measure of inflation, personal consumption expenditures excluding volatile food and energy prices (core PCE), will not fall to 2% until the end of 2028 from its current level of 2.9% annual growth. Just two years ago as inflation sat at 3.7%, the median view among Fed officials was that annualized growth of core PCE would fall to its 2% target by the end of 2026.

As inflation continues to move away from the Fed's 2% target, with tariffs taking root, joblessness on the rise and the majority of the futures market now betting that the Fed will cut its benchmark interest rate by another 125 bps by the end of next year, speculation is rising that central bankers now see the 2% inflation goal as untenable.

"The board is bending to both political pressure and to more challenging economic conditions because of tariffs," said David Russell, global head of market strategy at TradeStation. "They seem to be quietly abandoning the 2% target."

Federal Reserve Chairman Jerome Powell said the central bank is still committed to bringing core inflation down to that 2% target, but conceded that with the domestic jobs market showing signs of weakness, compelling the Fed to again start cutting rates, that target will be more difficult to reach.

"It's a difficult situation because we have risks that are both affecting the labor market and inflation, our two goals and so we have to balance those two," Powell said on Sept. 17, shortly after the Fed agreed to cut its benchmark rate by 25 basis points. "When they're both at risk, we have to balance them and that's really what we're trying to do."

Since inflation surged in the wake of the pandemic, Fed officials have consistently projected that inflation's return to 2% was still years away, said Derek Tang, an economist with LH Meyer/Monetary Policy Analytics.

"There is a question of how much longer the public and the market will continue believing it," Tang said.

While inflation is moving away from 2%, consumer inflation expectations have moved little. In August, the median three-year ahead expectation was 3%, according to the latest New York Fed Survey of Consumer Expectations. This is just 20 bps higher than it was three years earlier when annualized core PCE was 5.4%, the survey shows.

"The Fed seems satisfied that inflation is above 2% as long as they can credibly project that it will fall back down to 2% in the future," Tang said. "In practice, the question is if inflation expectations have risen; they have not. The Fed will never say out loud they are giving up on the 2% target, but actions speak louder than words."

'Policy disaster'

Still, Fed officials know that dropping their long-stated inflation goal could have major implications for markets and the economy, said Oren Klachkin, a financial market economist with Nationwide.

"They will do their utmost to avoid any risk of this happening," Klachkin said.

While the Fed continuing to miss its inflation forecast has created some credibility issues for the central bank, abandoning the 2% inflation target entirely would be a "policy disaster," said Michael O'Rourke, chief market strategist at JonesTrading.

"Stable prices lead to predictable environments that foster investment and consumption," O'Rourke said. "Abandoning the 2% target would fuel policy and inflation uncertainty that would slow investment, consumption and hiring."