Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

08 Sep, 2025

By Audrey Elsberry and Annie Sabater

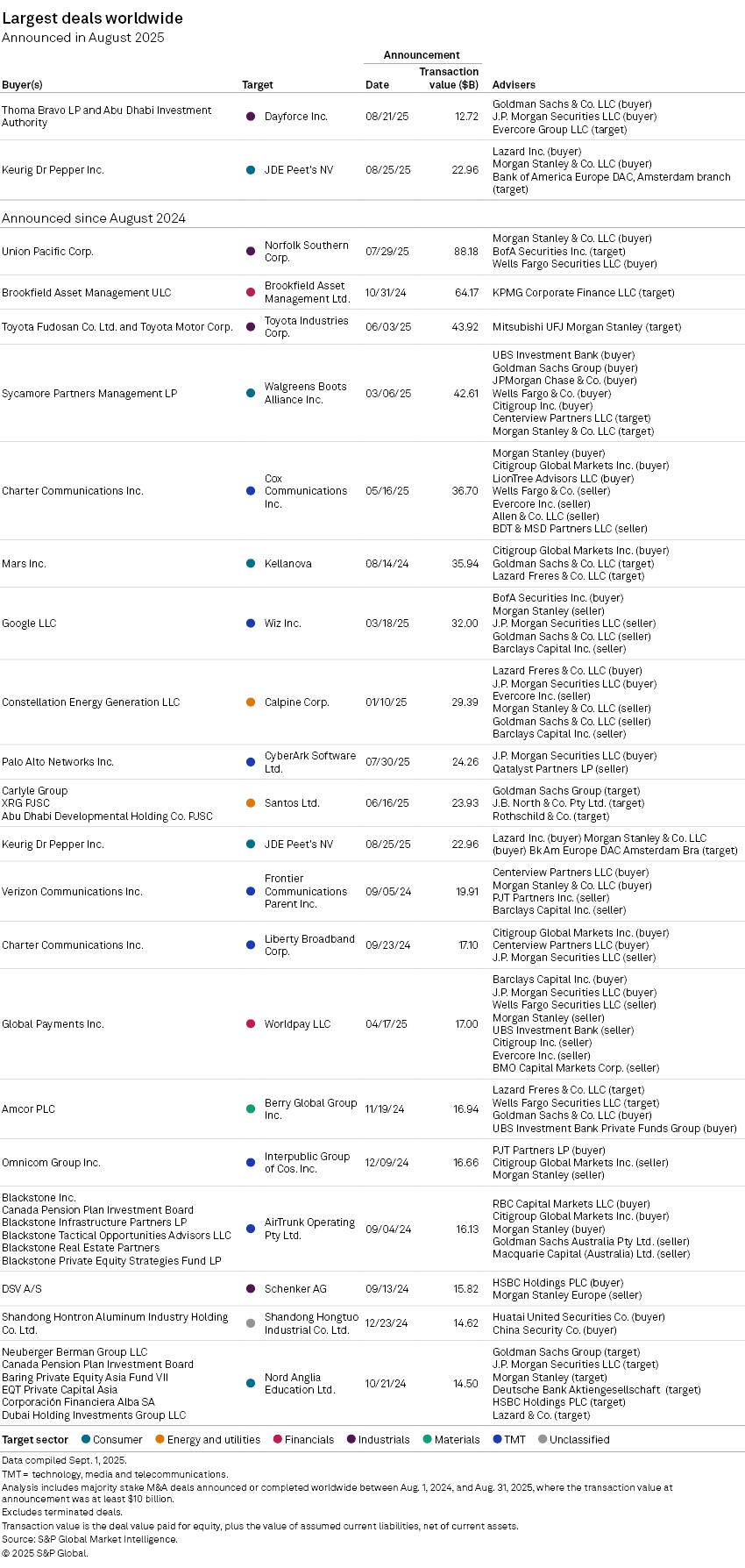

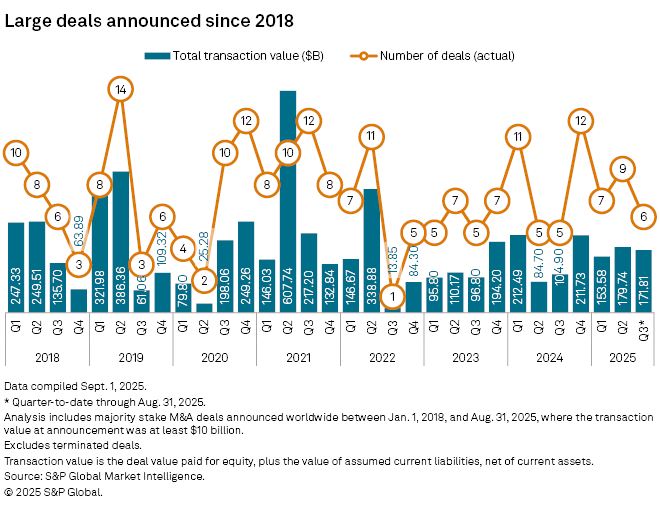

Two M&A deals with more than $10 billion in transaction value were announced in August, bringing the third quarter's deal count to six with a month left in the quarter.

One deal in the industrials sector and one in the consumer sector brought the total transaction value of $10 billion-plus deals so far in the third quarter to $171.81 billion. With three fewer deals, the value is not far behind the second-quarter total's $10 billion-plus transaction value of $179.74 billion, according to S&P Global Market Intelligence data.

On Aug. 25, US-based Keurig Dr Pepper Inc. said it plans to acquire Netherlands-based JDE Peet's NV in a deal with a transaction value of $22.96 billion. The beverage deal is the 11th-largest M&A transaction announced in the past 12 months.

The all-cash deal is expected to close in the first half of 2026, according to an investor presentation. After the deal closes, Keurig Dr Pepper will split into two independent US-listed companies, one a coffee pure play led by Keurig Dr Pepper CFO Sudhanshu Priyadarshi, and the other a beverage conglomerate led by Keurig Dr Pepper CEO Timothy Cofer.

The coffee company, Global Coffee Co., will combine JDE Peet's global portfolio of coffee brands with Keurig Dr Pepper's Keurig single-serve coffee platform. The other company, Beverage Co., will contain the non-coffee brands under Keurig Dr Pepper umbrella including Dr Pepper, Canada Dry and Snapple.

"The potential of this business will be only enhanced by the planned tax-free separation into Global Coffee Co.," Cofer said during an M&A call. "In parallel, the refreshment beverages business will make for a vibrant stand-alone Beverage Co. on the other side."

|

– View – Read the M&A and equity offerings research paper. – Read more |

An investor group said Aug. 21 that it would acquire US-based human capital management technology firm Dayforce Inc. in a deal with a transaction value of $12.72 billion. The group is led by US-based Thoma Bravo LP with a minority investment from United Arab Emirates-based Abu Dhabi Investment Authority.

Dayforce is a cloud-based platform that integrates human resources functions such as hiring, payroll and workforce management. Thoma Bravo is a private equity firm that focuses on software businesses.

The all-cash transaction will take Dayforce private, according to the merger release. Dayforce shareholders will receive $70 per share in cash under the terms of the agreement. The deal is expected to close in early 2026.